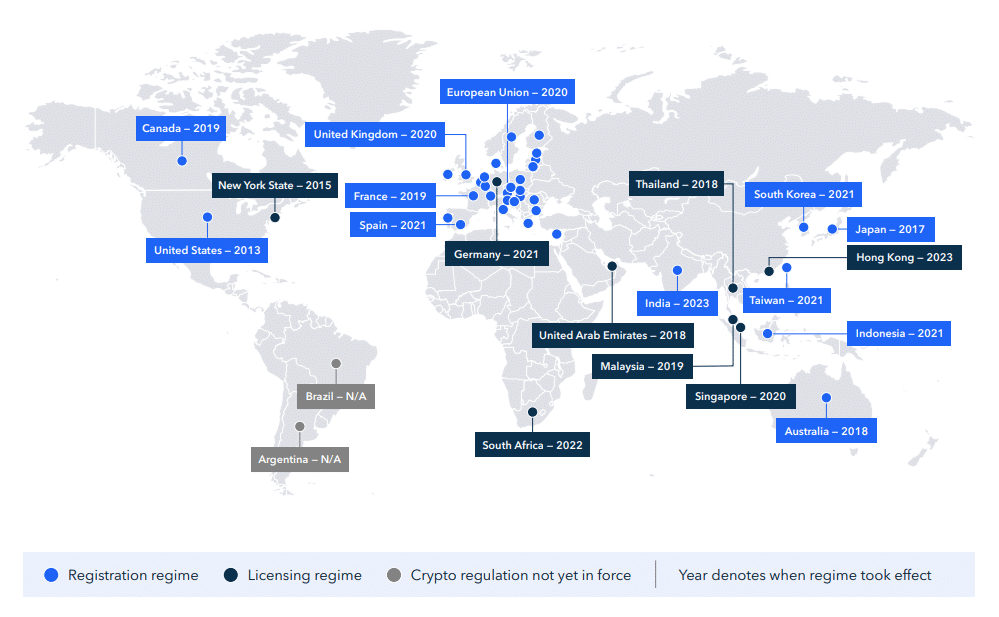

In keeping with knowledge compiled by TRM Labs, round 80% of 21 main jurisdictions, representing round 70% of worldwide crypto publicity, have strengthened crypto rules in 2023.

In a research report printed on Jan. 8, blockchain analytics agency TRM Labs disclosed that almost 80% of jurisdictions globally have applied measures to tighten regulations inside the crypto house. Nearly half of those jurisdictions particularly superior initiatives for enhanced client safety.

Whereas varied jurisdictions prioritize totally different nationwide targets, analysts at TRM Labs have found that crypto exchanges working in nations with established licensing and supervision frameworks reveal “decrease charges of illicit exercise than these in much less regulated jurisdictions.”

Regardless of the absence of a complete regulatory framework for cryptocurrencies within the U.S., TRM Labs anticipates pivotal rulings from federal courts in 2024 on whether or not particular crypto belongings could possibly be deemed securities.

“We are able to additionally count on the enforcement momentum to proceed, particularly towards mixers and different anonymity enhancing instruments.”

TRM Labs

Analysts acknowledge uncertainties inside the decentralized finance house, notably relating to problems with accountability, accountability, and the sensible train of oversight and authority by regulators. Whereas definitive solutions to those questions could not floor in 2024, TRM Labs says the 12 months ought to be anticipated as a second of “implementation and benchmark setting within the subsequent, hopefully much less wild, chapter of digital belongings.”

The present place of American regulators on crypto stays unsure, as their earlier indicators advised that current monetary legal guidelines are nonetheless relevant to digital belongings. In December 2023, the U.S. Securities and Change Fee (SEC) defined its denial of Coinbase’s Rulemaking Petition, citing three causes: current legal guidelines already apply to crypto securities markets, the SEC addresses crypto securities markets by way of rulemaking, and the necessity to protect Fee discretion in establishing rulemaking priorities.

Nonetheless, Coinbase сhief authorized officer Paul Grewal said the corporate would nonetheless try and have the SEC abdicate its obligation to find out crypto regulation requirements by way of one other attraction.