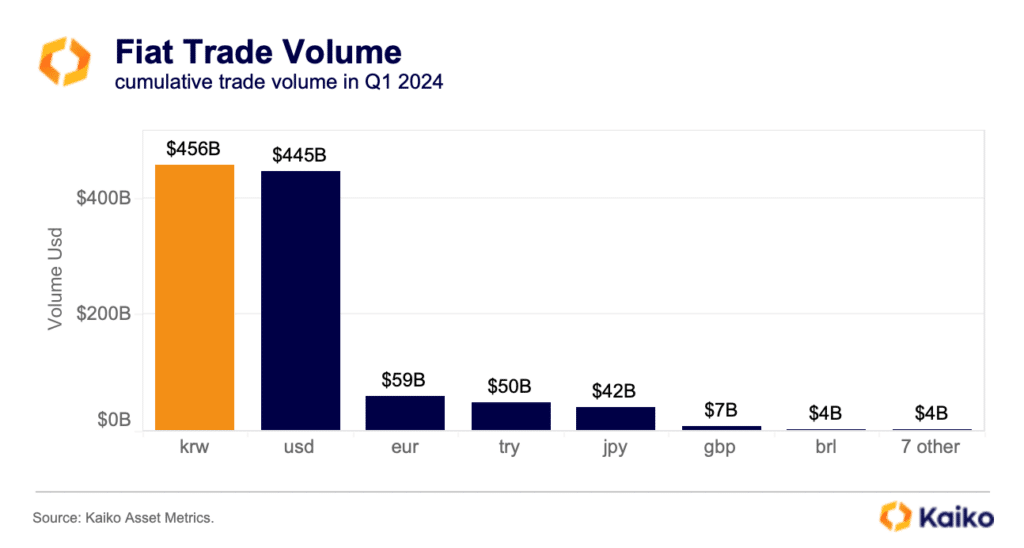

In Q1 2024, Korean crypto markets witnessed their highest commerce quantity in over two years, with KRW overtaking USD in cumulative commerce quantity, Kaiko says.

Commerce quantity in Korean crypto markets soared to its highest degree in over two years in early March, pushed by an improved macroeconomic surroundings and heightened competitors amongst native exchanges, in line with knowledge from blockchain analytics agency Kaiko.

Regardless of Upbit‘s longstanding dominance within the South Korean crypto scene, boasting a median market share of 82% over the previous three years, the current adjustments within the panorama seem to have introduced extra competitors to the market, with Bithumb and Korbit launching zero-fee campaigns towards the top of 2023.

Though Korbit’s market share has seen minimal progress, hovering round 1% in 2024, Bithumb skilled a big surge, tripling its market share within the months following the implementation of its zero-fee coverage in October 2023, analysts at Kaiko say. Regardless of the success of the zero-fee technique in driving commerce quantity, the analysts famous that Bithumb confronted a considerable income decline of 60% in 2023, prompting the alternate to discontinue the initiative.

“The numerous decline in income might have prompted the alternate to discontinue its zero-fee marketing campaign on Feb. 5, simply 5 months after its launch.”

Kaiko

Though there was a slight lower in KRW volumes in early April, Kaiko says market sentiment throughout the Asia-Pacific area may obtain a lift given the current approval of spot Bitcoin and Ethereum exchange-traded funds (ETFs) in Hong Kong.

As crypto.information reported earlier, HashKey and Bosera Worldwide secured conditional approval from the Hong Kong Securities and Futures Fee for 2 spot crypto ETFs, signaling a pivotal second for Asian traders. It’s anticipated that the Hong Kong Inventory Alternate would require roughly two weeks to finalize preparations for product itemizing and associated issues.