Analysts at Pantera Capital see a half-trillion-dollar alternative in bringing decentralized finance to Bitcoin, probably making Bitcoin-based decentralized apps high belongings in crypto.

Pantera Capital analysts have recognized a big alternative value over half a trillion {dollars} in bringing decentralized finance (defi) to the Bitcoin blockchain, probably positioning Bitcoin-based decentralized purposes as main belongings within the crypto house.

In a latest e-mail e-newsletter, Pantera Capital highlighted the potential for Bitcoin to build up $450 billion in liquidity via defi tasks, significantly in the event that they obtain related market shares as these that may be seen on the Ethereum blockchain proper now.

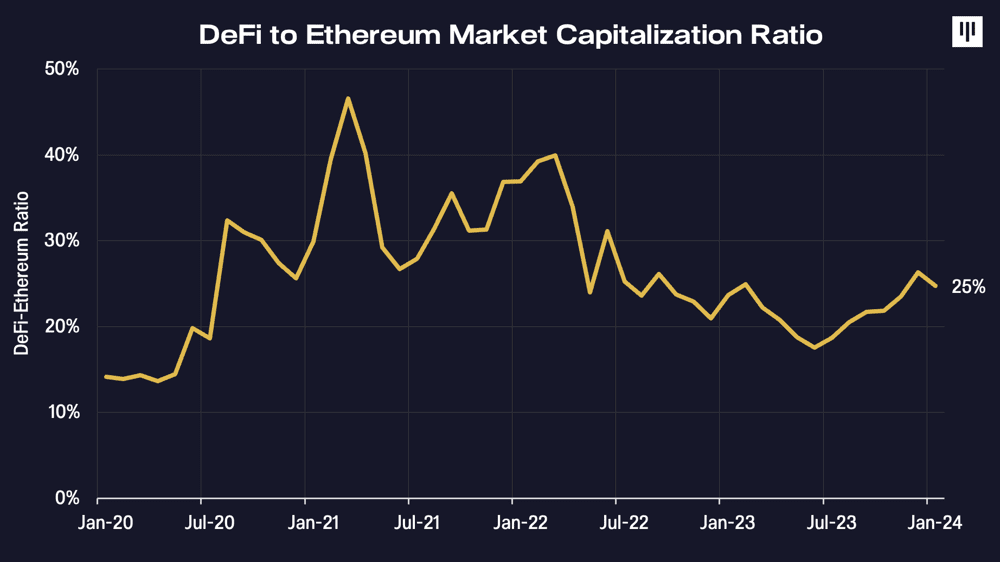

To this point, Ethereum dominates the defi panorama, internet hosting the vast majority of exercise, based on Pantera Capital. Traditionally, decentralized purposes on Ethereum have represented between 8% and 50% of Ethereum’s market capitalization, with the present determine standing at roughly 25%. Extrapolating these proportions to Bitcoin suggests the potential for the community to draw round $225 billion in worth.

Furthermore, Pantera Capital predicts that the main decentralized utility on Bitcoin may ultimately attain a valuation of $20 billion, firmly establishing itself among the many high most precious belongings within the ecosystem.

“This may place it squarely within the high 10 most precious belongings within the crypto ecosystem. Bitcoin is sort of again to being a trillion-dollar asset. But, it nonetheless holds an untapped half-trillion greenback alternative.” Pantera Capital

In mid-January, Pantera Capital emphasized the significance of choosing tokens with sturdy underlying protocols and confirmed product-market match, anticipating them to outperform within the upcoming cycle.

Though Pantera Capital didn’t title particular tokens, the agency mentioned that over the long run, token choice will likely be “paramount as a result of outperformance will likely be on a case-by-case foundation and never essentially in a sure sector or based mostly on fickle, short-lived speculative narratives.” The hedge fund additionally mentioned it expects the expansion of defi on the Bitcoin blockchain to proceed within the foreseeable future, with whole worth locked on the platform probably rising to 1-2% of Bitcoin’s market cap.