Throughout the subsequent decade, block rewards will solely provide a tiny quantity of Bitcoin. What does this imply for miners and the individuals who depend on this blockchain?

Bitcoin halvings are as uncommon as World Cups and the Olympics. Why? As a result of they solely occur each 4 years.

In a world the place it’s troublesome to foretell the place BTC’s value will probably be from in the future to the subsequent, halvings provide some certainty over when new cash are going to hit the market.

And given how 93% of Bitcoin’s provide has already entered circulation, right here’s one thing else we all know: they’re gonna get tougher and tougher to seek out.

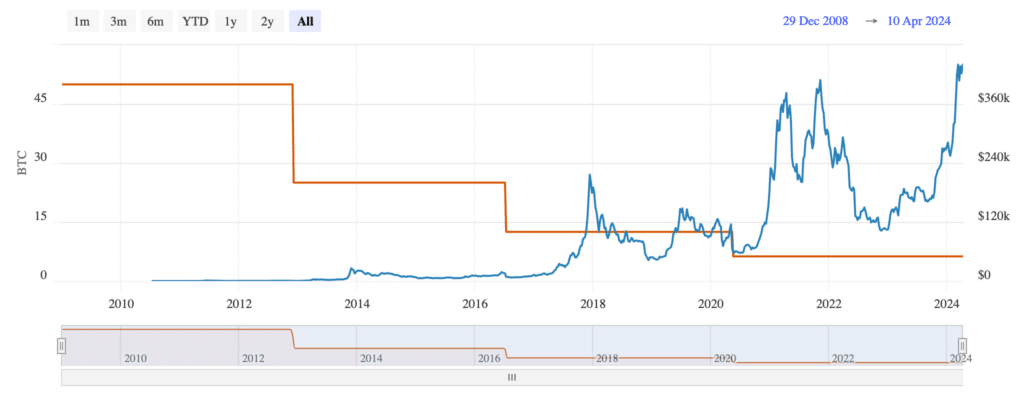

An enormous 50 BTC block reward was on provide for miners when the blockchain first launched in 2009. This plunged to 25 BTC in November 2012, with one other 50% drop to 12.5 BTC in July 2016. The third halving in Could 2020 noticed rewards dwindle to single digits — 6.25 BTC each 10 minutes — and simply 3.125 BTC is generated with every block after this newest discount.

As we all know, there’s excellent news and unhealthy information for miners. On one hand, April 2024’s halving means there are solely 450 Bitcoin up for grabs day-after-day, a lot lower than the 7,200 BTC out there every day 15 years in the past.

However on a brighter word, the greenback worth of this cryptocurrency has gone via the roof. In fiat phrases, 3.125 BTC is value lots of of hundreds of {dollars} at present market charges. On the time of the primary halving in 2012, 50 BTC would have set you again a mere $600.

So, what are future halvings going to seem like? Let’s discover out.

When are future Bitcoin halvings?

The precise date is somewhat exhausting to foretell, however we’ve undoubtedly received a tough determine. Halvings happen each 210,000 blocks — and given a brand new one is created each 10 minutes or so, the fifth discount in miner rewards is predicted in 2028… falling to 1.5625 BTC. This provide shock will come into drive when the Bitcoin community reaches a block top of 1,050,000.

Let’s quick ahead now to the 2030s, which is when Cathie Wooden predicts a single Bitcoin will probably be value $1.5 million — and a staggering $258,000 in her most bearish state of affairs. The 2032 halving will probably be vital as a result of it’ll mark the primary time that block rewards completely drop beneath one entire coin, to 0.78125 BTC. Satoshis, equal to 1 100-millionth of a Bitcoin, are going to turn into more and more necessary to miners.

Rewards are solely going to proceed getting increasingly more diminutive. By the point we get to 2036, miners will obtain a mere 0.390625 BTC for his or her position in preserving the community safe. To place this into context, that’ll imply simply 56.25 BTC goes to be launched each 24 hours.

Halvings will carry on coming each 4 years past then — every coinciding with when the Summer season Olympics are held — in 2040, 2044, 2048, and past. Every passing occasion will flip the reward that miners obtain right into a rounding error. By 2052, they’ll get simply 0.0244140625 BTC as a thank-you for including a block to the blockchain. On the time of writing, that might be value simply $1,660 in fiat phrases. The method will finish in 2140 when Bitcoin’s provide is lastly exhausted.

What does this imply for miners?

Being a Bitcoin miner is dear. It takes plenty of electrical energy and immense computing energy to win block rewards, and which means {hardware} must be up to date frequently. BTC value rises have been in a position to offset the affect of every halving thus far, as you’ll be able to see right here:

| Halving date | New block reward | Value at time of halving | |

| November 2012 | 25 BTC | $12.53 | |

| July 2016 | 12.5 BTC | $650.96 | |

| Could 2020 | 6.25 BTC | $8,601.80 |

Given there’s much less crypto to go round, miners must hold prices to a minimal to allow them to stay financially viable.

As time goes on, the transaction charges paid by the blockchain’s customers are going to turn into an more and more necessary supply of earnings. This doesn’t essentially imply that on a regular basis funds are going to turn into eye-wateringly costly for shoppers — Layer 2s such because the Lightning Community and different futuristic options will maintain these — however the price of giant transfers could need to rise to maintain miners in enterprise.

In a latest report, Galaxy predicted that mergers and acquisitions will turn into extra frequent to attenuate vitality prices, drive effectivity, increase capital, and obtain development. We’ve already seen smaller operators start to affix forces. However whereas consolidation goes to be a obligatory evil, this may very well be at the price of decentralization.

The 2024 halving is completely different in some ways. Not solely does it come scorching off the heels of Bitcoin ETFs launching within the U.S., attracting a swell of recent investor curiosity, however this 12 months marks the primary time that BTC’s value has hit a brand new report excessive earlier than block rewards have been slashed. Because the market shifts, miners should adapt, too.