Disclosure: The views and opinions expressed right here belong solely to the creator and don’t signify the views and opinions of crypto.information’ editorial.

On the floor, issues now appear very totally different from a yr in the past, with Bitcoin (BTC) being more than double the $16,000-17,000 and the full market cap of crypto being comfortably above a trillion {dollars}.

Whereas the costs do certainly mirror some type of restoration partly fuelled by hypothesis around the approval of Bitcoin ETFs, we haven’t progressed sufficient as an business, as many of the obstacles to crypto adoption nonetheless stay unresolved.

It could have been a grueling crypto winter, and the resurgence of bull-posting on X (former Twitter) is a welcome distinction, however the business must “regress and decelerate” to make significant progress in 2024. In any other case, it should principally be going by way of a repeat of the earlier market cycle, albeit with a couple of enhancements or variations.

The business remains to be nascent and solely barely over a decade previous, and there are nonetheless stable use instances missing because of this—however this youth won’t final without end, and neither ought to the established order.

The fast-paced nature of the business could be exhilarating and spectacular at instances, as quite a bit can change within the span of a day or week, like most technology-based industries. Nevertheless, this could be a double-edged sword because it inclines us to give attention to the brand new moderately than the previous and be caught in an echo chamber of kinds.

Whereas it might be counterintuitive, the business must power itself to decelerate as a substitute of all the time trying to go sooner. It additionally wants to take a look at what has been finished exterior of web3 that has already been tried, examined, and, extra importantly, resilient and affluent.

Certain, Metaverse-focused utilities akin to NFTs, web3 gaming, and SocialFi could also be refreshing concepts. Nonetheless, they’re much too overseas to mainstream customers to be efficient pull components for mainstream adoption. Such utilities function wonderful, distinctive niches for the business, producing curiosity and curiosity—however shouldn’t be misconstrued as drivers for mainstream adoption, no less than not for the close to future.

The fact is that blockchain know-how is already advanced sufficient as it’s to grasp for brand new customers, and this hasn’t modified a lot. Including comparatively overseas concepts to the combination as a focus solely exacerbates this additional.

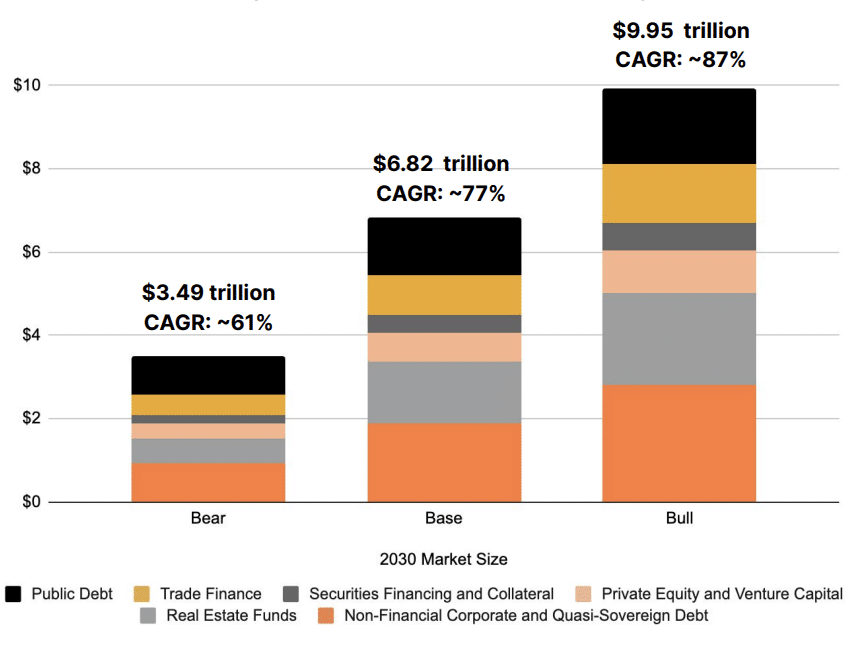

That is the place battle-tested and extra tangible utilities akin to established fee methods and real-world belongings (RWAs) are available as a extra viable basis for adoption—most mainstream customers already perceive how most of those perform, and the grounded nature of those utilities are far more interesting and appropriate for institutional and mass adoption as in comparison with newer and riskier verticals. Unsurprisingly, the information and metrics additionally again this up; the full worth locked (TVL) for RWAs is at present sitting at $5.7 billion in TVL, with projections for progress as much as $10 trillion.

