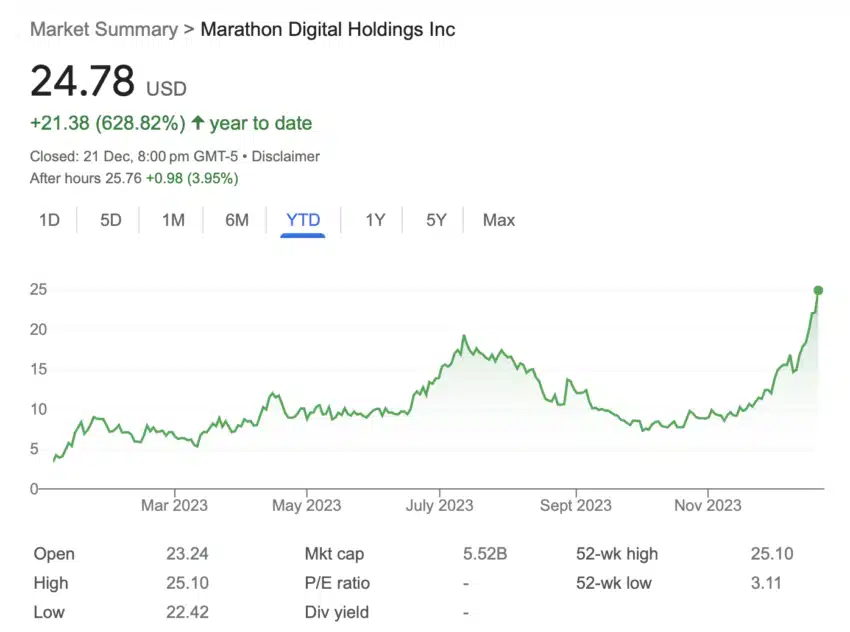

Bitcoin miner Marathon Digital Holdings (MARA) has skilled a exceptional surge in its inventory worth, with a 622.8% enhance all through 2023, although it has beforehand confronted a considerable decline from its all-time excessive ranges.

The present worth of Marathon Digital Holdings (MARA) sits at $24.78, a determine which, nevertheless, nonetheless represents an approximate 85% decline from its all-time excessive of $166.40 reached in March 2012.

The inventory’s exceptional efficiency coincides with pivotal developments within the cryptocurrency market, notably the anticipated resolution by the US Securities and Trade Fee (SEC) concerning the approval of the spot Bitcoin Trade-Traded Fund (ETF), expected by Jan. 10.

The approval of this ETF is anticipated to carry a large inflow of capital into the market, with main establishments like BlackRock and Grayscale doubtlessly providing it to their purchasers.

Amidst these market speculations, Marathon Digital’s CEO and Chairman, Fred Thiel, has pointed to the corporate’s “vital progress” in strengthening its monetary place, an element he considers essential within the lead-up to the Bitcoin halving occasion scheduled for April 2024.

This BTC halving occasion, which happens roughly each 4 years, is anticipated to influence miners’ rewards and has been a subject of debate inside the trade concerning its potential results on profitability.

This comes after current studies that Marathon Digital has not too long ago introduced a big transfer in direction of rising its operational capability.

The BTC mining agency has formalized a purchase order settlement to accumulate two absolutely operational Bitcoin mining websites, which collectively supply 390 megawatts of capability.

As earlier reported by crypto.information, the deal, valued at $178.6 million, represents a big shift for Marathon Digital as the corporate strikes from its earlier asset-light construction to managing a extra various vary of Bitcoin mining operations.

Financially, Marathon Digital has demonstrated a big turnaround, reporting a web revenue of $64.1 million within the third quarter, a stark distinction to a web lack of $72.5 million throughout the identical interval within the earlier yr.

This enchancment in monetary efficiency is attributed to a 467% enhance in Bitcoin manufacturing coupled with a 32% rise within the common worth of Bitcoin, leading to a considerable progress in quarterly revenues to $97.8 million.

Valuation challenges in wake of economic success

Regardless of these developments, Marathon Digital has not escaped scrutiny as MinerMetrics has recognized the corporate as one of the overvalued in the crypto mining sector, citing a excessive enterprise value-to-sales (EV/S) ratio of 5.6.

This elevated valuation is influenced by Marathon’s visibility and favorable standing amongst institutional buyers, which has facilitated higher entry to capital and, consequently, the next market valuation.

MARA’s energy prices are a number of the highest amongst public miners. Nevertheless, Bitcoin transaction charges peaked at a file two-year excessive, thereby including round 30% increased mining rewards for miners.

Wanting forward, Marathon Digital is positioning itself for additional progress, with plans to extend its hash price by roughly 30% in 2024.