Bitcoin worth dipped to a 40-day low of $40,700 on Jan 19, sparking issues of main liquidations if it loses the $40,000 assist.

Because the much-anticipated spot ETF approval verdict, Bitcoin (BTC) has delivered sideways worth efficiency. One other sell-off wave on Jan. 19 noticed costs tumble towards $40,000 for the primary time since mid-December.

Miners acquired BTC value $482 million amid market downturn

On Jan. 19, Bitcoin worth tumbled beneath $40,700 for the primary time in 40 days, having consolidated inside the $42,000 to $43,000 vary for the higher a part of the previous week. Nevertheless, on-chain knowledge tendencies reveal that the bullish miners swooped in to defend the important $40,000 assist degree.

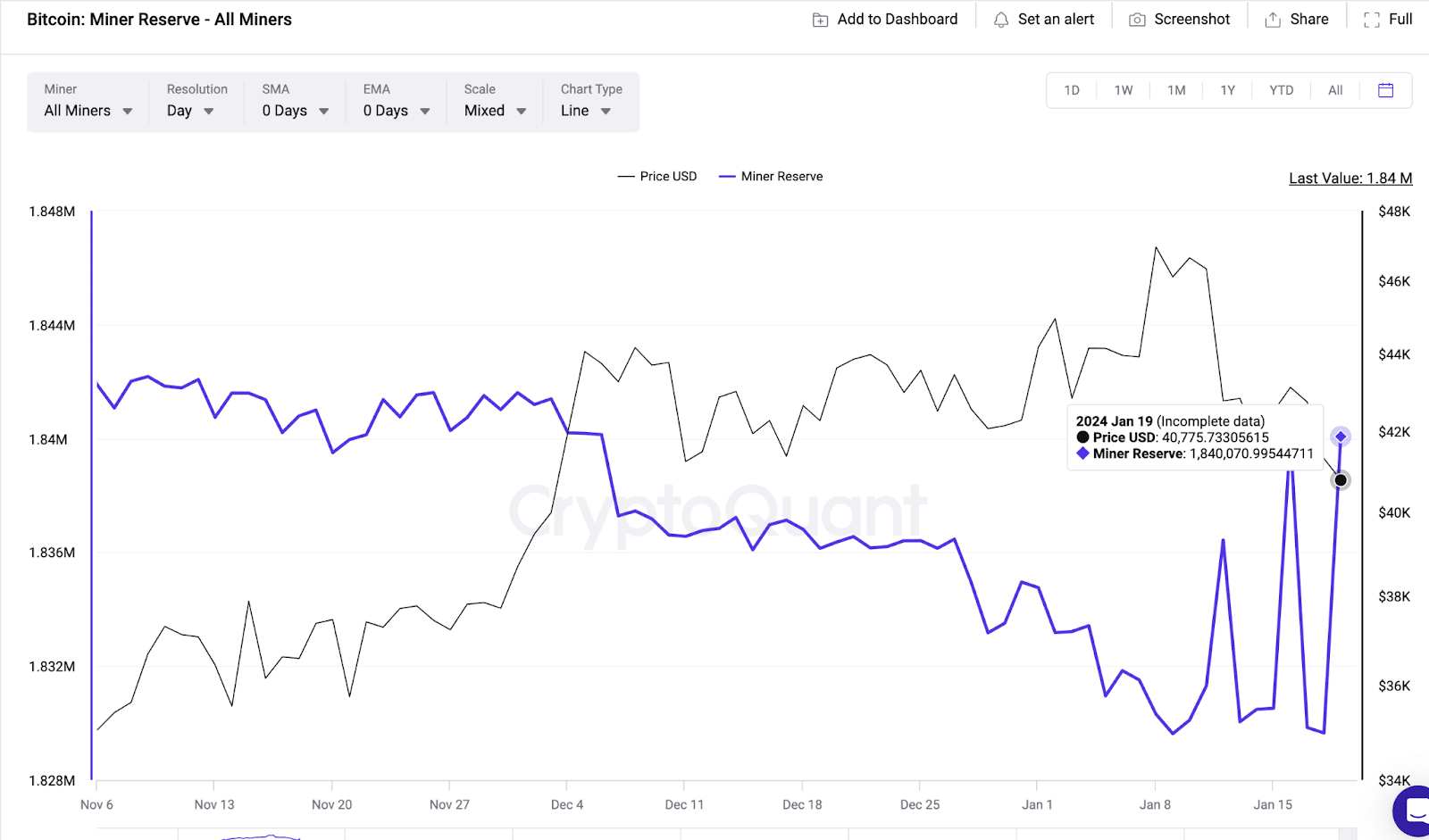

Cryptoquant’s miner reserve metric reveals what number of balances are at present held in wallets managed by acknowledged mining corporations and swimming pools.

