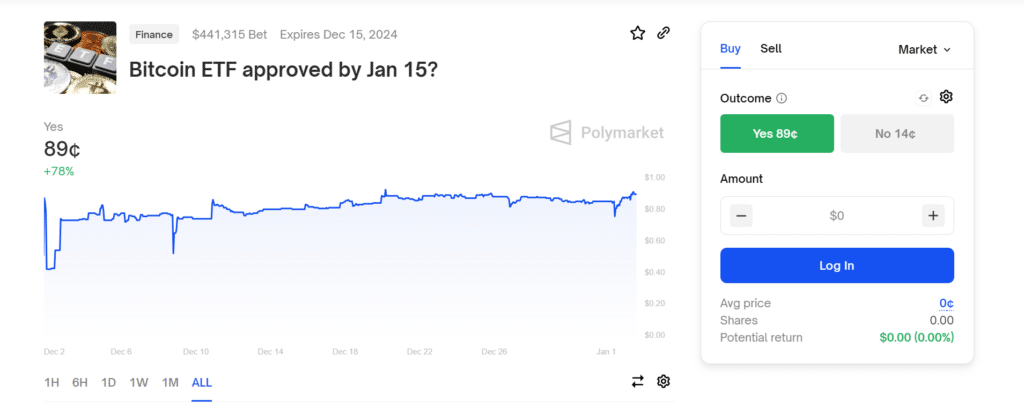

Merchants taking bets on the platform predict a 90% probability the SEC will approve spot Bitcoin ETFs by mid-January, whereas the minority is hedging towards the converse consequence.

Shares of a “Bitcoin ETF accredited by Jan 15” contract on Polymarket, a decentralized prediction venue, traded for 90 cents as hypothesis for a forthcoming choice from the U.S. Securities and Trade Fee (SEC) dominated market sentiment.

At press time, the contract had attracted $441,315 price of “YES” bets, with simply 10% of merchants selecting “NO”. These buyers additionally admitted their opposing selection was a method to hedge their bets and switch a revenue ought to the SEC delay past Jan. 15.

I don’t doubt the inevitability of a Bitcoin ETF, I doubt the SEC’s skill to work quick sufficient to say sure by Jan. 15.

Polymarket dealer

Reuters reported that the SEC might announce approvals as early as Jan. 3 for the 14 issuers to listing their merchandise within the coming weeks. Nevertheless, Fox journalist Eleanor Terrett said that is extremely unlikely on account of ongoing opinions of up to date S-1 filings from companies like Hashdex and VanEck.

Though nobody is aware of when the SEC will determine on spot Bitcoin ETFs, specialists and crypto proponents fancy the probabilities of a Jan. 10 consequence. This date coincides with the deadline for a joint submitted by ARK 21Shares.

Cathie Wooden, Ark Make investments CEO, additionally foresees a choice by this date. Wooden believes an approval would endorse Bitcoin (BTC) and cryptocurrencies by means of Wall Road, a sentiment shared by MicroStrategy founder and BTC maxi Michael Saylor.