Bitcoin Alternate-Traded Funds (ETFs) skilled a outstanding buying and selling day on March 12, with a record-breaking buy of 14,261 bitcoins.

The determine not solely surpasses the preliminary enthusiasm witnessed in the course of the ETFs’ launch but additionally units a brand new excessive for market engagement. The strategy for calculating these Bitcoin purchases entails dividing the day by day financial influx by Bitcoin’s common value, highlighting the ETFs’ vital position available in the market.

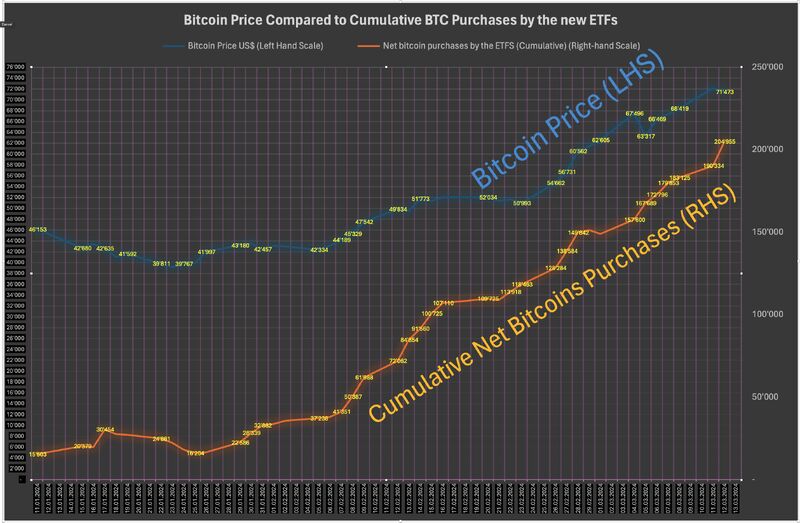

After experiencing a downturn in inflows that coincided with a discount in Bitcoin’s value, the ETFs have proven a powerful rebound. Present tendencies point out not only a restoration however an ongoing improve in investments. This surge in demand for Bitcoin through ETFs, contrasted with the day by day new provide from mining at roughly 900 bitcoins, is contributing to an upward motion in Bitcoin costs. This hole is anticipated to broaden with the upcoming Bitcoin halving event, which is able to scale back the day by day mining output to 450 bitcoins.

In a March 14 post on LinkedIn, Clive Thompson, a former managing director of wealth administration with a background in Swiss Non-public Banking, famous a possible hyperlink between the rise in Bitcoin holdings by ETFs and the rise within the cryptocurrency’s value.

This means that ETF actions might play a vital position in Bitcoin’s market actions. Regardless of value fluctuations, Bitcoin’s total pattern stays constructive, supported by a excessive Cryptocurrency Concern and Greed Index at 91, indicating a powerful market sentiment.

The market is presently pushed by two principal components: the anticipation of the Bitcoin halving occasion, which is predicted to provoke the following bull cycle, and the continual curiosity in ETFs. The introduction of Bitcoin ETFs has been notably vital, attracting institutional funding and rising the cryptocurrency’s mainstream enchantment.

In line with Kaiko Analysis, liquidity depth within the Bitcoin market has hit a brand new excessive, with a notable imbalance between bids and asks so as books, suggesting a pattern of profit-taking amongst merchants. Regardless of this, excessive refinancing charges point out sustained demand for Bitcoin.

The rising curiosity in spot Bitcoin ETFs, each from institutional and retail buyers, is making a noticeable impression. With Bitcoin ETFs nearing $60 billion in belongings underneath administration (AUM) and quickly closing the hole with Gold ETFs, which stand at about $98 billion, the momentum suggests a possible shift in funding preferences.

Eric Balchunas from Bloomberg Intelligence factors out that every one 10 Bitcoin ETFs are prone to surpass Gold ETFs in AUM. The least ranked amongst them, WisdomTree‘s BTCW, already manages $74 million, inserting it within the prime 15% of the 108 ETFs launched in 2024, signaling a powerful market acceptance and progress potential for Bitcoin ETFs.