The Reserve Rights (RSR) token has surged by 30% within the final 24 hours, setting it aside as one of many standout performers within the cryptocurrency market.

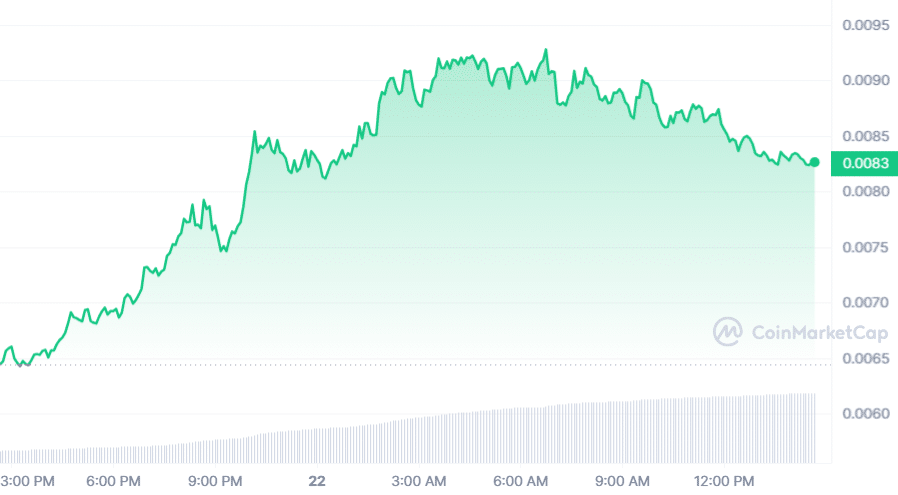

As per information by CoinMarketcap, on March 22, the token’s worth reached $0.0096, marking its highest stage since 2022.

The surge happens at a time marked by a basic downturn available in the market, with main cryptocurrencies resembling Bitcoin, Ethereum, and Ripple experiencing declines.

Reserve Rights is a blockchain initiative geared toward making a secure, inflation-resistant forex. The Reserve Protocol permits customers to supply RTokens, that are belongings which can be launched into the ecosystem.

Anybody can create an RToken by merely depositing collateral using blockchain expertise. Sometimes, these tokens may be redeemed 1:1 for the underlying belongings. Most importantly, they’re meant to be overcollateralized, which implies that if any of the collateral tokens fail, there’s a pool of worth to guard the worth of the RToken holders.

The explanations behind the sudden enhance in Reserve Rights Token’s value stay speculative. In accordance with sources, the sudden surge of this token seems to have been attributable to tweets from a number of well-known individuals within the cryptocurrency enterprise.

They speculated on Twitter about Reserve’s potential involvement within the rising blockchain asset tokenization development. RSR investor @MopHandle envisioned a situation during which Reserve Protocol would launch on Coinbase’s newly launched Ethereum Layer-2 community Base in August 2023.

One other issue attributed to the rise is the keenness surrounding Blackrock’s announcement of a tokenization fund on Ethereum.

The Blackrock USD Institutional Digital Liquidity Fund’s ticker is BUIDL, and it’s backed by money and Treasuries. In accordance with an announcement from the corporate’s head of digital belongings,

“We’re targeted on creating options within the digital belongings house that assist clear up actual issues for our purchasers, and we’re excited to work with Securitize.”

Robert Mitchnick, BlackRock’s head of digital belongings

Blackrock’s enterprise into tokenization underscores a rising curiosity in tokenized belongings, becoming a member of different distinguished entities resembling Franklin Templeton, JPMorgan, London Inventory Alternate, and Citi, which have launched comparable merchandise in latest months.

With over $10 trillion in belongings below administration, Blackrock’s entry into the tokenization house is seen as a big endorsement of the demand for such belongings and a validation of the Reserve Rights blockchain firm.

Discussions on social media additional recommend that the Reserve Protocol’s capability to take care of secure belongings, demonstrated through the USDC depeg occasion amidst the Silicon Valley Financial institution disaster, positions it as a significant participant within the tokenization efforts of main corporations.

Tweets by @cjdemelker highlighted the alignment of Blackrock’s involvement and rumors of a Coinbase collaboration with Reserve’s potential, signaling a promising outlook for RSR holders, particularly if the token surpasses the $0.01 mark.