The U.S. Securities and Change Fee (SEC) has once more postponed the deadline for a choice on BlackRock and Fidelity‘s purposes to launch Ethereum (ETH) spot ETFs.

Details about the appliance appeared on the regulator’s website. The SEC as soon as once more postponed the deadline for consideration of the appliance and requested feedback from market individuals.

“The Fee has reached any conclusions regarding any of the problems concerned. Relatively, as described under, the Fee seeks and encourages individuals to touch upon the proposed rule change.”

SEC assertion

The primary postponement of the choice on purposes was recorded in January 2024. The March postponement was the second. The SEC might change the choice date on purposes thrice in complete.

In line with Bloomberg analyst James Seyffarth, the instrument may hit the market on Might 23, 2024. At the present time marks the deadline for the SEC to problem a choice on VanEck’s software to launch a spot Ethereum-ETF.

In February, the American funding fund Franklin Templeton, which manages $1.5 trillion in belongings, joined the checklist of purposes to launch an Ethereum-ETF. The corporate plans to entrust the storage of ETH to the Coinbase alternate as a custodian. Items of the Franklin Ethereum ETF will commerce on the Chicago Board Choices Change (CBOE).

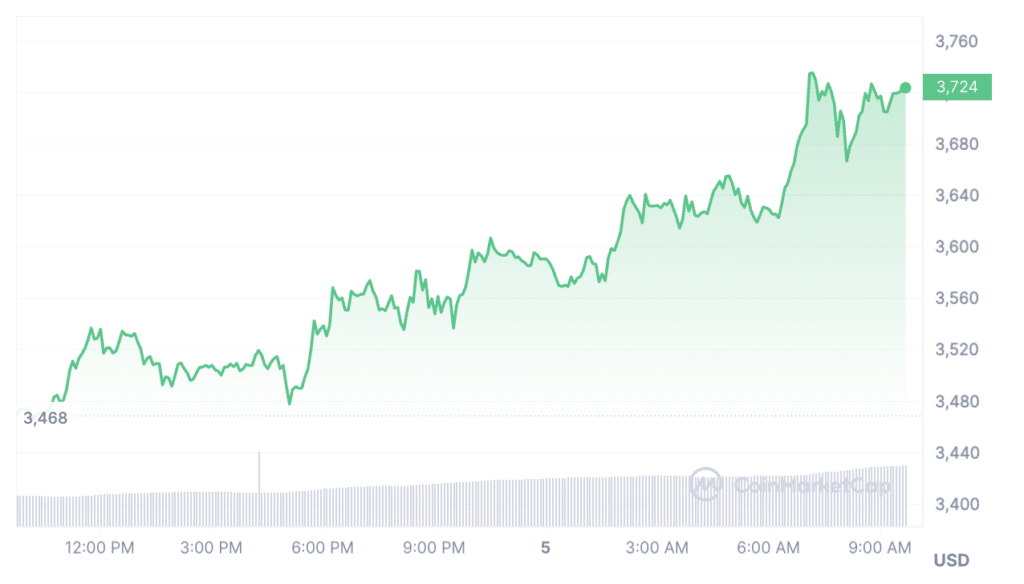

In the meantime, the SEC’s resolution didn’t have an effect on the value of Ethereum in any approach. The second-largest cryptocurrency by market cap is up greater than 7% over the previous 24 hours, buying and selling above $3,700 on the time of writing, in line with information from CoinMarketCap.

The expansion of ETH adopted the fast rally of Bitcoin (BTC) – on March 4, BTC got here as shut as attainable to its all-time excessive, reaching $68,770.