What’s a crypto bubble and the way does it work? Uncover their intricacies and discover their historical past and warning indicators.

The crypto market seems to once more be getting ready to new highs, with Bitcoin (BTC) not too long ago smashing by way of the $64,000 mark for the primary time since 2021. But, the customarily fleeting nature of those peaks has left consultants and traders grappling with a urgent query: is there a crypto a bubble destined to pop?

Whereas some assert the resilience of cryptocurrencies, others warn of an imminent crypto collapse.

On this article, we delve into the that means of the time period ‘crypto bubble’, dissecting its anatomy, exploring its parallels with conventional monetary bubbles, and providing prudent methods for traders navigating these unsure waters.

What are crypto bubbles?

Crypto bubbles symbolize a frenzied surge in cryptocurrency costs pushed primarily by hype and hypothesis, far surpassing their intrinsic worth.

Not like conventional property, most cryptocurrencies lack tangible property or income streams, rendering their valuation a speculative endeavor that’s susceptible to market sentiment and hype.

Very similar to the dot-com bubble within the late Nineteen Nineties or the housing bubble in 2008, crypto bubbles lure traders in with guarantees of astronomical good points, culminating in a pointy and probably devastating collapse.

The parallels between crypto bubbles and their conventional counterparts are onerous to disregard. Each are characterised by exuberance and euphoria, driving costs to dizzying heights, and fueled by the fear of missing out (FOMO) and speculative frenzy.

The absence of clear valuation metrics and the proliferation of recent funding merchandise typically additional exacerbate market volatility, echoing the patterns seen in previous monetary bubbles.

How does a crypto bubble work?

Under is how a typical crypto bubble works:

Preliminary hype and adoption: A brand new cryptocurrency, know-how, or blockchain challenge good points consideration attributable to its potential utility, revolutionary options, or guarantees to disrupt present industries. This typically results in an preliminary surge in curiosity and funding as early adopters and lovers purchase into the thought.

Speculative funding: As extra folks turn out to be conscious of the potential for top returns, speculative traders enter the market, hoping to revenue from the rising costs. This inflow of funding additional drives up demand and costs, making a constructive suggestions loop.

Media consideration and FOMO: As costs proceed to rise, mainstream media retailers and influencers on social media platforms begin masking and pushing the crypto craze, attracting much more traders. Worry of lacking out units in, prompting folks to speculate rapidly with out absolutely understanding the know-how or dangers concerned.

Irrational exuberance: Costs could then soar to unsustainable ranges, typically far exceeding the precise worth or utility of the underlying property. Right here, greed could take over, and traders could disregard elementary evaluation to chase fast income.

Peak and correction: Ultimately, the bubble peaks as shopping for strain subsides or unfavourable information emerges. At this level, some early traders could start to promote their holdings to understand income, which may set off a sell-off. As costs plummet, panic promoting ensues, exacerbating the decline.

Bubble burst: The bubble bursts when costs collapse dramatically, wiping out vital parts of traders’ wealth. It may be triggered by numerous elements, equivalent to regulatory crackdowns, safety breaches, technological flaws, or just a lack of confidence out there.

Restoration and consolidation: After the bubble bursts, costs sometimes stabilize at a decrease stage because the market undergoes a interval of consolidation. Surviving tasks with sturdy fundamentals could finally get well and proceed to thrive, whereas weaker or fraudulent tasks could fade away.

Examples of previous crypto bubbles

Crypto bubbles have had an interesting historical past for the reason that debut of Bitcoin in 2009, with the coin witnessing quite a few cycles of increase and bust. Market hypothesis, technological developments, and regulatory influences typically drove these fluctuations.

