Circle has introduced its choice to halt assist for the USD Coin (USDC) on the Tron blockchain.

The agency emphasised that this transfer is a part of its dedication to sustaining USDC as a trusted, clear, and secure foreign money.

Efficient instantly, Circle will cease minting USDC on Tron, planning to part out assist for the blockchain community by February 2025. This choice impacts Circle Mint enterprise clients, although they’ll nonetheless switch USDC to different blockchains till the required date.

Retail customers and people in a roundabout way affiliated with Circle are suggested to switch their Tron-based USDC to exchanges the place the stablecoin is supported on different blockchain networks.

The corporate’s option to discontinue Tron assist isn’t accompanied by a selected motive. Nonetheless, Circle talked about that it repeatedly evaluates the suitability of all blockchains inside its threat administration framework. The discontinuation is described as the end result of a complete, company-wide strategy that includes numerous departments, together with compliance and enterprise group.

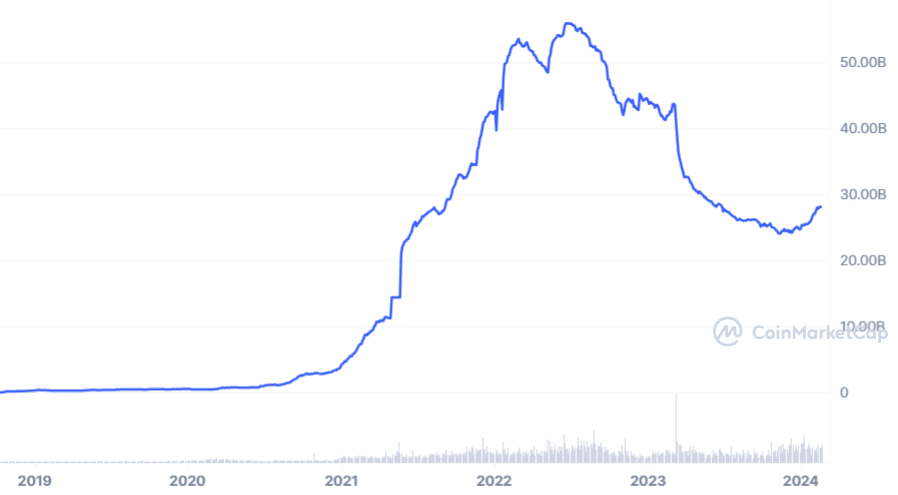

Stablecoins like USDC are cryptocurrencies pegged to fiat currencies, such because the U.S. greenback, and backed by a reserve of belongings. USDC is the world’s second-largest stablecoin, with a market capitalization of over $28 billion, as per data from CoinMarketCap. This determine locations it among the many high 10 cryptocurrencies globally regardless of a virtually 36% drop in market cap over the previous 12 months.

Data signifies that the distribution of USDC throughout numerous blockchains is very skewed in direction of Ethereum, with greater than $22 billion of its complete circulating provide hosted there. Solana comes subsequent, holding $1.4 billion, adopted by Polygon with $530 million. Tron, by comparability, accounts for a comparatively modest $313 million of USDC’s complete market presence.

The choice comes after a tumultuous first quarter of 2023 for USDC, marked by financial institution runs and a banking disaster affecting a number of giant monetary establishments, together with Silicon Valley Financial institution. Greater than a 12 months later, Circle is specializing in expansion in Europe, looking for key licenses to extend its market presence.

Circle’s transfer to go public in the USA was disclosed final month, highlighting the numerous market place of its USDC stablecoin. This announcement got here amidst earlier denials from Circle relating to service provision to Tron founder Justin Solar, following allegations by the Marketing campaign for Accountability of potential compromise attributable to integration with the Tron community.

The Marketing campaign for Accountability has linked the Tron community to varied worldwide legislation enforcement actions involving organized crime and sanctioned entities.

Moreover, the Securities and Trade Fee initiated a lawsuit towards Solar and the Tron Basis in March 2023, accusing them of issuing unregistered securities and fascinating in manipulative buying and selling practices, allegations that Solar refutes.