The U.S. Securities and Trade Fee (SEC) might start notifying the general public of outcomes of the spot Bitcoin (BTC) ETFs shortly.

In line with a Jan. 3 report in Fox Business, sources conversant in the matter say the primary announcement of the approval of spot Bitcoin ETFs may come on Jan. 5, with buying and selling starting as early as subsequent week.

The information comes after an earlier Matrix report published on Jan. 2 predicted the SEC would deny purposes. Of their opinion, approvals is not going to occur till — on the earliest — Q2 of 2024.

In line with the Fox Enterprise report, nevertheless, analysts and ETF issuers stay assured {that a} favorable SEC determination can be made by Jan. 10, because the SEC continues to satisfy with key gamers on the problem.

Fox Enterprise notes that the upcoming approval of the ETF can also be indicated by the truth that SEC attorneys from the Division of Buying and selling and Markets met with representatives of the foremost exchanges – the New York Inventory Trade, Nasdaq, and the Chicago Board Choices Trade – on which the ETFs can be traded.

The conferences are seen as a optimistic signal that the SEC is transferring nearer to approving some or all of a dozen product purposes from giant cash managers and crypto companies, nameless sources on the companies stated.

Nevertheless, the destiny of purposes for spot Bitcoin ETFs remains to be unknown. For the previous a number of weeks, hypothesis has been rampant {that a} spot Bitcoin ETF is imminent.

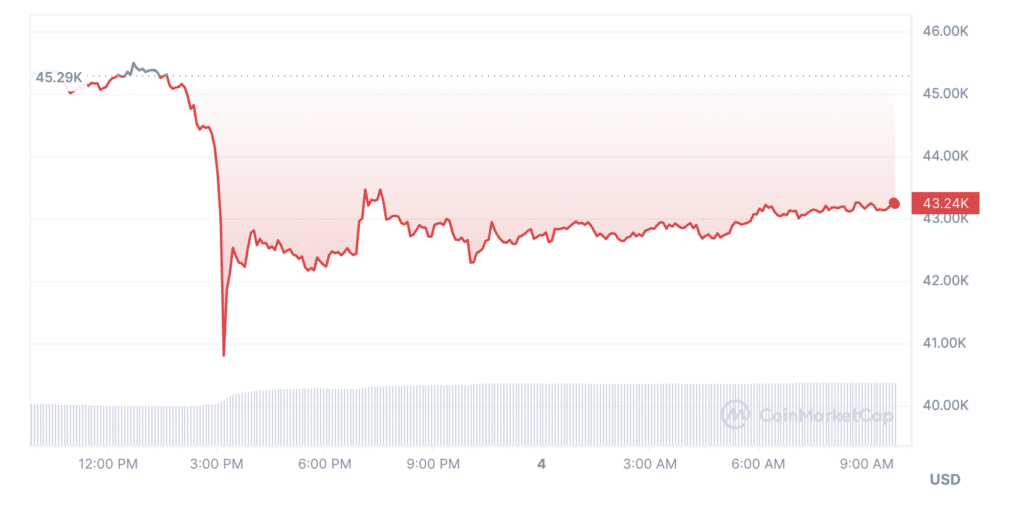

Towards the backdrop of the Matrix report, the worth of BTC fell by 4.5% to $43,240 on the time of writing. This occurred shortly after Bitcoin broke by means of the $45,000 degree, its highest since April 2022.

The complete crypto market additionally crashed 7% and misplaced almost $1.7 trillion on the heels of the information {that a} spot Bitcoin ETF could also be doubtful.