In 2023, buyers in China’s cryptocurrency market noticed spectacular features, accumulating roughly $1.15 billion, in accordance to Chainalysis.

This achievement positioned them fourth globally, trailing behind the U.S., the UK, and Vietnam.

Chainalysis, a blockchain analysis agency in New York, highlighted a big rebound within the crypto area, exhibiting robust continued curiosity inside China regardless of the federal government’s restrictions.

Notably, the entire features by crypto buyers worldwide in 2023 amounted to $37.6 billion, a substantial restoration from the earlier 12 months’s losses.

Nevertheless, the quantity nonetheless contrasts with the explosive $159.7 billion features made in 2021 through the crypto market’s final main bull run earlier than it succumbed to a long-drawn winter.

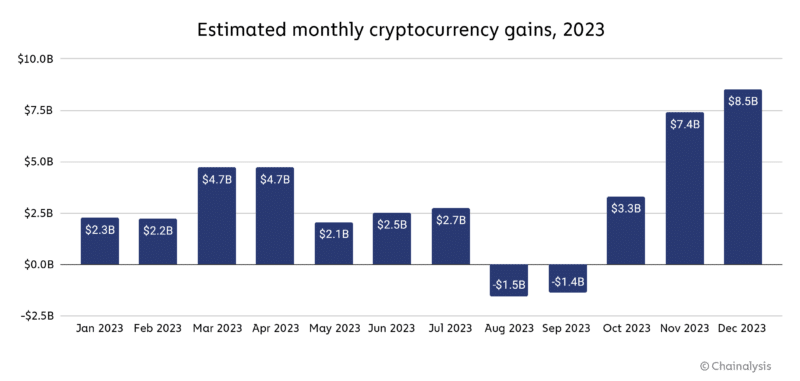

Per the evaluation, crypto earnings in 2023 have been regular all 12 months till they dropped in August and September.

After that, earnings shortly went up, with November and December having a lot increased numbers than some other months earlier than.

Earnings by American crypto buyers simply surpassed these of the remainder of the world, with Chainalysis estimating they made roughly $9.36 billion in 2023. Compared, buyers within the second-highest-earning nation, the UK, collectively made about $1.39 billion.

Though about eight instances lower than the U.S., mainland China’s efficiency is especially outstanding given the stringent ban imposed by Beijing on cryptocurrency-related actions.

The persistence and success of cryptocurrency fanatics within the nation underscore a resilient curiosity in digital belongings, at the same time as the federal government maintains a good grip on the sector.

In the meantime, in Hong Kong, buyers managed to safe $250 million in features, indicating a vigorous market regardless of fluctuating fortunes since 2021.

Regardless of China’s common skepticism in the direction of cryptocurrencies, the particular administrative area has taken steps to draw crypto companies and monetary giants to its shores, aiming to be a number one heart for the way forward for digital funds.

Globally, the continued energy of cryptocurrency adoption, particularly in Asia, alerts a promising horizon for the digital asset class, regardless of regulatory challenges and market volatility.

The early months of 2024 have proven promising developments which may herald features similar to the height of 2021, with vital cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) experiencing notable worth surges, with BTC even breaking its all-time high worth file.

This optimism is met with cautionary recommendation from Chinese language authorities, reminding buyers of the inherent dangers regardless of current successes.