Will the much-anticipated approval of spot Bitcoin ETFs be the catalyst for widespread adoption, or might it paradoxically hinder Bitcoin’s development?

As of Dec. 11, the U.S. Securities and Change Fee (SEC) has not authorised any spot Bitcoin (BTC) ETF purposes regardless of rising curiosity and quite a few filings from main monetary entities.

This persistent reluctance stems from issues about fraud and market manipulation, with the SEC emphasizing the necessity for a “complete surveillance-sharing settlement with a regulated market of serious dimension.”

Traditionally, applications for Bitcoin spot ETFs have been repeatedly submitted and rejected. Notable funding corporations like Ark Make investments, Invesco, WisdomTree, VanEck, Bitwise, and Valkyrie have all confronted rejections of their makes an attempt to launch such merchandise.

Regardless of these setbacks, the race for approval continues, with BlackRock, the world’s largest asset supervisor, lately submitting a renewed ETF utility. This transfer has sparked renewed hope within the crypto neighborhood, contemplating BlackRock’s profitable observe report with ETF purposes.

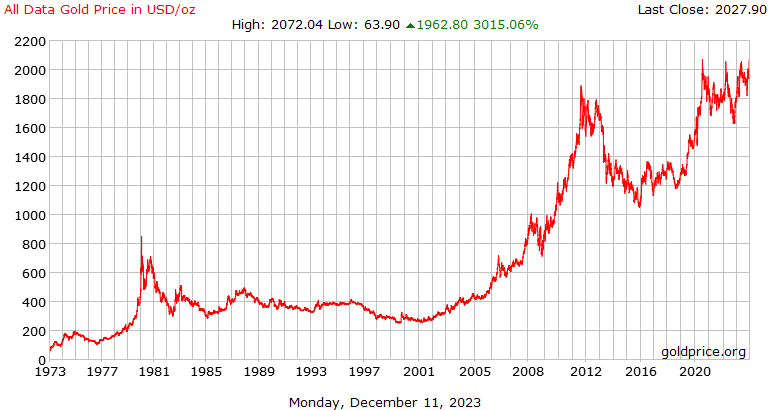

However what does historical past inform us? Wanting again on the gold market’s evolution post-ETFs, we see a path paved with elevated demand and hovering costs – a path Bitcoin may nicely comply with.

But, Bitcoin, with its distinctive digital nature and a market dynamic distinct from conventional belongings like gold, presents a fancy and multifaceted situation.

Let’s delve into this intricate narrative, exploring the historic parallels, knowledgeable opinions, and financial implications of a world the place Bitcoin spot ETFs are not a hypothetical however a actuality. How will this impression Bitcoin’s trajectory, and what does it imply for traders, idealists, and the worldwide monetary panorama?

Gold vs Bitcoin: what does historical past inform us?

The historical past of gold ETFs provides invaluable insights into how a possible approval of a Bitcoin spot ETF might impression the cryptocurrency’s market dynamics.

The primary gold ETF, Gold Bullion Securities, was launched on the Australian Securities Change in March 2003, adopted by the launch of SPDR Gold Shares (GLD) in the USA in November 2004. This marked a major shift in how traders might entry the gold market.

Earlier than the arrival of gold ETFs, funding in gold was sometimes finished by means of bodily gold purchases or shares in gold miners, which supplied leverage to gold costs.

Bodily gold, nevertheless, had a number of drawbacks, similar to gross sales tax, storage prices, and regulatory constraints, making it much less accessible to the typical investor.

The introduction of gold ETFs democratized gold funding, providing a extra simple and cost-effective option to put money into gold with out proudly owning it bodily. This ease of entry performed a pivotal position in growing gold’s attraction to a broader vary of traders.

The impression of gold ETFs in the marketplace was substantial. The gold worth, which had been in decline from its peak in 1980, started to rise steadily after central financial institution promoting stopped and VAT was eliminated on bodily gold purchases.

Following the launch of the primary gold ETF, gold costs skilled a major enhance. Between 2004 and 2011, gold worth soared from round $450 to greater than $1,820, marking an almost 350% enhance.

Drawing parallels to Bitcoin, the approval of a Bitcoin spot ETF might probably have a equally transformative impact.

A Bitcoin spot ETF would supply direct publicity to Bitcoin’s worth, making it extra accessible to a wider vary of traders, together with these much less inclined to navigate the complexities of cryptocurrency exchanges or digital wallets.

This elevated accessibility might result in larger demand and probably drive up Bitcoin’s worth.

Nevertheless, it’s essential to think about the variations between gold and Bitcoin markets. Bitcoin’s market dynamics, regulatory atmosphere, and investor profile differ considerably from these of gold. Whereas historical past can present insights, the impression of a Bitcoin spot ETF might manifest in a different way because of these distinctive components.

What do specialists assume?

