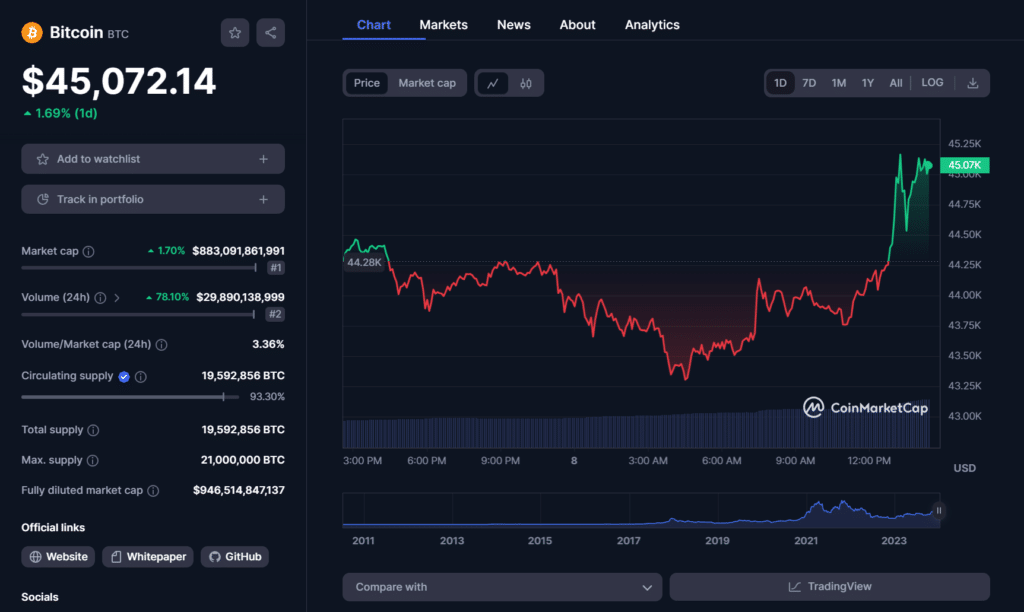

BTC broke above $45,000 as BlackRock, Grayscale, ARK 21Shares, and different corporations submitted up to date spot Bitcoin ETF types main as much as the primary deadline for approval.

As of 10 a.m. ET on Jan. 8, 10 spot Bitcoin ETF issuers had filed amended S-1 and S-3 types with the USA Securities and Change Fee (SEC) in a closing push for approval of conventional monetary funds that might monitor the value of spot Bitcoin (BTC), the most important cryptocurrency.

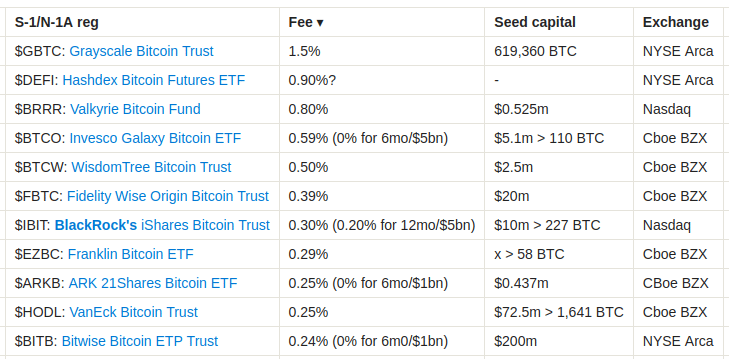

Valkyria, Wisdomtree, Invesco Galaxy, BlackRock, ARK 21Shares, VanEck, Constancy, Bitwise, and Franklin Templeton included charges for his or her spot Bitcoin ETFs within the SEC filings. Grayscale additionally submitted a contemporary registration of securities for its GBTC conversion.

The types have been submitted two days earlier than the final deadline for a choice on the ARK 21Shares Bitcoin ETF, slated for Jan. 10. Main exchanges such because the Nasdaq and NYSE already despatched up to date 19-b4s following a meeting with the SEC.

In line with the filings seen by crypto.information, Bitwise provided the bottom payment at 0.24%, and Grayscale disclosed the most costly payment, set at 1.5%, though not all issuers had submitted amended types at press time. Some corporations additionally plan to checklist with payment waivers.

As an example, BlackRock will checklist its iShares Bitcoin Belief with a 0.2% payment for its first 12 months. The payment waiver will apply for as much as $5 billion in property below administration (AUM). ARK 21Shares and Bitwise additionally plan to cost zero charges for the primary six months and as much as $1 billion AUM.

Invesco Galaxy will supply its first six months with no charges and as much as $5 billion AUM earlier than reverting to a 0.59% payment.

spot Bitcoin ETF payment tussle

The spot Bitcoin ETF payment battle seems underway as every issuer tabled aggressive charges and moved to draw buyers to their iteration of America’s first spot BTC ETF. Nonetheless, remarks from Bloomberg analyst Eric Balchunas recommend that fund charges is probably not a deciding issue.

One fast be aware on the momentary payment waivers that we’re seeing within the Bitcoin ETFs. Traditionally this hasn’t moved the needle a lot. One ETF again within the day really paid you to put money into it till it reached a sure AUM mark however nobody cared. Advisors targeted on common charges since they’re long-term buyers. That mentioned, given all these ETFs do the identical factor possibly it’ll matter all else equal, we’ll see.

Eric Balchunas, Bloomberg ETF analyst

Custodia Financial institution founder and CEO Caitlin Long voiced issues over the no-fee funds. The Bitcoin proponent pointed to skepticism round securities lending, which she mentioned might threaten buyers’ security.

In the meantime, Bitcoin responded to the information with an uptick in market value, gaining below 2% to surge past $45,000 after a 10% drop final week. Opinions differ concerning the influence of a spot BTC ETF on Bitcoin, with some believing the information to be priced in already and others predicting an enormous rally towards its earlier $69,000 ATH.

Robert Quartly-Janeiro, chief technique officer at crypto change Bitrue, shared two views on value actions to count on ought to the SEC approve spot Bitcoin ETFs, including that the upturn in institutional adoption ought to drive BTC value up in the long run.

Certain, some patrons are there within the hope of short-term achieve – that occurs in so many asset courses. However at a deeper, secondary stage, is the actual fact buyers all over the world really feel they’ve one thing that’s actually totally different. Of their eyes, it’s already investment-grade, however now it must be an investment-grade product within the largest financial system on the planet.

Robert Quartly-Janeiro, chief technique officer, Bitrue

It’s a closing hurdle, mentioned Quartly-Janeiro.