As the decision on spot Bitcoin ETFs approaches between Jan. 8 and Jan. 10, market analysts, together with K33 Senior Analyst Vetle Lunde, predict a sell-the-news state of affairs.

Lunde, citing dealer publicity and derivatives’ huge premiums, suggests a 75% chance of this consequence, overshadowing the 20% likelihood of approval.

Regardless of indicators of froth within the market, resembling futures premiums reaching annualized ranges of fifty%, institutional gamers proceed to construct lengthy publicity, reflecting expectations of approval. Open curiosity surged by over 50,000 BTC within the final three months, pushed by anticipation of ETF approval.

On the retail facet, funding charges on offshore exchanges hit an annualized excessive of 72%, indicating excessive anticipation. Nevertheless, given the aggressive leverage from lengthy positions, the upcoming ETF verdict might set off lengthy squeezes.

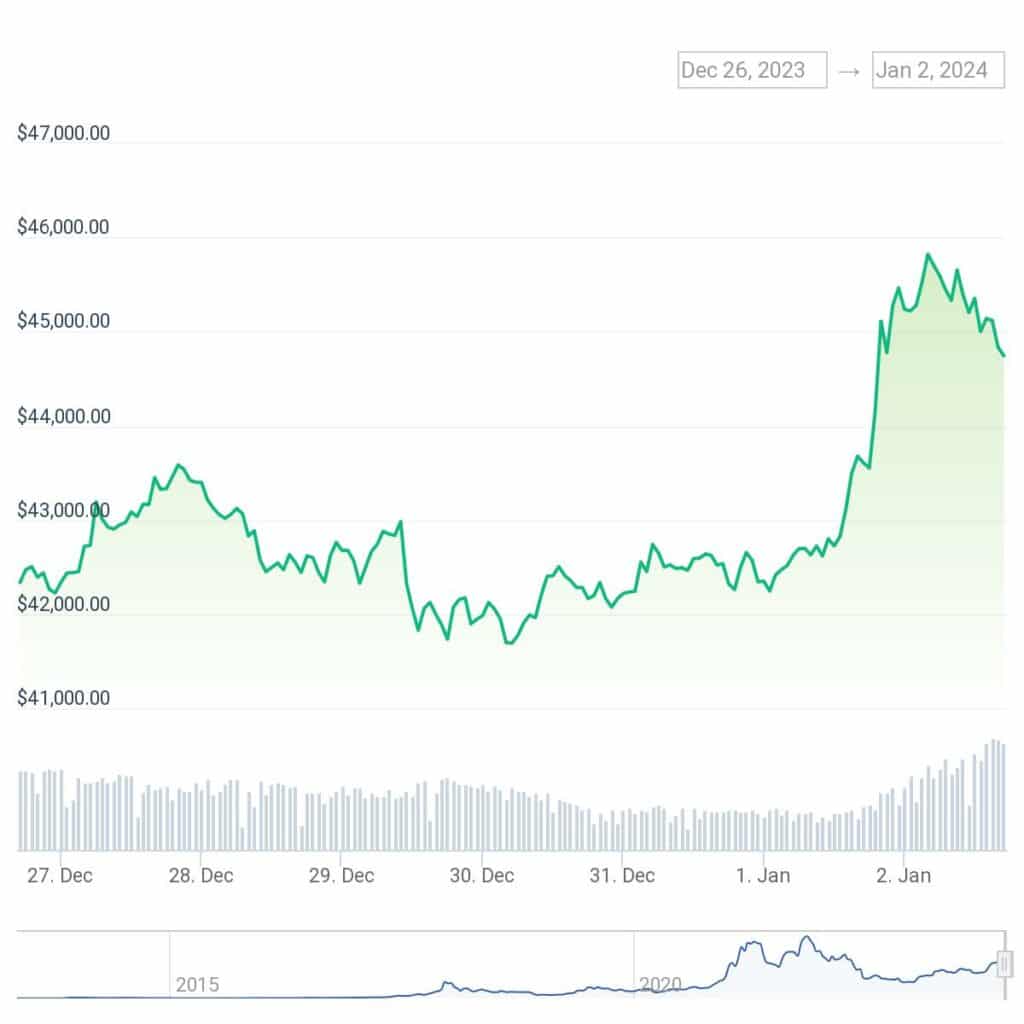

Bitcoin’s latest gains, surpassing $45,000, correlate with rising U.S. spot ETF approval anticipation. Analysts counsel a possible peak within the present rally on the decision date on account of profit-taking and unsustainable premiums.

Wanting forward, Lunde expects a internet influx of a minimum of 50,000 BTC, equal to $2.3 billion in January, essential for sustained market progress. Whereas a sell-the-news occasion might result in short-term fluctuations, the mix of potential spot ETFs and the Bitcoin halving occasion in April may contribute to a positive market outlook because the 12 months progresses.