Immediately’s buyers face many choices past shares and bonds, with crypto vs. conventional finance turning into an more and more widespread discourse.

Each private and non-private gamers are always looking for alternatives to deploy capital into funding automobiles that yield substantial returns whereas posing minimal danger. Nonetheless, the character of danger urge for food has advanced within the final decade with the emergence of a brand new asset class accessible from anyplace on the planet.

Earlier than committing sources to any trade, whether or not it’s decentralized finance (defi) or conventional markets, buyers want to know what separates the 2. This text explores crypto vs. conventional finance: the variations, similarities, and whether or not now is an efficient time to get into them.

Сryptocurrency or conventional finance

Within the debate of cryptocurrency vs. conventional finance, the important thing variations lie of their operational fashions and accessibility. Conventional finance (tradfi) depends on centralized entities like banks, ruled by regulations typically set by a number of officers, and is restricted by geographical and operational constraints. Whereas trusted because of its lengthy historical past, this technique typically excludes these in distant areas from accessing monetary providers.

However, decentralized finance (defi) operates with out conventional banking infrastructure, providing transparency and group involvement via auditable codes and good contracts. Crypto vs. finance highlights the flexibleness of defi, permitting 24/7 buying and selling globally with out geographical boundaries, in contrast to the restricted buying and selling hours of conventional markets just like the U.S. inventory change.

What’s conventional finance? It’s a system the place innovation might be gradual because of strict regulatory compliance, whereas cryptocurrencies encourage the fast improvement of recent monetary merchandise. Moreover, conventional finance typically incurs greater transaction prices and slower cross-border settlements than crypto’s fast and cost-effective transactions.

Funding evaluation additionally differs between these sectors. Conventional finance buyers give attention to metrics like price-to-book ratios, whereas crypto buyers take into account venture whitepapers, tokenomics, and group engagement. This comparability between crypto vs. finance underscores the evolving panorama of economic providers and the rising enchantment of cryptocurrencies.

Crypto vs. conventional finance in 2023

Markets skilled important worth actions all through 2023. Inflation within the U.S. and nations across the globe seemingly incentivized money injections into quite a few tradfi and defi sectors to hedge towards financial downturns.

In keeping with official information, the S&P 500 recorded a 24.87% year-to-date (YTD) enhance.

Gold, one of the crucial widespread belongings in tradfi, achieved its all-time excessive (ATH) worth in 2023. Costs of the yellow metallic peaked in December, buying and selling as excessive as $2,150 per ounce. This represented a 13.3% development in 12 months.

Bitcoin (BTC), crypto’s main blockchain and token, noticed a 158% YTD development, eclipsing each the S&P 500 and gold. The cryptocurrency, typically known as digital gold, exchanged fingers at simply $43,000 because the 12 months ended, round 36% under its ATH achieved in November 2021.

One other main cryptocurrency, Ethereum (ETH), registered 100% YTD good points, additionally surpassing gold and the S&P 500 in profitability. Presently, the coin is buying and selling at $2,404, remaining the primary blockchain for constructing crypto infrastructure and launching tokens and dapps.

Nonetheless, crypto usually experiences large volatility and worth fluctuation in comparison with TradFi.

Why do folks choose crypto

The crypto trade is notably nonetheless in its nascent stage, though institutional curiosity is rising, as indicated by spot exchange-traded fund (ETF) hype, and mass adoption can be on the rise, with a number of jurisdictions creating clear guidelines to supervise digital belongings.

Billions of {dollars} have been poured into cryptocurrencies as buyers search new markets with sizable returns. Whereas crypto does function inherent dangers starting from safety issues to unhealthy actors, it additionally gives transparency since anybody can view blockchain transactions with instruments like Etherscan.

This transparency permits for anonymity, as on-chain transactions present beneath an alphanumeric pockets deal with moderately than a checking account related to personal data like your identify and deal with.

On-chain transfers are immutable, which implies they can’t be altered or tampered with, including an additional layer of belief from customers. Many defi protocols are additionally open-source; anybody can view the underlying code, reinforcing transparency inside the crypto group.

Due to this fact, customers can handle their danger whereas incomes excessive returns on their preliminary capital investments. Moreover, crypto is managed by the collective and encourages peer-to-peer monetary interplay in a impartial setting the place demand and provide exist.

Importantly, cryptocurrencies and defi are open to all, no matter geography. You don’t want authorities approval or financial institution authorization to take part in crypto. Crypto buying and selling is, nonetheless, banned in choose nations like China.

Is now an excellent time to put money into crypto?

Crypto, like every monetary sector, has its bear and bull cycles the place the market is both up or down. Digital asset markets traditionally work in a single to two-year intervals with anyplace from 12-34 months between cycles.

Contemplating that the final confirmed bull run resulted in 2021, adopted by a crash in 2022 marked by a number of crypto bankruptcies, and a resurgence in 2023 fueled by institutional curiosity, it is perhaps an excellent time to guage crypto asset investments.

Wall Avenue titans like BlacRock have filed for exchange-traded merchandise to put money into Bitcoin and Ethereum at spot costs. These are the world’s two largest blockchains and cryptocurrencies, with a mixed market cap of over $1 trillion.

