In keeping with knowledge, crypto and digital funds firms paid almost $6 billion in fines in 2023 for shortcomings in buyer checks and anti-money laundering controls violations.

Crypto and fintech teams confronted fines exceeding these of your entire conventional monetary system in 2023, the Monetary Occasions reports, citing knowledge compiled by software program supplier Fenergo. Information revealed that the crypto trade paid a staggering $5.8 billion in fines final 12 months, because of safety shortcomings, anti-money laundering controls, and failures to uphold sanctions to handle monetary crime points.

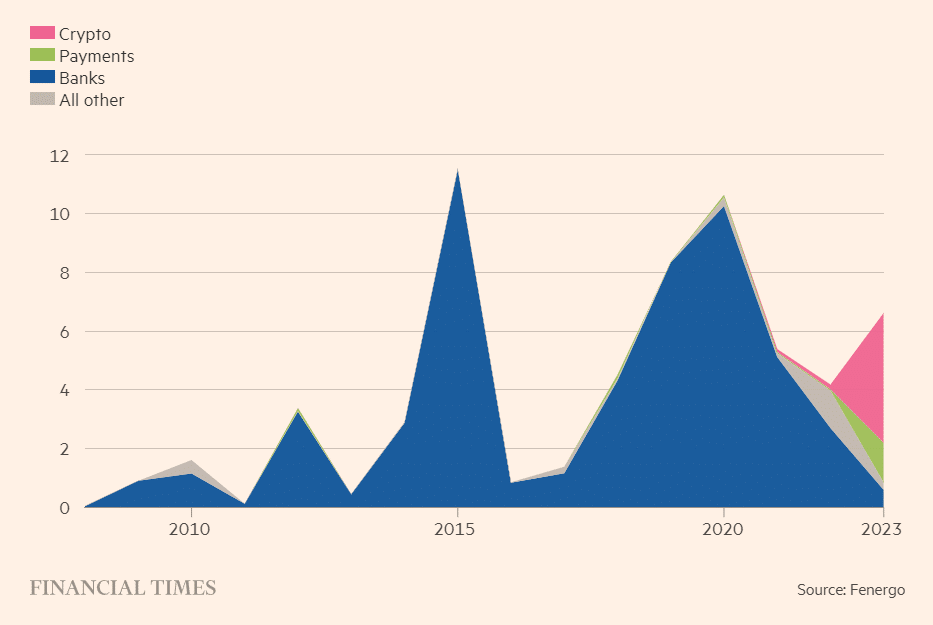

Nearly all of the sum included a $4.3 billion penalty imposed on Binance, described by U.S. prosecutors as “one of many largest company penalties in U.S. historical past.” As famous by the report, the determine far surpassed the $835 million paid by conventional monetary providers teams, marking the bottom stage in a decade.

Information additionally indicated that complete fines for cash laundering and monetary crime violations rose over 30% to $6.6 billion in 2023, though the determine stays beneath the 2015 peak of $11.3 billion. In keeping with the Monetary Occasions, the variety of fines in opposition to crypto companies elevated considerably final 12 months, as crypto companies confronted 11 fines, in comparison with a mean of lower than two a 12 months over the previous 5 years.

In late November 2023, U.S. Commodity Futures Buying and selling Fee (CFTC) Commissioner Christy Goldsmith Romero said the regulator would proceed to pursue cryptocurrency exchanges that break the regulation, emphasizing the company’s efforts to crack down on providers that assist customers circumvent KYC guidelines.

Romero’s assertion got here shortly after Binance CEO Changpeng Zhao joined the opposite disgraced crypto entrepreneur Sam Bankman-Fried in making headlines, admitting to fees in opposition to him and his cryptocurrency alternate that included violating U.S. anti-money laundering legal guidelines.