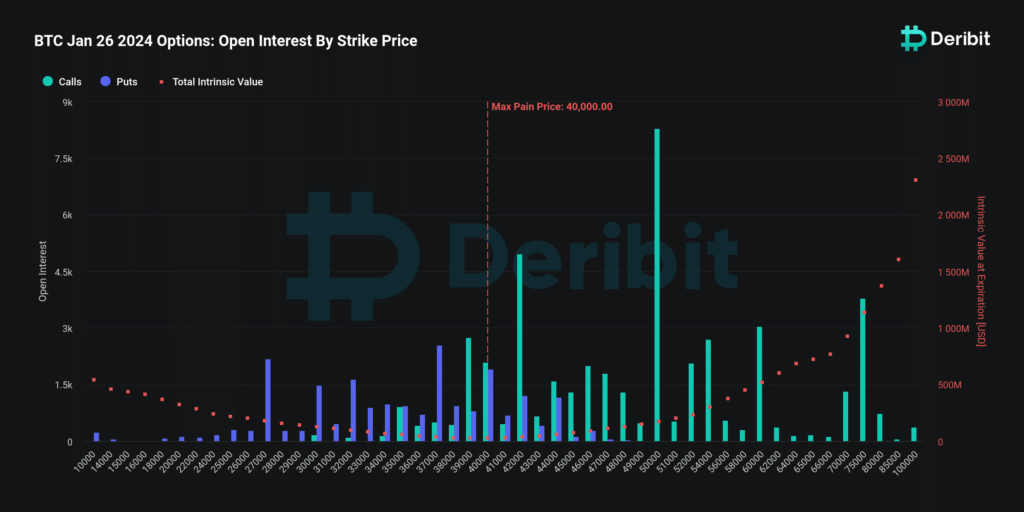

In response to Bitcoin’s latest worth fluctuations, the choices market is displaying heightened exercise, notably with a deal with name choices at a $50,000 strike worth set to run out on Jan. 26.

In accordance with Deribit data, over 8,300 contracts, valued at $376 million, are excellent at this strike worth, suggesting a notable anticipation of a possible rise in Bitcoin’s worth.

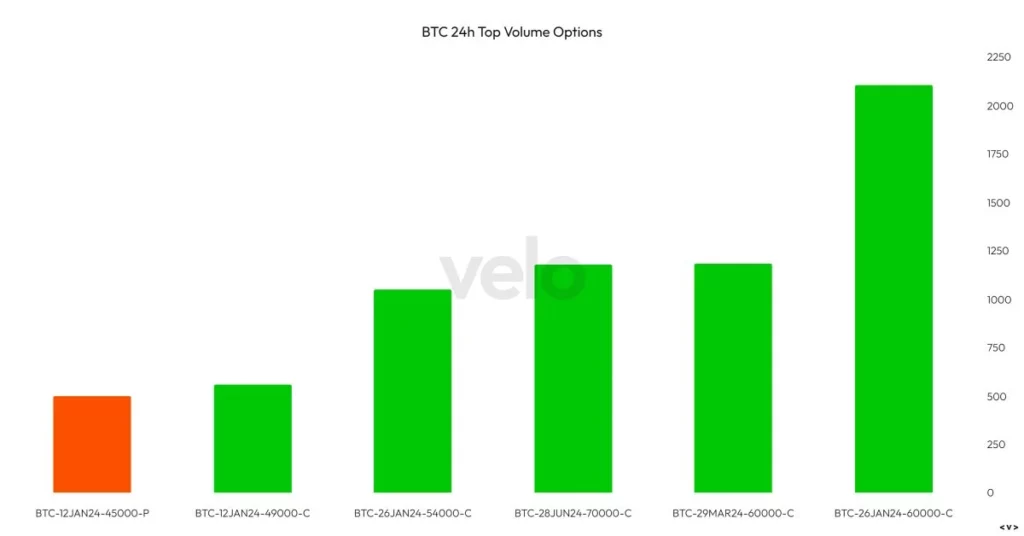

Throughout all expiry dates on Deribit, there are greater than 21,800 contracts for calls at $50,000, totaling a notional worth of $926 million. Moreover, Velo Data highlights a skew in the direction of larger strike costs, notably at $60,000 for the Jan. 26 expiry.

Excessive-leverage buying and selling permits merchants to regulate positions with much less capital and may amplify earnings and intensify losses. Current market volatility led to the liquidation of over $147 million in Bitcoin (BTC) positions, primarily affecting longs.

Within the final 24 hours, the crypto market skilled a complete of $642 million in liquidations throughout centralized exchanges, emphasizing the significance of danger administration in such situations. Bitcoin’s worth retraced over 6% to beneath $43,000 after reaching a year-to-date excessive of $45,800.