Nitin Gaur, World Head of Digital Asset and Expertise Design at State Road, opines that Bitcoin ETFs might usher in a transformative period for Bitcoin’s market dynamics. He says:

“The approval of Bitcoin ETFs isn’t just a regulatory milestone; it’s a gateway to unprecedented capital inflows into the Bitcoin ecosystem. Publish-approval of those spot Bitcoin ETFs, we might witness Bitcoin’s worth hovering previous $60k ranges by the following halving occasion.”

Gaur additionally emphasised the broader implications past the value jumps, specializing in how Bitcoin spot ETFs might basically alter Bitcoin’s long-term viability and acceptance within the monetary ecosystem. He additional talked about:

“This isn’t merely about worth increments; it’s about legitimizing Bitcoin within the eyes of conventional traders and accelerating its journey to turning into a mainstream monetary asset.”

In the meantime, Hubertus Hofkirchner, founding father of Bitcredit Protocol, supplied a nuanced perspective on the potential impression of Bitcoin spot ETFs.

“The joy round ETF approval embodies the dichotomy inside the Bitcoin neighborhood — idealists championing a brand new financial paradigm, and traders eyeing worth appreciation. Whereas an ETF might certainly propel Bitcoin’s worth because of elevated shortage, idealists fear about amplified volatility undermining Bitcoin’s adoption in the actual economic system.”

Hubertus Hofkirchner, Founding father of Bitcredit Protocol

These issues heart across the potential for heightened volatility, which might deter Bitcoin’s adoption in on a regular basis transactions and its acceptance as a steady monetary instrument within the broader economic system. This volatility, fueled by speculative buying and selling typically related to ETFs, might undermine the very attributes—similar to stability and reliability—that make Bitcoin a sexy various to conventional currencies.

He additionally identified the distinction between Bitcoin and conventional commodities like gold, noting that Bitcoin’s distinctive digital attributes differentiate it considerably from bodily commodities:

“Not like gold, Bitcoin’s digital nature eliminates the logistical challenges of bodily commodities, which could render the attract of a Bitcoin ETF much less compelling than it was for gold.”

Consequently, the first attraction of a Bitcoin ETF lies not in addressing logistical challenges, as with gold, however slightly in providing a regulated, mainstream monetary instrument for Bitcoin funding.

Turning to a crucial viewpoint, Peter Schiff, a widely known skeptic of cryptocurrencies, supplied a starkly totally different absorb his current tweet.

Schiff’s perspective embodies the skepticism some conventional traders maintain relating to the sustainability and actual worth of Bitcoin, particularly compared to conventional belongings like gold.

Therefore, whereas some Bitcoin ETFs are a game-changer that would considerably increase Bitcoin’s worth and mainstream attraction, others warning about potential volatility and the distinction with conventional belongings.

Unraveling the financial implications of Bitcoin spot ETFs

Whereas crypto fans are excited concerning the introduction of Bitcoin spot ETFs, believing it might enhance Bitcoin’s worth, it’s important to tell apart between worth and worth.

The convenience of buying and selling an ETF might certainly appeal to new demand from those that discover proudly owning Bitcoin instantly cumbersome, probably elevating its worth within the close to time period. Nevertheless, this doesn’t inherently enhance Bitcoin’s underlying worth.

From an financial standpoint, the idea of a “detrimental sum sport” is essential in understanding the potential impression of Bitcoin ETFs.

In sport concept, a zero-sum sport is a scenario the place one participant’s achieve or loss is strictly balanced by the losses or features of different members.

Bitcoin, when considered by means of the lens of buying and selling and funding, could be likened to a detrimental sum sport, just like poker in a on line casino with a rake. Right here, the winner’s achieve equals the sum of losses from different gamers, however extra prices (the “rake”), like buying and selling commissions, margin curiosity, and promotional bills, create a web loss within the system.

The introduction of ETFs probably will increase this “rake”. Whereas it would streamline entry to Bitcoin, the extra layers of charges and bills related to ETFs might exacerbate the detrimental sum nature of the funding.

That is notably related if the ETF construction doesn’t add intrinsic worth to Bitcoin however merely provides a extra handy funding car. In such a market, solely extremely expert merchants (just like skilled gamblers) may revenue, primarily throughout instances of excessive inflow of inexperienced merchants. Nevertheless, this isn’t sustainable.

As much less skilled merchants exit the market after losses, the competitors amongst expert merchants intensifies, making it more durable to beat the elevated prices and keep profitability.

Furthermore, the introduction of Bitcoin ETFs might impression Bitcoin’s decentralization ethos. Whereas ETFs may convey Bitcoin nearer to mainstream monetary programs and enhance its adoption, they accomplish that by integrating it inside conventional monetary buildings, which can be opposite to the unique decentralized, anti-establishment imaginative and prescient of Bitcoin.

In conclusion, whereas Bitcoin spot ETFs may enhance the cryptocurrency’s worth and mainstream attraction within the brief time period, they introduce complexities that would have an effect on its long-term financial sustainability and philosophical ethos.

The differentiation between worth enhance and true worth addition is crucial in assessing the potential impression of those monetary devices on Bitcoin’s market dynamics.