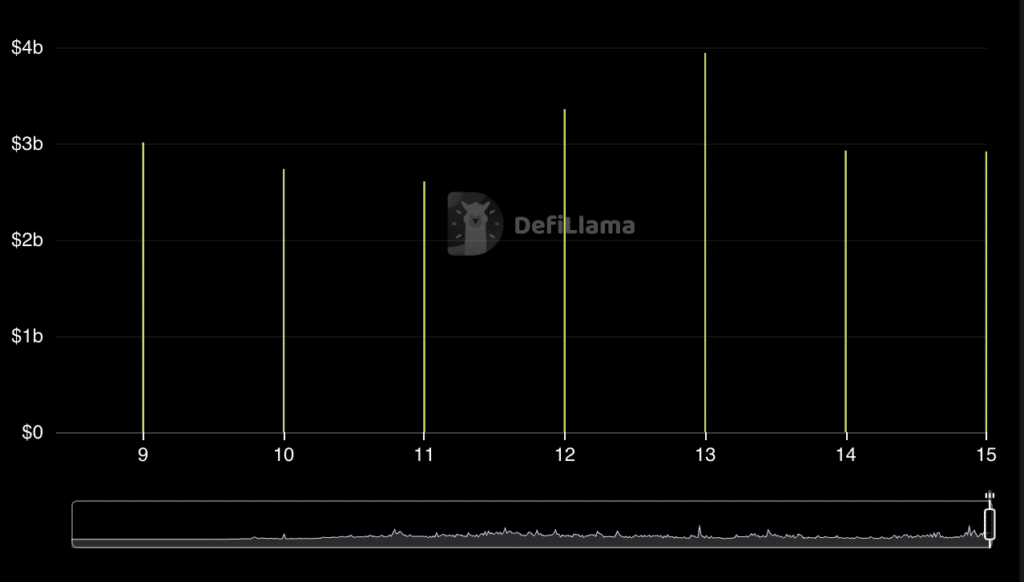

The typical each day buying and selling quantity on the Uniswap decentralized change has approached $3 billion over the previous week.

In keeping with DefiLlama, between April 10 and April 15, Uniswap’s common each day buying and selling quantity was $3.08 billion.

Breaking the $3 billion mark signifies that DEX didn’t file a decline within the indicator amid information of a potential authorized confrontation with the U.S. SEC.

In keeping with obtainable statistics, the elevated threat of authorized confrontation with the SEC has not deterred customers. There was no vital decline in buying and selling quantity; this determine has remained from $2.6 billion to $3.9 billion for the final 5 days.

As of April 16, the whole worth locked (TVL) was $6.62 billion, and the platform’s market capitalization was $5.65 billion.

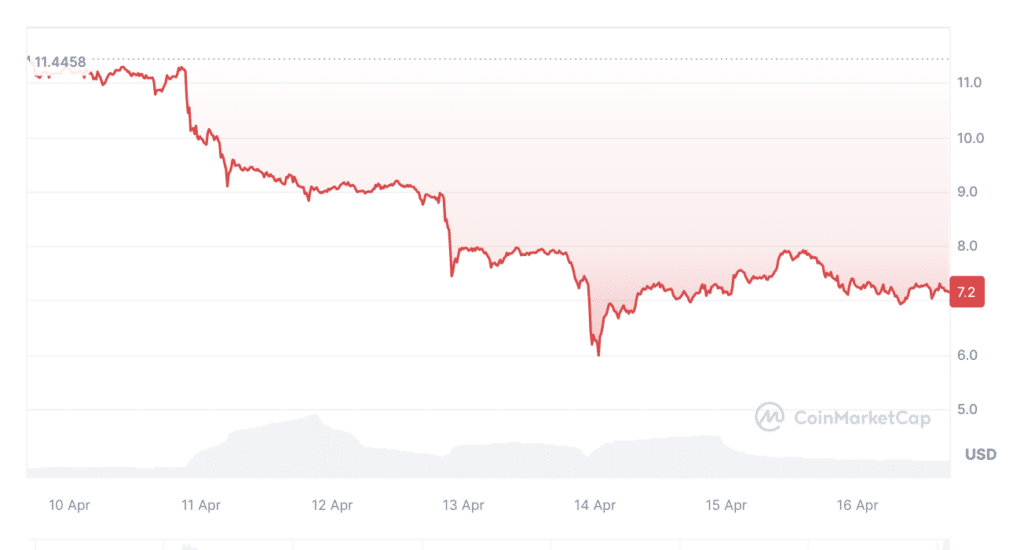

Nevertheless, the Uniswap token (UNI) fee has not boasted constructive dynamics. Over the previous week, the token’s worth fell by 37.5%, in keeping with CoinMarketCap. On April 10, the UNI worth was $11, however dropped under $6 three days later. On the time of writing, UNI is buying and selling at $7.15, having fallen in worth by 8% during the last 24 hours.

On April 10, Uniswap CEO Hayden Adams stated that the company had offered his group with a Wells discover. Usually, such a letter is shipped earlier than submitting a proper lawsuit or to offer a ultimate alternative to refute any allegations.

The change additionally increased its commissions after information of a potential SEC lawsuit from 0.15% to 0.25%.