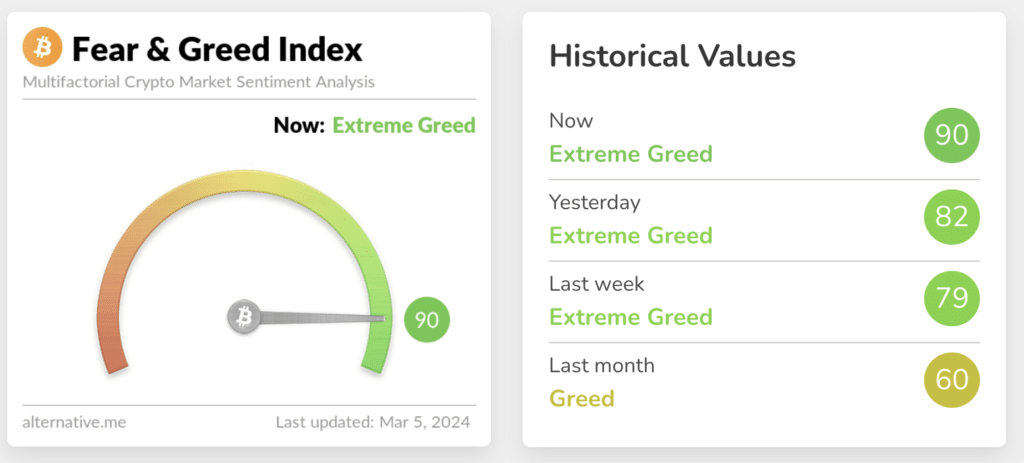

The Concern and Greed Index has reached its highest stage since February 2021.

With Bitcoin (BTC) approaching an all-time excessive (ATH), the cryptocurrency Concern and Greed Index has reached 90,

The extent of 75-100 exhibits an excessive stage of greed and implies that merchants available in the market are within the temper to purchase extra. When the market goes up, folks are likely to accumulate extra cryptocurrency, which suggests they develop into extra grasping, a phenomenon that results in increased value actions.

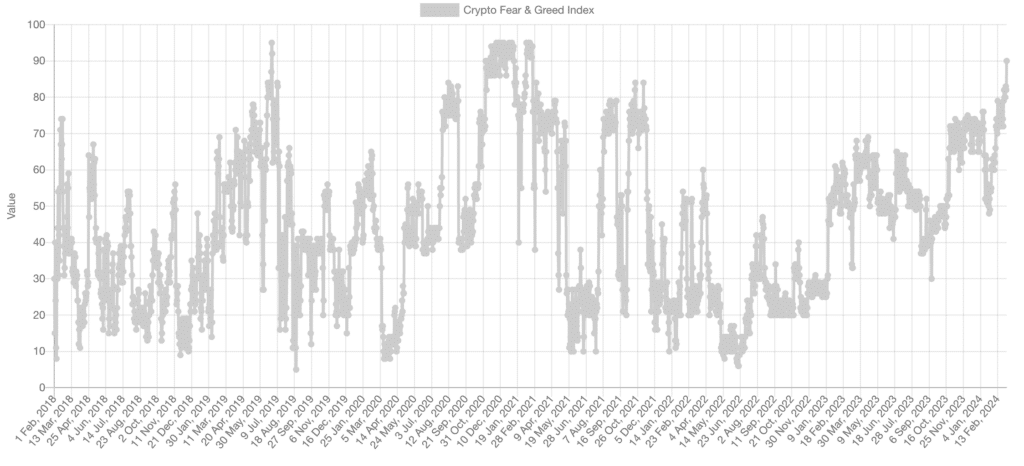

The graph exhibits that the metric has been under 70 for a number of years. Market sentiment has improved noticeably since final fall amid the market restoration and its transition to a bullish part.

On the time of writing, BTC is buying and selling at $66,700. Over the previous 24 hours, the asset has risen in value by 2.4%; in 7 days, it has elevated by 17.7%, in response to CoinMarketCap. Bitcoin’s market capitalization has updated its all-time excessive above $1.3 trillion, and on March 4, the BTC value reached $68,600 – slightly below the all-time excessive recorded in November 2021.

In opposition to this rise, the quantity of liquidations on futures on the cryptocurrency market amounted to greater than $560 million. Most liquidations occurred on buying and selling pairs with Bitcoin, Ethereum (ETH), Dogecoin (DOGE), Shiba Inu (SHIB). The most important quantity of liquidations has historically been recorded on the Binance and OKX cryptocurrency exchanges.