As Bitcoin usurped silver because the eighth most precious asset, Michael Saylor’s MicroStrategy stuffed its digital coffers with extra cryptocurrency.

Virginia-based enterprise software program agency MicroStrategy scooped an extra $821.7 million value of Bitcoin (BTC) following its convertible notes offering to stack extra of the world’s main crypto.

MicroStrategy acquired 12,000 BTC from its debt safety sale proceeds and extra money. The corporate based by Bitcoin maxi Michael Saylor purchased its newest stash at a mean value of $68,477 per BTC, reaffirming Saylor’s promise all the time to purchase the highest.

The Tysons Nook, Va.-based big has now spent practically $7 billion on the digital asset and holds some 205,000 BTC value over a staggering $14.8 billion, because the cryptocurrency traded at an all-time excessive (ATH) on March 11. MicroStrategy has momentarily inched forward of spot BTC ETF issuer BlackRock as one of many largest company BTC holders.

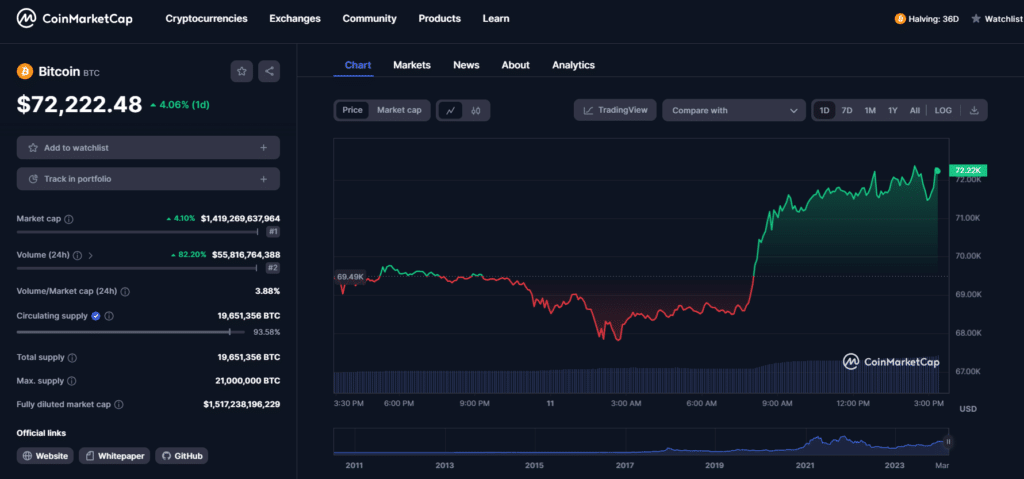

Per CoinMarketCap, BTC was up greater than 4% in 24 hours and offered for greater than $72,000 for the primary time in its 15-year historical past. The leap additionally propelled BTC’s market cap to over $1.4 trillion, a landmark second for crypto’s king token.

Saylor: Bitcoin is the superior digital asset

Talking to CNBC about BTC’s worth proposition amid ATH euphoria and MicroStrategy’s most up-to-date addition, Saylor opined that crypto outclasses different belongings for numerous causes.

Bitcoin is digital property. It’s superior to different investments comparable to gold, fairness, or actual property as a result of it’s digital, out there, world, moral, and helpful to thousands and thousands of corporations and billions of individuals.

Michael Saylor, MicroStrategy founder

Saylor said MicroStrategy plans to carry BTC for over 100 years and can proceed to purchase the crypto with money, debt, and different monetary devices the corporate can entry.