Bitcoin’s value fell to a weekly low of $50,600 on Feb. 23, down 5% within the final three days, however a uncommon shopping for frenzy noticed throughout Korean exchanges supplies contemporary market insights.

Cryptocurrency exchanges in South Korean markets have witnessed an uptick in Bitcoin (BTC) buying and selling this week. Historic developments counsel that this might considerably impression Bitcoin’s short-term value motion.

Korean buyers improve shopping for stress amid falling costs

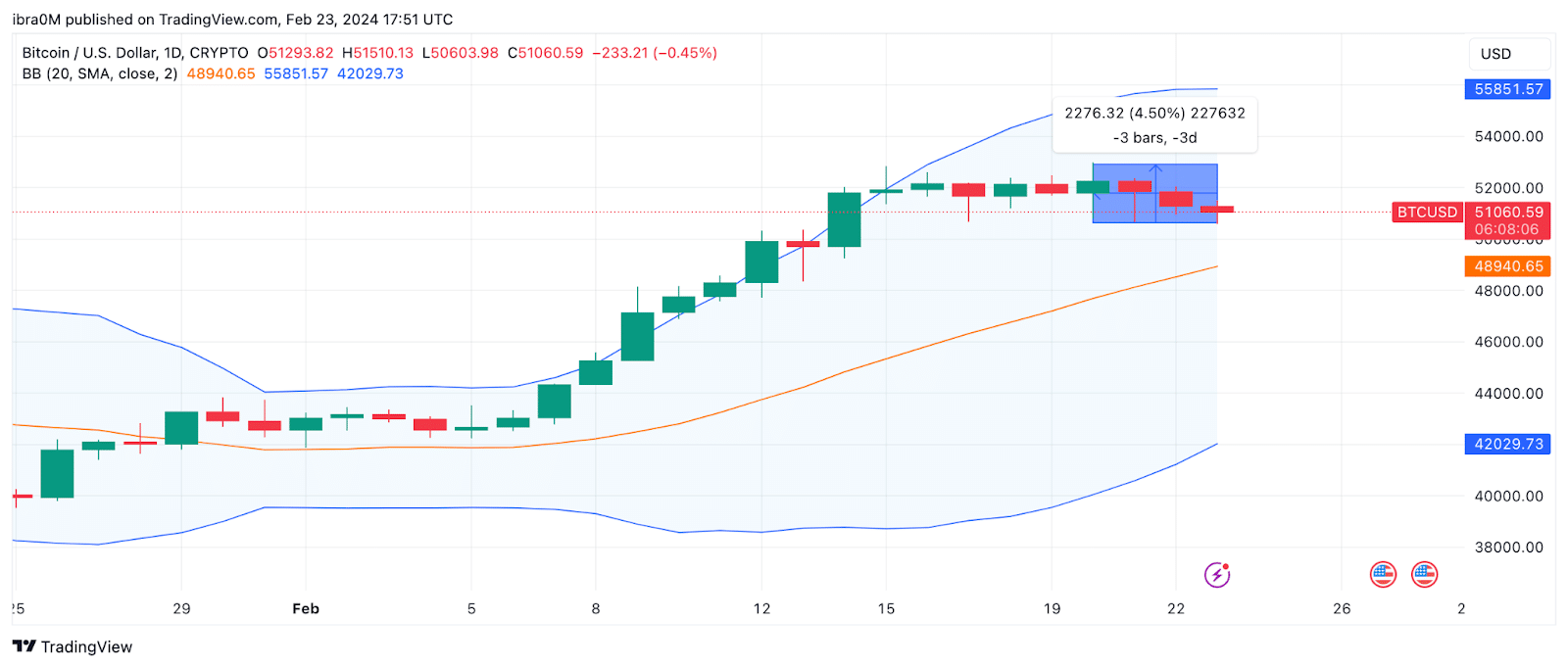

Following a blistering 27% uptrend within the first half of February, Bitcoin’s value has struggled to maintain the momentum this week. After hitting a yearly peak of $52,985 on Feb. 20, BTC value has now tumbled 5% to a brand new weekly low of $50,600 on the time of writing on Feb. 23.

Earlier this week, crypto.information reported on South Korean political events espousing pro-crypto insurance policies favoring ETFs and delays on further taxes. A uncommon shopping for development has emerged amongst crypto buyers in South Korean markets amid the falling Bitcoin value.

Nevertheless, historic developments counsel this might additional exacerbate Bitcoin’s ongoing value dip.

