Investor sentiment in Bitcoin ETFs displays a rising choice for the crypto over conventional gold regardless of each reaching unprecedented value ranges.

Bitcoin and gold are sometimes seen as protecting measures in opposition to inflation and useful property, however this 12 months has marked a notable divergence in investor habits. Latest knowledge reveals gold ETFs skilled withdrawals totaling roughly $4.6 billion.

Conversely, Bitcoin ETFs authorized by the SEC on Jan. 11 witnessed $8 billion in internet investments, marking a report debut for the monetary devices.

The comparability between Bitcoin and tangible property like gold, notably of their non-yielding nature, has gained traction amongst traders, particularly amid the low-interest charges noticed through the Covid pandemic.

Latest tendencies recommend anticipations of financial coverage changes, world political uncertainties, and issues over potential fairness market downturns more and more affect gold’s value actions.

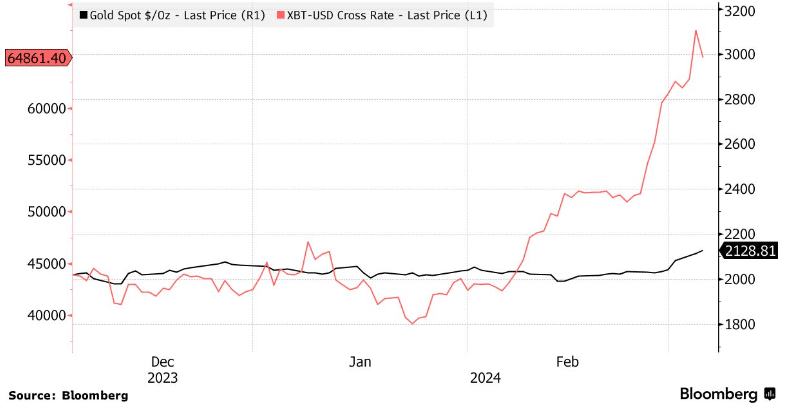

Bitcoin’s worth soared to its highest level in over two years on Tuesday, although the height was short-lived. The cryptocurrency’s value reached $69,191 earlier than retracting roughly 6%, as traders determined to capitalize on the 12 months’s important positive factors, which amounted to round 60%.

In the meantime, gold stays close to its record-high value of $2,141, showcasing the contrasting investor confidence within the two property amidst a unstable market.