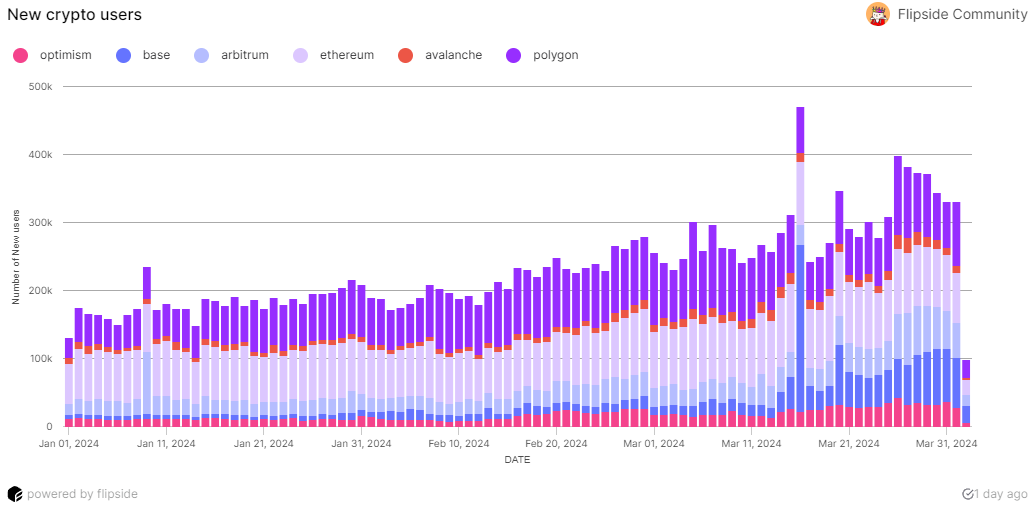

Ethereum and Polygon keep their lead over newer Ethereum Digital Machine (EVM) chains in drawing new customers and rising buying and selling volumes, as revealed by Flipside’s “New EVM Customers: Q1 Snapshot” report.

As of March 27, Ethereum had 13.4 million new customers, whereas Polygon had 12.3 million, accounting for roughly 70% of the full variety of new EVM customers this yr. In distinction, Arbitrum has added 4.7 million customers for the reason that starting of 2024.

Whereas Ethereum’s mainnet maintains its historic dominance, Layer-2 protocols are processing extra knowledge. Decentralized finance (defi) stays the important thing attraction for brand new customers, with Ethereum main in buying and selling quantity at $12 billion in Q1.

Moreover, the upward development of defi exercise contrasted with the earlier yr’s intermittent, unstable swings, indicating a rising curiosity and participation in DeFi amongst novices within the blockchain house.

Arbitrum ranked second on the checklist, with a $9.5 billion acquire for the reason that starting of 2024. The Flipside report attributes this milestone to elevated new person exercise in Arbitrum’s defi house. In distinction, Polygon’s excessive new person numbers are ascribed to a rise in non-fungible token (NFT) exercise.

With a file 243,000 new customers as of March 16, Base has practically octupled its new person base since January, owing to Coinbase’s efforts to simplify cryptocurrency for novices.

“Whereas this nonetheless places Base far behind the main EVM chains when it comes to general new person quantity, it nonetheless represents spectacular progress, significantly for the reason that chain’s exercise waned in the course of the ultimate months of 2023,” the report said.

The report notes that the surge coincides with Bitcoin reaching a brand new all-time excessive and represents the best single-day new person rely amongst EVM chains this yr.

Demonstrating range, a good portion of newly registered customers work together with an assortment of decentralized purposes (dApps) on Ethereum. Nonetheless, the evaluation discovered that Ethereum didn’t have probably the most evenly distributed app adoption among the many six analyzed chains.

“This distinction goes to Base, the place the distinction in new person quantity between the chain’s 1 and a couple of apps was solely 16.9%, in comparison with Ethereum’s ~300%.”

“The truth that Base is comparatively new doubtless decreased early protocols’ first mover benefit and consequent community results, stopping person consolidation round a single app.”

Token swaps and bridging apps are the most common entrance factors for brand new customers on EVM chains, with Uniswap and Orbiter Finance main the best way on Ethereum and Base, respectively.

As revealed by extra insights within the Flipside report, NFT buying and selling exercise throughout EVM chains painted a muddled image.

New person NFT buying and selling on Ethereum and Base elevated steadily, whereas it declined considerably on Polygon from its early peaks; this variation highlights the erratic nature of curiosity in NFTs and means that they could not proceed to dominate the market narrative within the upcoming cycle as they’d up to now.

Furthermore, the report additionally emphasised the position of particular purposes in directing person exercise on varied chains. As an illustration, many new Optimism customers have been lured to Worldcoin (WLD), indicating a long-term neighborhood curiosity in sure tasks:

“This outstanding statistic, together with Optimism’s low DeFi and NFT buying and selling quantity relative to different noticed chains, could replicate a possible divergence between Optimism’s ecosystem evolution relative to different EVM chains.”