The chart beneath reveals that Bitcoin miners elevated their reserves by 12,058 BTC on Jan. 19 alone.

As depicted above, the miners elevated their holdings by 12,058 BTC value roughly $494 million at present costs. The timing of this huge acquisition suggests the miners swooped in to cease the droop simply as costs started to tumble towards $40,000.

Miners are influential stakeholders in any proof-of-work cryptocurrency ecosystem. This important shopping for development among the many miners may quick retail investor’s confidence and avert a panic unload.

Bullish futures merchants are displaying resilience

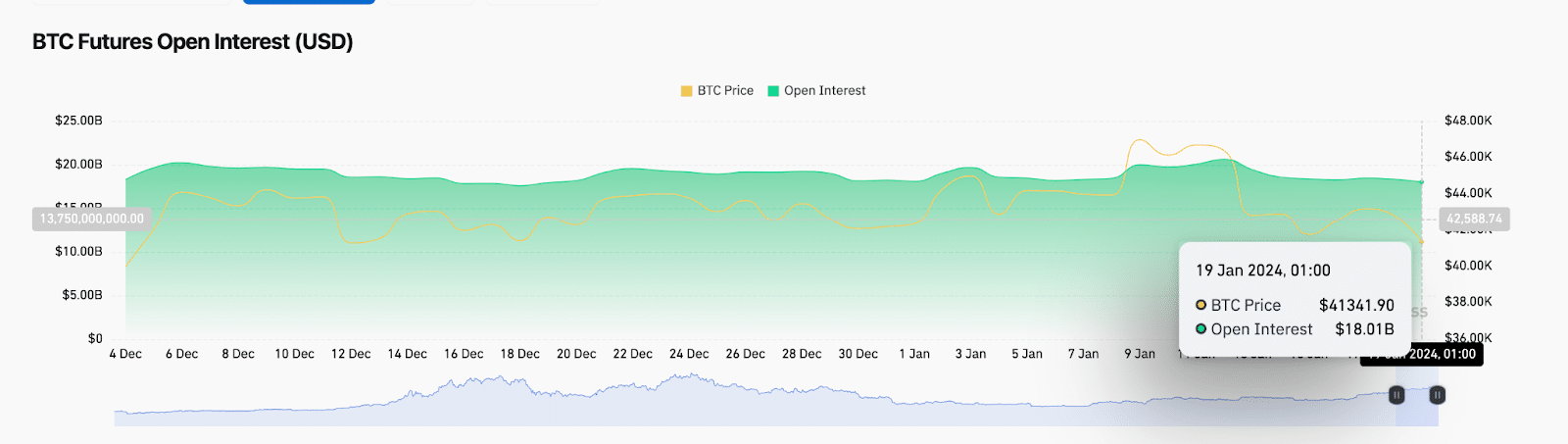

Moreover, bullish merchants within the Bitcoin derivatives markets additionally seem to maintain up their optimism amid the BTC worth droop. By midday Japanese buying and selling hours on Jan. 19, BTC worth had tumbled 7% inside the day by day timeframe.