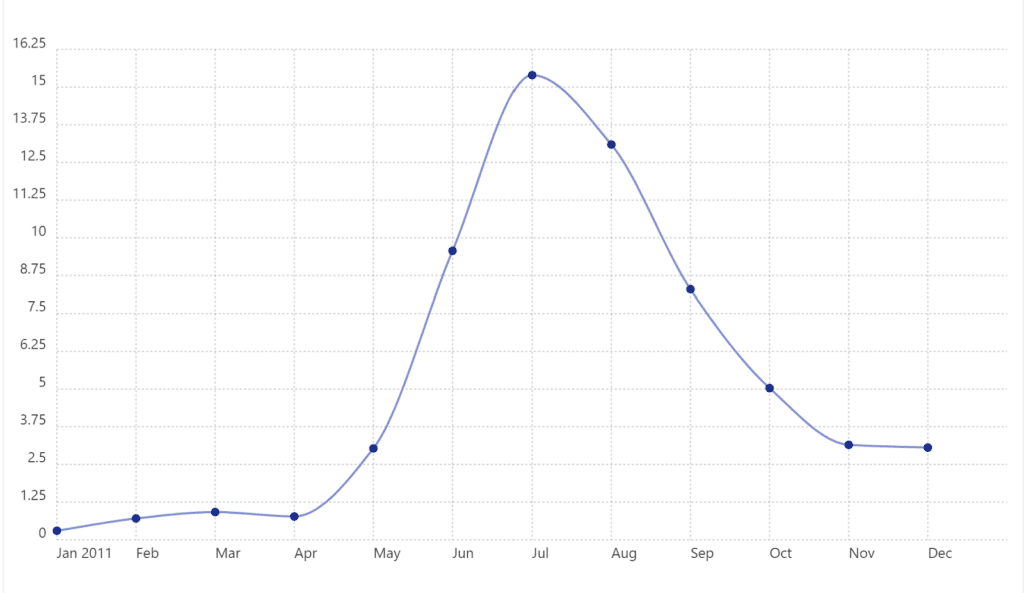

The first notable crypto bubble emerged throughout Bitcoin’s early days in 2011. The cryptocurrency’s worth surged from just a few cents to round $30 from April to June of that yr. This sparked a frenzy of funding and media consideration. Nonetheless, the crypto bubble burst, inflicting Bitcoin’s worth to plummet to single digits, leading to vital losses for early traders.

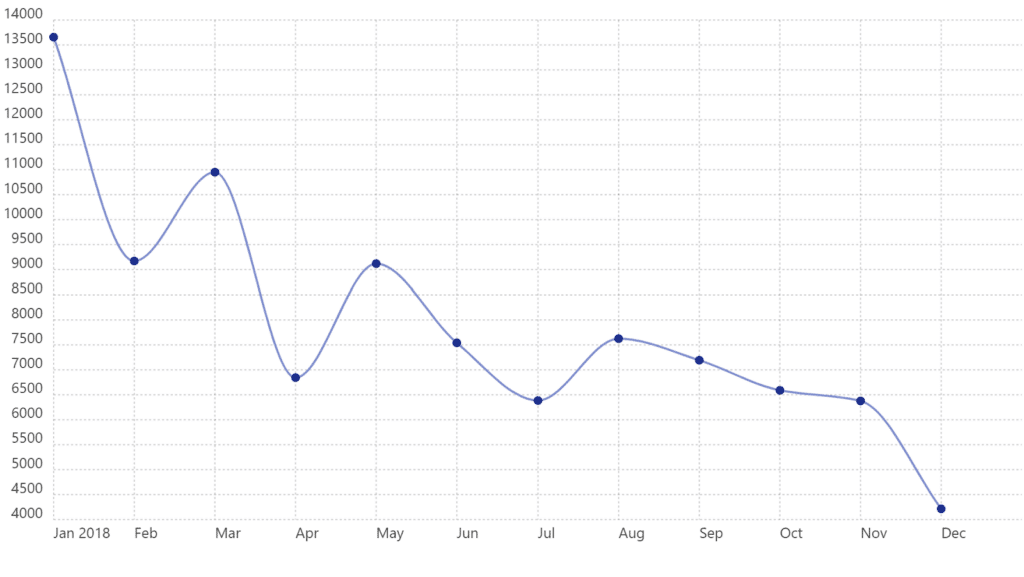

One other instance is the notorious Bitcoin bubble of 2017, which is etched within the reminiscences of many traders. BTC’s worth soared to almost $20,000 on the finish of 2017, earlier than crashing to round $3,000 inside a yr.

Across the identical time, the crypto area was additionally experiencing the preliminary coin providing (ICO) bubble, the place quite a few cryptocurrencies had been launched by way of ICOs, typically with out tangible services or products. Many of those tasks turned out to be scams, inevitably resulting in a cryptocurrency crash and inflicting substantial losses for many who had purchased into the hype.

Equally, the altcoin bubble of early 2018 noticed various cryptocurrency costs attain all-time highs, primarily pushed by hype. Nonetheless, by December 2018, many had misplaced almost all their market worth, as soon as once more inflicting vital losses for traders.

In 2021, non-fungible tokens (NFTs) gained widespread attention, with some selling for millions of {dollars}. Nonetheless, the NFT bubble burst in 2022, with buying and selling quantity plummeting considerably.

In the identical yr NFTs had been having fun with the limelight, Bitcoin went by way of one other part that many market watchers termed a bubble, surging to an all-time excessive of over $68,000 earlier than present process a major correction.

Warning indicators for crypto bubbles

Detecting a crypto bubble isn’t a precise science, however there are clues to look at for.

One telltale signal is a sudden surge in worth over a brief interval. Think about the worth of Ripple (XRP) or Solana (SOL) doubling and even tripling in only a matter of days or perhaps weeks — that form of speedy development typically indicators a bubble brewing.

