Analysts from CryptoQuant revealed two situations that would unfold earlier than the approval of spot Bitcoin (BTC) ETFs.

CryptoQuant specialists analyzed the assist and resistance ranges of the primary cryptocurrency primarily based on the common worth of BTC holders and introduced two situations: bullish and bearish.

In line with the primary bullish state of affairs, earlier than the U.S. Securities and Change Fee (SEC) makes a last determination, the worth of BTC may attain an area peak of $48,500. On this case, the share of short-term holders (from at some point to per week) will exceed 8%, which signifies a market overheating. As well as, this indicator will increase the probability of a correction. This degree could change into the primary resistance degree for Bitcoin. $48,500 is the common worth for long-term holders.

In a bearish state of affairs, the worth of BTC may drop by 2-30%. Historic information proof this: after lively development, the worth often falls. If this occurs once more, the important thing assist ranges might be $30,000 and $34,000. The primary indicator is the common worth of long-term holders, and the second being short-term holders.

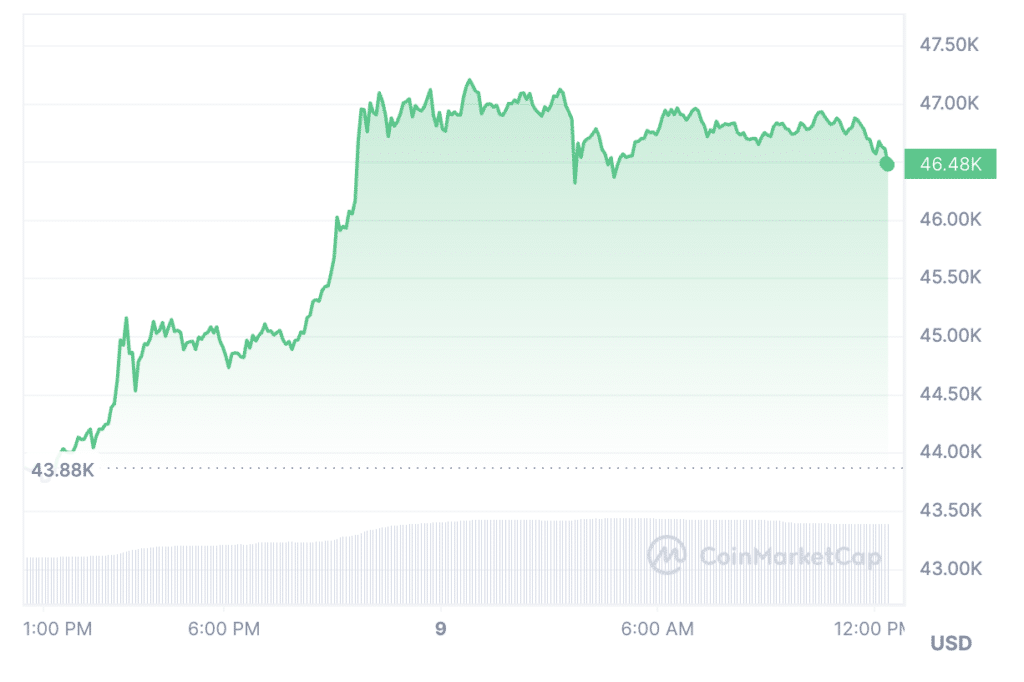

On Jan. 8, the worth of BTC as soon as once more updated its annual most at $47,218. The final time the determine reached this degree was in April 2022. In line with CoinMarketCap, Bitcoin is at the moment buying and selling at $46,477 on the time of writing. Over the previous 24 hours, the asset’s worth has strengthened by 7%.

The destiny of spot Bitcoin ETFs stays unsure. The crypto market is awaiting a choice on purposes from the SEC this week.