Glassnode examined how the newest development in direction of restaking protocols might affect Ethereum’s function as a financial asset.

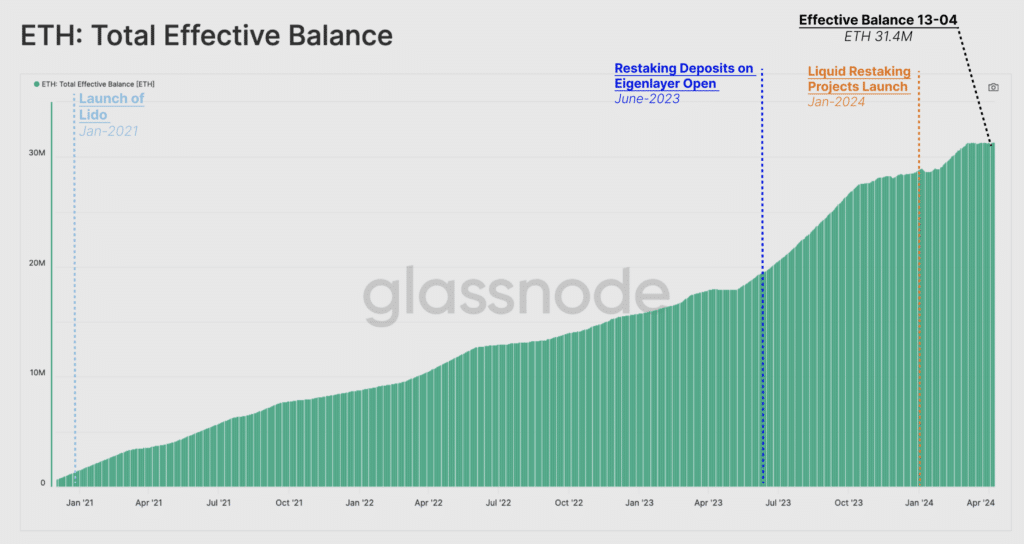

The emergence of the EigenLayer and LRT staking protocols increased ETH’s share of staking to 26% of the overall provide. Analysts additionally recorded a rise within the total development in cash staked to 31.4 million Ethereum (ETH) as of April 13.

Though extra ETH reduces non-validator rewards, the overall quantity of rewards paid might nonetheless contribute to inflation if there are a big variety of locked belongings, Glassnode suggests.

After The Merge, the share of latest cash within the complete Ethereum provide reached 1.01%. Throughout this era, about 3.55% of ETH was withdrawn from circulation.

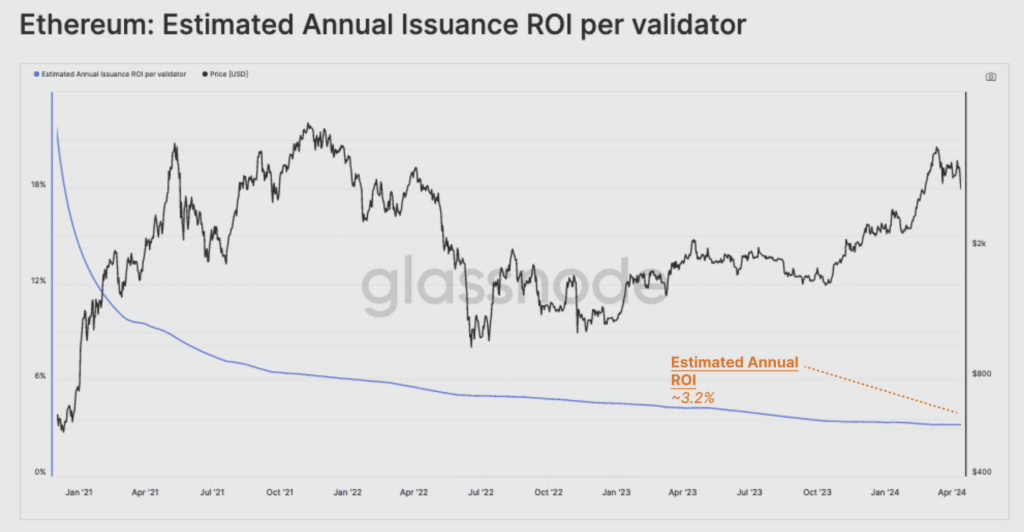

Because of the metric improve, the remuneration stage for making certain community safety per every validator dropped to three.2% every year.

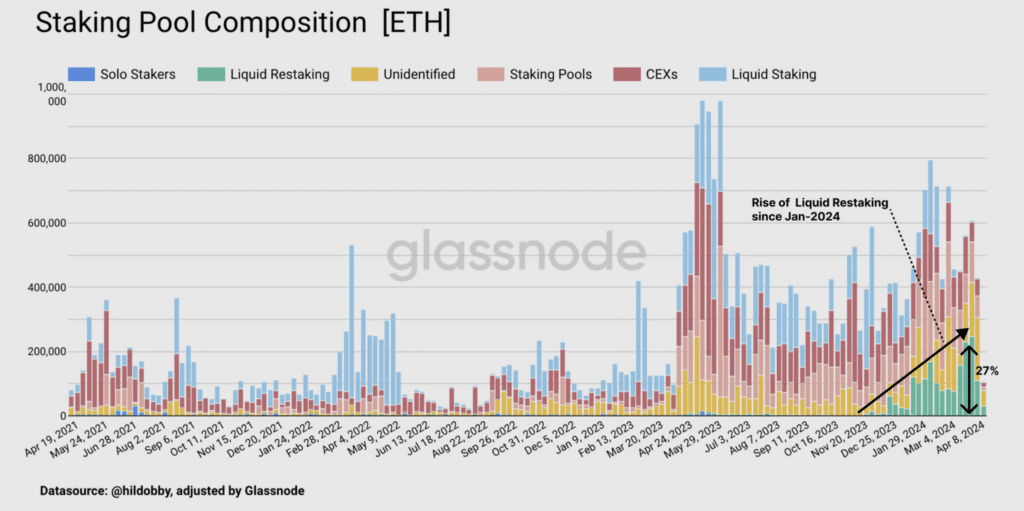

As well as, improvements like MEV, liquid staking, restaking, and liquid restaking have led to elevated staking wants past the unique intent, in response to consultants. Liquid restaking protocols account for 27% of the cash despatched to the deposit contract.

As extra ETH is staked, the consequences of inflation start to have an effect on fewer and fewer holders of the asset. In different phrases, there’s a switch of wealth to individuals who generate further earnings from sustaining the community’s safety.

Specialists identified that over time, the actual yield element might make possession of ETH much less engaging and negate Ethereum’s perform as a financial asset within the Ethereum ecosystem.

Restaking permits customers to stake their belongings a number of occasions on the principle blockchain and extra protocols. Because the starting of the 12 months, the restaking sector has been actively rising.

Firstly of April, the overall worth locked (TVL) within the restaking protocols exceeded $8 billion. The chief was the ether.fi mission with $3.2 billion.