One other warning signal is hype. Bubbles are likely to inflate alongside a surge in public curiosity, attracting a flood of inexperienced traders chasing quick income. If a cryptocurrency out of the blue dominates social media feeds and headlines, accompanied by a lightning-fast worth hike, it’s typically a crimson flag for a possible bubble.

Under are another key monetary indicators to look at for that will point out you’re within the midst of a crypto bubble able to pop:

Volatility: Hold a watch out for wild worth swings taking place briefly bursts. These excessive fluctuations recommend speculative buying and selling somewhat than steady funding methods.

Excessive buying and selling quantity: When buying and selling exercise spikes together with sizable purchase or promote orders, it may sign emotional somewhat than rational decision-making driving the market.

Market capitalization: If the entire market worth of cryptocurrencies skyrockets past what appears life like primarily based on adoption and utility, it’s an indication that issues may be overheated.

Worry and Greed Index: Excessive readings on sentiment indicators just like the Worry and Greed Index can point out irrational market conduct pushed by excessive optimism or pessimism.

Elevated margin buying and selling: Rising ranges of margin buying and selling and leverage within the crypto market can amplify good points and losses, indicating heightened speculative exercise.

Making ready for the burst

As crypto bubbles come and go, prudent methods are paramount for traders in search of to climate the storm. Listed below are some methods you may observe that might probably assist traders come by way of a crypto bubble burst comparatively unscathed.

Scale back publicity: Some consultants recommendation that when traders see the warning indicators of a bubble forming, as defined above, they take into account promoting off a few of their crypto holdings. This may increasingly assist mitigate potential losses and even flip a revenue if carried out strategically.

Monitor the market: Keep knowledgeable about crypto news and market traits. Maintaining your finger on the heart beat of the business may help in making knowledgeable choices and navigate the bubble with better ease.

Search professional recommendation: Think about consulting with skilled merchants or monetary advisors. Their insights may present helpful steerage on how one can navigate the turbulent waters of the crypto market.

Assume long-term: Whereas bubbles could also be momentary, the potential of cryptocurrencies is long-lasting. Adopting a long-term mindset could support in driving out the storm and presumably even rising stronger on the opposite facet.

Implement stop-loss orders: Think about establishing stop-loss orders to mechanically promote your property if costs dip beneath a sure threshold. These will help shield your investments in periods of market volatility.

Keep disciplined: Keep on with your funding technique and keep away from making impulsive choices primarily based on feelings or short-term fluctuations. Self-discipline is essential to weathering the storm of a crypto bubble.

Can traders revenue from crypto bubbles?

Whereas the attract of fast good points throughout a crypto bubble is attractive, it’s important to tread cautiously. There are vital cryptocurrency bubble dangers, together with the potential for substantial losses.

Crypto bubbles are a cocktail of hypothesis, hype, and human psychology. They epitomize the unstable nature of the crypto market, characterised by speedy worth fluctuations and speculative fervor.

Nonetheless, it’s necessary to notice that whereas crypto bubbles can result in vital monetary losses for traders, additionally they function studying experiences for the market as a complete. They spotlight the significance of conducting thorough due diligence, understanding the underlying know-how, and investing with a long-term perspective somewhat than succumbing to short-term hypothesis.

They’ll additionally function a reminder that it’s crucial to method crypto investing with warning, armed with data, and with a steadfast dedication to sound funding rules.

What are the indicators of a crypto bubble?

Figuring out the indicators of a possible crypto bubble might be advanced, as numerous elements affect market dynamics. Nonetheless, some frequent indicators embrace speedy and unsustainable worth will increase throughout a number of cryptocurrencies, heightened speculative exercise pushed by worry of lacking out (FOMO), extreme media protection emphasizing fast income, and a disconnect between valuations and the underlying fundamentals of tasks.

What are the principle dangers of cryptocurrency bubbles?

Cryptocurrency bubbles pose a number of dangers to traders and the broader market. One vital threat is the potential for substantial monetary losses when costs inevitably right after reaching unsustainable ranges. Moreover, bubbles can result in elevated regulatory scrutiny and interventions, which can affect market liquidity and investor confidence. Furthermore, bubbles can gasoline fraudulent actions and scams, as opportunists use the hype to advertise doubtful tasks.

Is Bitcoin a bubble?

Whether or not Bitcoin is in a bubble is topic to interpretation and debate. Like different cryptocurrencies, Bitcoin has skilled intervals of speedy worth appreciation adopted by vital corrections, which some observers characterize as bubble-like conduct. Nonetheless, others argue that Bitcoin’s long-term worth proposition as a decentralized retailer of worth and medium of trade warrants its present worth ranges.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.