Bankrupt cryptocurrency lender Celsius Community revealed plans in the present day to unstake its present Ethereum holdings in preparation for immediate distributions to its collectors.

On Jan. 5, the lending firm Celsius that’s at present embroiled in chapter proceedings since its Chapter 11 submitting in July 2022, declared the initiation of asset reallocation to safe ample liquidity forward of potential distribution of funds again to collectors.

Celsius additionally introduced plans to unstake its present holdings of Ether (ETH), which have been producing important staking rewards earnings for the property.

The launched Ethereum goals to cowl varied prices incurred through the restructuring and expedite distributions to collectors.

The choice is seen as a constructive improvement for Celsius prospects, who’ve been awaiting the return of their funds for over a 12 months and a half. Based on Celsius’ restoration plan, collectors will obtain Bitcoin (BTC) and/or Ethereum as a part of the settlement.

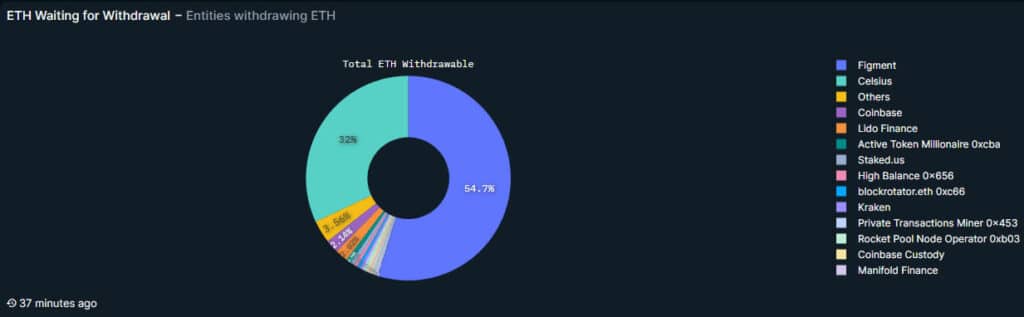

Nansen, a blockchain analytics agency, reported that Celsius at present holds about 32% of the Ether now pending within the withdrawal queue, amounting to 206,300 ETH, valued at round $468.5 million.

The agency additionally famous that Celsius has withdrawn 40,249 ETH so far and that 19,906 validators are awaiting full withdrawal.

Whereas some worry that this large-scale withdrawal of Ethereum may negatively impression its market worth, others believe it can positively affect Ethereum’s long-term prospects as Celsius progresses via its restructuring.

Celsius’s journey into chapter 11 started in July 2022 following a liquidity disaster triggered by the downturn within the crypto market. This led to the freezing of withdrawals and the eventual submitting for Chapter 11 bankruptcy protection within the U.S. Chapter Courtroom for the Southern District of New York.

Celsius has since been engaged on a settlement plan that allows certified customers to withdraw 72.5% of their crypto holdings till Feb. 28. Courtroom paperwork from September reveal that round 58,300 customers held a complete of $210 million in property labeled as “custody property.”

Alex Mashinsky, Celsius Community’s founder and former CEO, at present launched on bail after being arrested on fraud charges. His trial is about for Sep. 17.

Celsius pivots in direction of crypto mining operations

Final month, Choose Martin Glenn licensed Celsius Community to pursue an alternate plan beforehand ratified by its collectors involving forming a brand new public firm with a sole deal with Bitcoin mining.

Collectors of Celsius shall be compensated partly via shares on this new Bitcoin mining venture, aligning their pursuits with the success and enlargement of the mining actions. The method additionally releases $225 million value of cryptocurrency property, initially earmarked for different tasks however turned down by the SEC.

The brand new firm, dubbed MiningCo, is about to be managed by Hut 8 underneath a contract spanning 4 years, specializing in mining operations.

The deal contains managing 5 Texas-based mining services, collectively outfitted with a computational energy of roughly 12 EH/s, akin to 122,000 miners, and a complete vitality output exceeding 300 MW.

MiningCo is about to focus on staking and mining actions, with an anticipated steadiness sheet reaching $1.25 billion, together with $450 million in available cryptocurrency property.

Based on courtroom filings, the enterprise goals to generate annual income between $10 and $20 million from staking cryptocurrencies on the Ethereum community.