Legacy banks like JP Morgan Chase, America’s largest financial institution, have moved to commercialize blockchains and propel tokenization of real-world belongings (RWAs) like actual property. RWAs on blockchains are already a billion-dollar trade, per Coingecko.

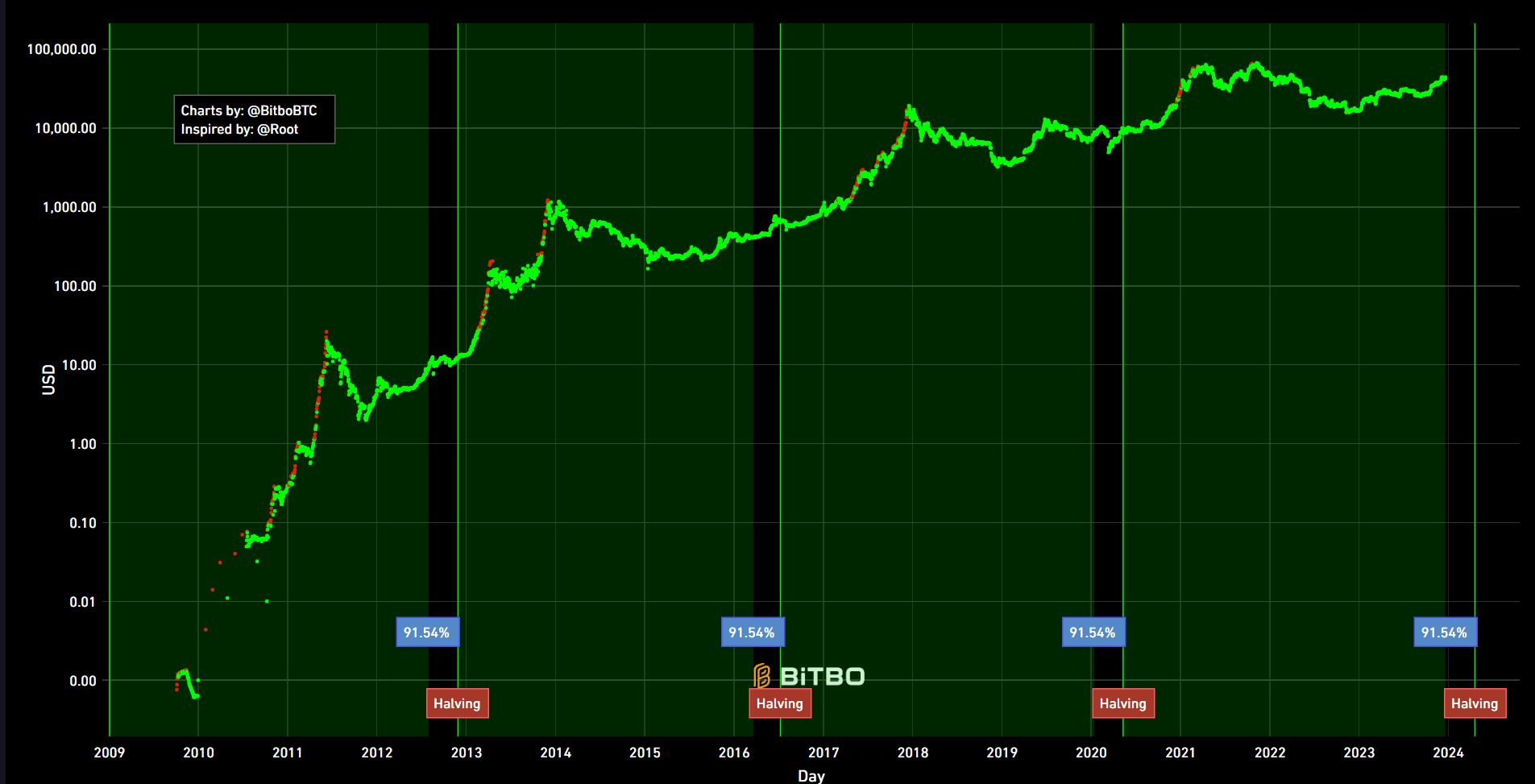

Moreover, the Bitcoin halving is predicted to happen by April 2024. This may successfully halve Bitcoin’s provide and create a state of affairs that might set off elevated demand. There’s division amongst proponents on whether or not this improvement is already priced in. Nonetheless, information reveals that Bitcoin has by no means returned to its pre-halving worth.

A mixture of cyclical patterns, institutional consideration in crypto spot ETFs, BTC’s halving, and common bullish sentiment means this can be an excellent time to put money into crypto. Nonetheless, when investing in speculative markets and danger belongings like digital currencies, warning is suggested.

Conclusion

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.

Cryptocurrencies and conventional finance have each had watershed moments in 2023. Property like gold hit an ATH, and the world’s largest asset managers had been fascinated with BTC and ETH, an indicator that billions of {dollars} in retail cash might quickly flood into cryptos.

General, prime cryptocurrencies outperformed conventional markets and finally got here out on prime within the crypto vs. conventional finance match-up in 2023. Nonetheless, it’s necessary to remember the fact that each markets might be risky, and thus, buyers ought to remember to do their due diligence earlier than making any funding resolution in 2024 or additional sooner or later.