The BTC open curiosity has held up firmly, barely shedding 2% because it moved from $18.5 billion to $18 billion — this alignment suggests widespread LONG-covering maneuvers amongst derivatives merchants.

Open curiosity tracks the real-time worth of all energetic derivatives contracts for a crypto asset. When open curiosity holds up regular throughout a worth droop, as noticed above, it means that the merchants holding LONG contracts are doubling down on their positions in hopes of a fast rebound within the spot markets.

Somewhat than shut out their positions as BTC costs dipped, the buying and selling knowledge reveals that Bitcoin miners and bullish derivatives merchants have swooped in, investing tens of millions to defend their positions.

BTC worth forecast: Can Bitcoin keep above $40,000?

Because the BTC worth tumbled beneath $41,000, it sparked issues that dropping $40,000 may set off stop-loss orders and margin name orders. From an on-chain perspective, the $482 million acquisition by the miners and derivatives merchants defending their LONG positions may construct up enough demand to maintain BTC above $$40,000.

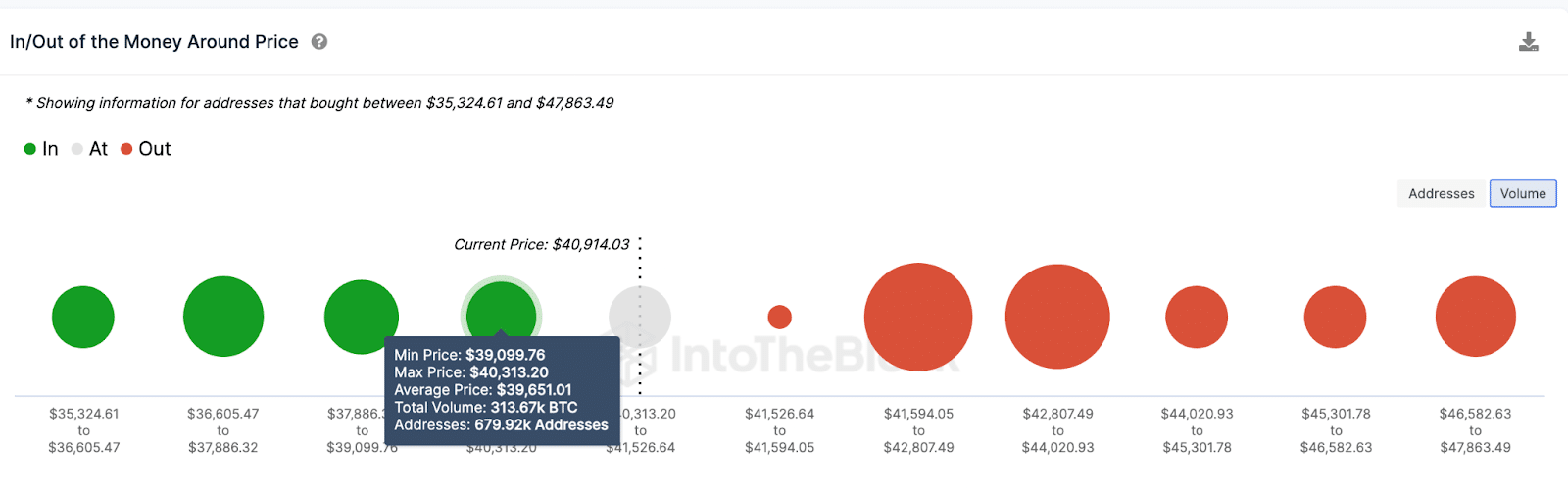

IntoTheBlock’s in/out of the cash round worth knowledge additional emphasizes that BTC has important assist within the $40,000 space.

The chart above depicts that 679,910 present addresses had acquired 313,000 BTC on the most worth of $40,313. If that buy-wall can maintain firmly, BTC worth will doubtless keep away from additional downswing beneath $40,000 within the short-term.

On the upside, Bitcoin bulls may regain market management if the value can climb above the $45,000 barrier.