Bitcoin (BTC) is again above the $70,000 mark after tumbling for 11 days with excessive value volatility.

BTC is up by 5.4% previously 24 hours and is buying and selling at $70,500 on the time of writing. The flagship asset’s market cap is barely above the $1.38 trillion mark with a every day buying and selling quantity of $42.7 billion.

Knowledge from CoinGecko shows that Bitcoin’s value rally has introduced bullish momentum to the worldwide crypto market capitalization with a 5.4% enhance — presently hovering round $2.83 trillion.

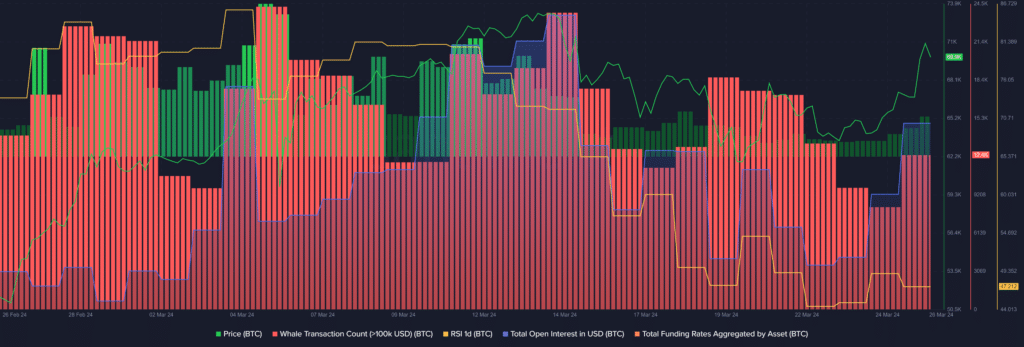

In accordance with information offered by Santiment, the variety of whale transactions consisting of at the very least $100,000 price of BTC surged by 50.7% over the previous 24 hours — rising from 8,233 to 12,404 distinctive transactions per day.

Furthermore, Bitcoin’s whole open curiosity (OI) additionally registered an $800 million enhance. Per information from Santiment, the whole BTC OI surged from $11 billion to $11.8 billion over the previous day.

Increased value volatility is often anticipated when an asset’s whale exercise and open curiosity register sudden will increase.

Alternatively, information reveals that the quantity of trades betting on an extra value surge for Bitcoin has hiked. In accordance with Santiment, the whole BTC funding fee aggregated from all exchanges jumped from 0.01% to 0.02%.

This reveals that merchants are optimistic a few BTC value surge because the fourth Bitcoin halving will get nearer.

Per a crypto.information report, “Wealthy Dad, Poor Dad,” creator Robert Kiyosaki believes that the BTC value might probably surpass the $100,000 mark by September this 12 months. Kiyosaki additionally claimed that he would buy 10 extra Bitcoins earlier than April.

Notably, the Bitcoin Relative Energy Index (RSI) has been constantly declining over the previous three weeks regardless of the overheated market circumstances.

Santiment information reveals that the BTC RSI declined from 49 to 47 over the previous 24 hours. The indicator reveals that Bitcoin is in good situation for a possible value surge.