Bitcoin and Ethereum are seemingly following the sample of earlier years, when their costs jumped by 500% and 1,000% respectively, Coinbase analysis says.

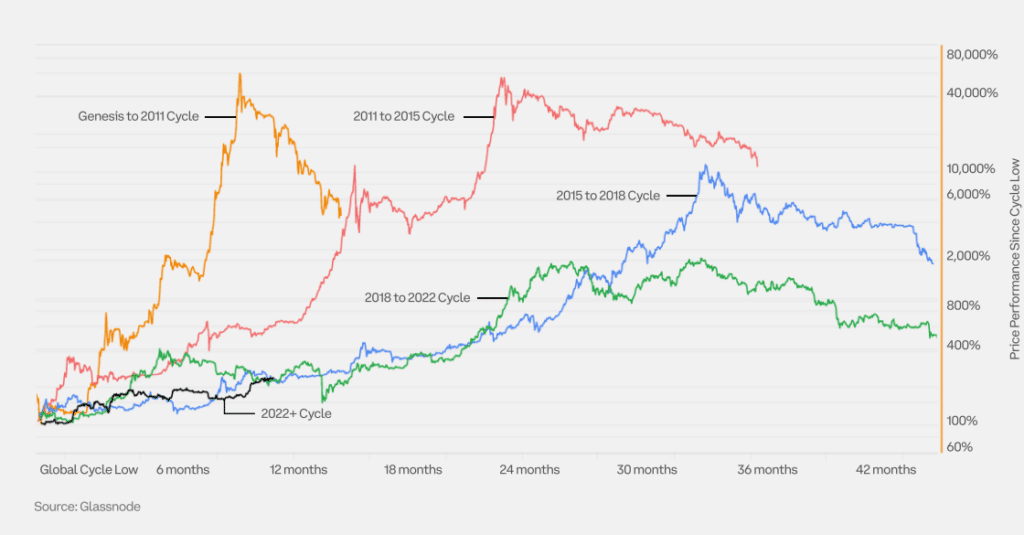

The present crypto market cycle for Bitcoin (BTC) and Ethereum (ETH) intently echoes the interval between 2018 and 2022, when each cryptocurrencies witnessed a major surge of their costs, in response to the most recent research report performed by Coinbase Analysis and Glassnode.

As famous by analysts, varied metrics of cyclicality, together with web unrealized revenue/loss and provide in revenue, comply with the earlier traits and point out that the present state of the crypto markets doesn’t replicate the euphoric situations witnessed through the most of 2023, suggesting the market nonetheless has room to surge.

Whereas acknowledging the potential constructive impression of the upcoming Bitcoin halving, Coinbase Analysis stays cautious, noting restricted supporting proof and characterizing the connection as considerably speculative.

“With solely three halving occasions traditionally, we’ve got but to see a transparent sample totally emerge, significantly as earlier occasions have been contaminated by elements like world liquidity measures.”

Coinbase Analysis

The following Bitcoin halving is expected to happen in April 2024 based mostly on present mining charges. The block reward will lower from 6.25 to three.125 BTC.

Relating to Ethereum, analysts highlight the forthcoming improve named Cancun. Anticipated to boost scalability and safety, the improve goals to make layer-2 transactions as cost-effective as attainable, probably resulting in a major improve within the variety of processed transactions on the Ethereum community.

Coinbase additionally notes that each Bitcoin and Ethereum have undergone two cycles, encompassing each bull and bear markets, with the continued cycle, which initiated in 2022, intently mirrors the patterns noticed within the previous cycles.