Type 8-A filings submitted by Constancy, Grayscale, and VanEck point out progress towards the extensively anticipated approval for spot Bitcoin ETFs, though the SEC has not given the nod but.

Grayscale Investments and VanEck filed Type 8-As on Jan. 4 with the US Securities and Change Fee (SEC), marking registration of securities with the watchdog. That is a part of a course of that permits issuers to ultimately listing Bitcoin (BTC) ETFs on an change ought to the SEC approve.

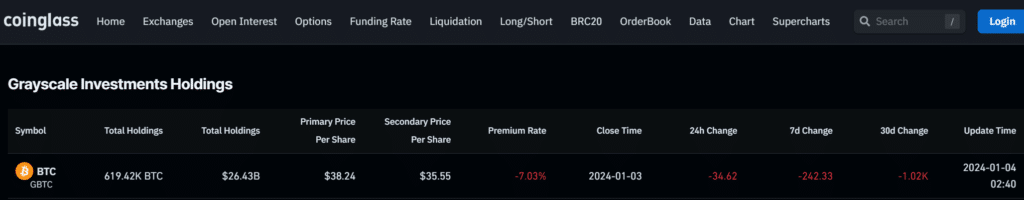

The issuer of Grayscale BTC Belief (GBTC), which holds some 620,000 BTC valued at over $26 billion, hopes to transform its present product into an exchange-traded fund that tracks spot Bitcoin worth. GBTC would commerce on the NYSE Arca as a spot BTC ETF if authorized.

Constancy had submitted its Type 8-A a day earlier than Grayscale and VanEck as issuers bolstered their readiness forward of a deadline when the SEC should settle for or reject at the very least one bid for spot Bitcoin ETFs.

The SEC has a deadline of Jan. 10 to resolve on the ARK 21Shares Bitcoin ETF. Consultants have mentioned that the securities watchdog will seemingly approve a number of filings by this date, with the possibilities of acceptance at 90%, in accordance with Bloomberg analysts Eric Balchunas and James Seyffart.

Merchants on decentralized prediction platforms like Polymarket have placed bets value over $1 million that the SEC points a go-ahead for any of the 14 issuers to listing their spot Bitcoin ETFs by Jan. 15. The quantity locked within the “Bitcoin ETF authorized by Jan. 15” contract elevated by over $600,000 in two days regardless of a Matrixport report suggesting the SEC could reject all functions in January.