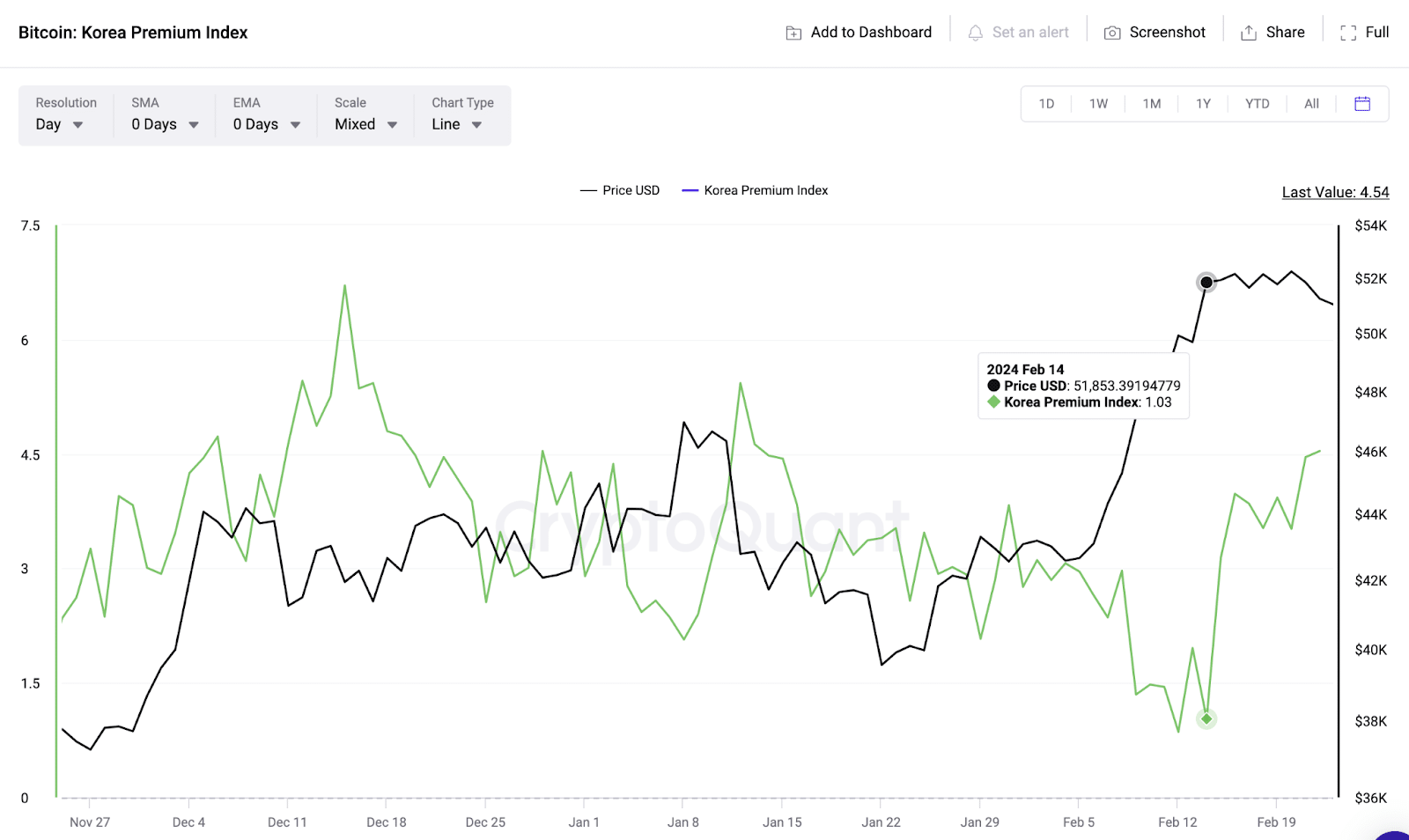

CryptoQuant’s Korean Premium (KP) Index tracks the value hole between South Korean exchanges and different exchanges. Rising values counsel elevated shopping for exercise amongst Korean buyers and vice versa.

The KP index has spiked 400% from 1.03 to 4.54 between Feb. 14 and Feb. 23, coinciding with Bitcoin’s ongoing value correction.

Traditionally, there was a noticeable correlation between the BTC value and the Korean Premium Index. When the KP Index spikes, indicating heightened shopping for exercise amongst Korean buyers, Bitcoin’s value usually experiences downward stress or detrimental correlation.

Bithumb, Upbit, Coinone, and Korbit are the main crypto exchanges in South Korea, often known as “The Huge 4.” These platforms host 90% of all crypto property held by the nation’s residents, in accordance with Seoulz.com analysis

The long-term inverse relationship with BTC costs means that fluctuations within the Korean market can affect broader market sentiment and contribute to cost volatility within the cryptocurrency ecosystem.

Bitcoin value prediction: BTC Can Discover Help at $48,900

If this uncommon detrimental divergence between Bitcoin value and Korean market exercise repeats, BTC will seemingly dip beneath $50,000. Moreover, with Bitcoin ETFs as a result of shut buying and selling for the week of Feb. 23, institutional demand for BTC will seemingly decline additional within the days forward.

Capitalizing on these crucial components, bears might make a brazen try and drive a speedy downswing towards $45,000.

On this state of affairs, Bitcoin shedding the $50,000 assist might set off a freefall towards the 20-day SMA value of $48,942. Contemplating the general sentiment surrounding the crypto markets remains to be largely bullish, BTC bulls might mount a consolidation buy-wall at that key assist stage.

Then again, Bitcoin might obtain a requirement surge from leveraged bullish buyers trying to avert margin calls on the $50,000 stage. On this case, Bitcoin value might expertise an upswing towards the subsequent important resistance on the $55,500 space, as depicted by the higher Bollinger Band indicator.