4 potential spot Bitcoin ETF issuers have disclosed preliminary seed capital exceeding $10 million earlier than the SEC decides on bids.

Per particular person filings with the U.S. Securities and Alternate Fee (SEC), VanEck has outclassed BlackRock in direct funding into its spot Bitcoin ETF. VanEck has seeded its bid with $72.5 million.

Crypto funding agency Bitwise seeded its Bitcoin (BTC) ETF with $500,000 however famous a further $200 million money injection expected from Pantera Capital if the SEC approves functions.

BlackRock and Fidelity seeded their BTC funds with $10 million and $20 million, respectively. These disclosures had been both made or totally confirmed in amended S-1 varieties filed with the SEC on Jan. 8.

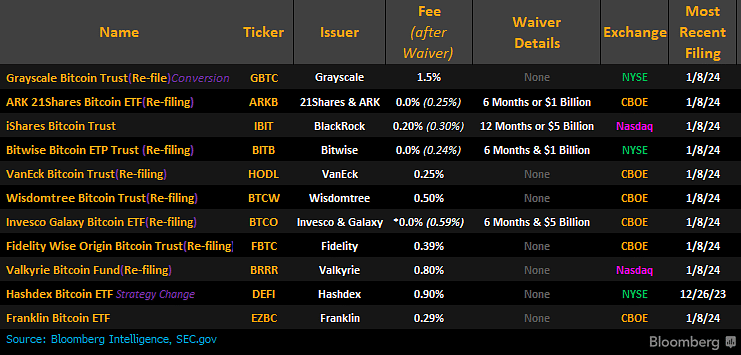

As crypto.information reported, these up to date filings, which included S-3 varieties from corporations like Grayscale, additionally revealed the charges these issuers plan to cost. The GBTC supplier fielded the costliest charges at 1.5%, a shock to consultants as its significantly increased than rivals.

5 corporations, together with Invesco Galaxy, will provide payment waivers, permitting buyers to commerce choose spot Bitcoin ETFs at discounted prices for as much as six months. Bitwise plans to charge the bottom payment at 0.24%, with ARK 21 Shares and BlackRock shut behind with 0.25% and 0.3% charges.

The filings possible point out that markets are near a choice from the SEC on whether or not to simply accept or reject spot Bitcoin ETF to permit American buyers to commerce BTC through regulated automobiles for the primary time.

To mark a long-term imaginative and prescient and robust optimism for spot BTC ETFs, VanEck has pledged 5% of its potential revenue to help core Bitcoin builders. The agency has already made a $10,000 donation towards this trigger.