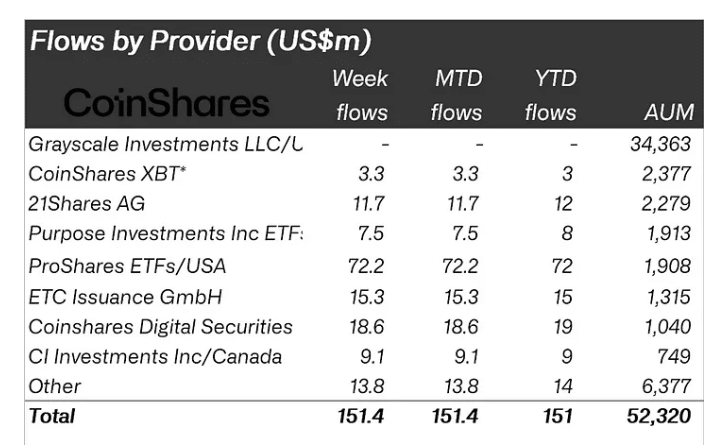

Within the first week of 2024, digital belongings funding merchandise witnessed a big surge in capital inflows, amounting to $151 million.

In accordance with CoinShares evaluation, since Grayscale’s victory over the SEC concerning their spot Bitcoin ETF utility final yr, the market cumulatively attracted $2.3 billion in inflows, equating to 4.4% of the overall belongings below administration (AUM).

Regardless of Bitcoin ETF not being authorised but, American exchanges accounted for a considerable portion, 55%, of those inflows. European markets, particularly in Germany and Switzerland, additionally confirmed sturdy exercise, contributing 21% and 17% of the inflows, respectively. The start of the yr additionally marked a optimistic pattern for blockchain fairness investments, with a notable $24 million inflow up to now week.

Bitcoin emerged because the frontrunner on this rally, attracting $113 million in capital. This determine represents 3.2% of Bitcoin’s complete AUM over the previous 9 weeks. In distinction, the yr’s first week noticed a $1 million outflow from short-Bitcoin investments. This pattern contradicts the anticipated ‘purchase the rumor, promote the information’ response anticipated with the potential launch of a U.S. ETF, as evidenced by the $7 million outflow from short-Bitcoin ETPs during the last 9 weeks.

Ethereum additionally skilled a optimistic shift in investor sentiment, garnering $29 million in inflows, which provides as much as $215 million during the last 9 weeks. Alternatively, Solana confronted a much less favorable begin to the yr, with outflows reaching $5.3 million. Cardano additionally caught traders’ consideration, with inflows of $3.7 million.