Estimated tokenization market sizing | Supply: 21.co

As for fee methods, we’re additionally seeing established legacy gamers akin to Visa and Mastercard making strikes to help crypto utilization in 2023, and this development will solely proceed to achieve momentum within the coming yr.

Accessibility has all the time been an issue hindering adoption for web3 and crypto, so having extra handy on and off-ramps for crypto will undoubtedly be vital for consumer acquisition and retention. Coupled with regulatory compliance, these utilities would be the actual spine and basis for adoption as they’re steady and dependable sufficient to face up to the take a look at of time.

Whereas hypothesis undeniably fuels the web3 area, this creates a stage of volatility and instability that intimidates and deters new entrants—the web3 business can’t depend on this whether it is to scale past being handled merely as a decentralized on line casino.

Options akin to memecoin buying and selling additionally don’t add a lot legitimacy to the business for mainstream customers to take web3 significantly, and this all wants to alter.

Because the business matures, tokenomics, fashionable narratives, and buzzwords will take a backseat to sustainable enterprise fashions in 2024, as tasks with out precise worth creation and income era proceed to be weeded out by more and more discerning customers. We’ve already gotten essential classes from FTX, Luna, USTC, and most just lately SafeMoon on the significance of decentralization, self-custody, and correct due diligence.

The crypto area does are likely to have goldfish reminiscence, and most customers are blissful so long as they’re earning money and overlook about present considerations—however this strategy wants to alter as ponzinomic tasks don’t convey any significant positives to the business and don’t final without end.

Frauds like FTX could have grown to a colossal measurement and lasted for a very long time on empty guarantees and lies, however ultimately collapsed and broken the business’s credibility tremendously.

Conversely, tasks like Pudgy Penguins and their transfer to introduce a real-world toy assortment, along with typical NFT utilities, have finished comparatively effectively by way of the bear market, not like most NFT tasks. This isn’t a mere coincidence and highlights the significance of getting sustainable enterprise fashions.

In 2024, we are going to see increasingly more constructive examples as tasks ship on their product roadmap and drive precise utility overcome opponents with empty guarantees and hype-based advertising and marketing. Each builders and customers should be sensible and affected person as a substitute of looking for moonshots or just trying to make a fast buck to construct and help tasks with correct income sources.

Except for tasks requiring sustainable enterprise fashions, one other core subject is that web3 infrastructure can’t at present maximize the business’s full potential because of its nascency. For example, decentralized exchanges (DEXes) present a necessary basis for decentralized finance, which is a core vertical of web3—however buying and selling quantity and liquidity for the highest DEXes are nonetheless bested by the main centralized exchanges because of the familiarity of the consumer expertise, higher slippage, depth of liquidity, and extra.

Whereas decentralization maximalists may not just like the notion, many mainstream customers are a lot too comfy with custodial providers to leap straight into self-custody—leading to many centralized providers appearing as a bridge of kinds into web3.

We already see such a development slowly rising, with Coinbase providing a gateway for its users into the Ethereum ecosystem with its L2 Base, Binance providing its users with an entry point into defi with its just lately launched web3 pockets, and even Telegram-focused custodial wallet TON House.

Increasingly of such web2.5 services, that are constructed on a hybrid mixture of the decentralization from web3 and battle-tested effectivity from web2, will drive important use instances and larger-scale adoption for the crypto business.

The safety facet of the infrastructure additionally must be improved, because the web3 business remains to be rife with scams and exploits—with $290 million being lost from just five hacks in November alone and legacy pockets suppliers like Ledger falling victim to an exploit which put many customers in danger in December.

It’s nonetheless far too early for decentralization alone to be the means to an finish, because the web3 business nonetheless requires extra time to mature. Person schooling additionally has a pivotal position, together with product UI and UX enhancements. Because it stands, decentralization and its autonomy ought to be an finish state that the web3 business strives to make accessible, protected, and simple to make use of even for mainstream customers.

Whereas this has not but been achieved, the “development by way of regression” for web3 in 2024 ought to be celebrated, as it should undoubtedly convey the business nearer to creating important breakthroughs and mainstream adoption potential.