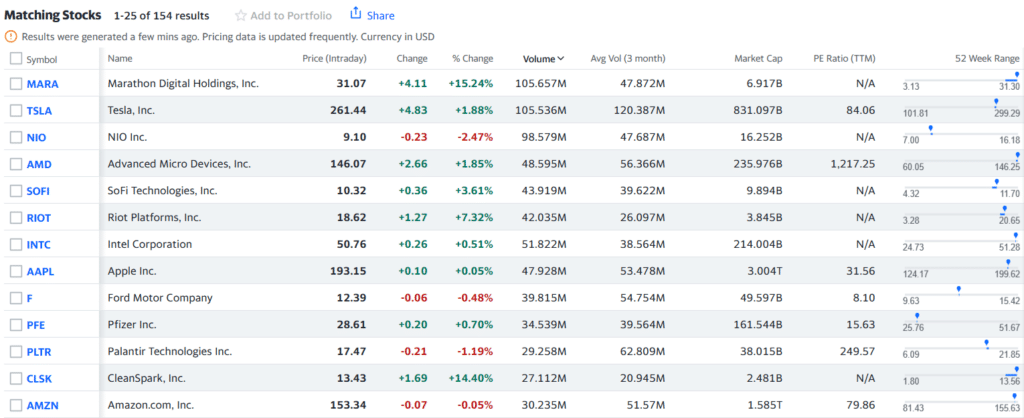

Bitcoin miner Marathon Digital has seen its inventory buying and selling volumes soar, topping U.S. mid and large-cap shares forward of a possible spot Bitcoin ETF approval.

Up to now 24 hours, the agency’s buying and selling quantity exceeded 105 million shares, outperforming tech giants like Tesla, Apple, and Amazon, as per Yahoo Finance’s market information.

Riot Platforms, one other vital participant within the Bitcoin mining sector, additionally marked a notable presence, rating because the sixth most-traded inventory with over 40 million shares traded in the identical interval.

This surge in Bitcoin mining shares is attributed to the mining business’s enlargement efforts in anticipation of the potential approval of a spot Bitcoin exchange-traded fund (ETF) in early January, coupled with the upcoming Bitcoin halving event in April.

Just lately, Marathon introduced its intention to amass two mining facilities for $179 million, a strategic transfer to spice up its mining capability by a further 390 megawatts, supplementing its present 584-megawatt output.

Riot Platforms, on an analogous progress trajectory, purchased Bitcoin mining rigs worth $291 million, marking the agency’s largest hash fee enhance thus far.

2023 has been a affluent yr for Bitcoin, with its worth escalating by over 163% for the reason that yr’s begin. Nonetheless, Bitcoin mining shares, notably these of Marathon Digital and Riot Platforms, have outpaced Bitcoin’s progress, recording year-to-date features of 767% and 452%, respectively, in accordance with TradingView information.

The situation was starkly completely different for Marathon final yr, as the corporate confronted a close to $400 million loss in 1 / 4 marred by declining Bitcoin costs, a power outage at its Montana facility, and monetary publicity to the then-bankrupt miner Compute North.

Bitcoin mining, recognized for its excessive vitality prices, faces vital monetary challenges throughout Bitcoin worth downturns, as miners’ earnings diminish whereas vitality prices stay excessive.

Marathon’s CEO, Fred Thiel, highlighted the corporate’s resilience, having overcome debt hurdles apart from a convertible notice. He additionally famous Marathon’s latest shift to enlargement, together with the acquisition of two absolutely owned Bitcoin mining websites in Texas and Nebraska for $178.6 million.

These acquisitions have expanded Marathon’s mining portfolio by 56%, which now boasts 910 megawatts of capability.

Thiel additionally emphasised the corporate’s concentrate on elevated effectivity and diversification, aiming to scale back reliance on Bitcoin mining to 50% of its income by 2028.

Coinbase, the most important publicly traded crypto trade, has additionally seen significant growth, with its worth rising by over 450% for the reason that starting of 2023.

The crypto sector, nonetheless recovering from the FTX collapse and different 2022 setbacks, started the yr as a preferred quick commerce. Nonetheless, this technique backfired for a lot of merchants, as over $6 billion in crypto-related shorts have been liquidated this year.