Privateness tokens face challenges assembly crypto alternate itemizing standards amid regulatory stress, resulting in an all-time low in liquidity, Kaiko’s information exhibits.

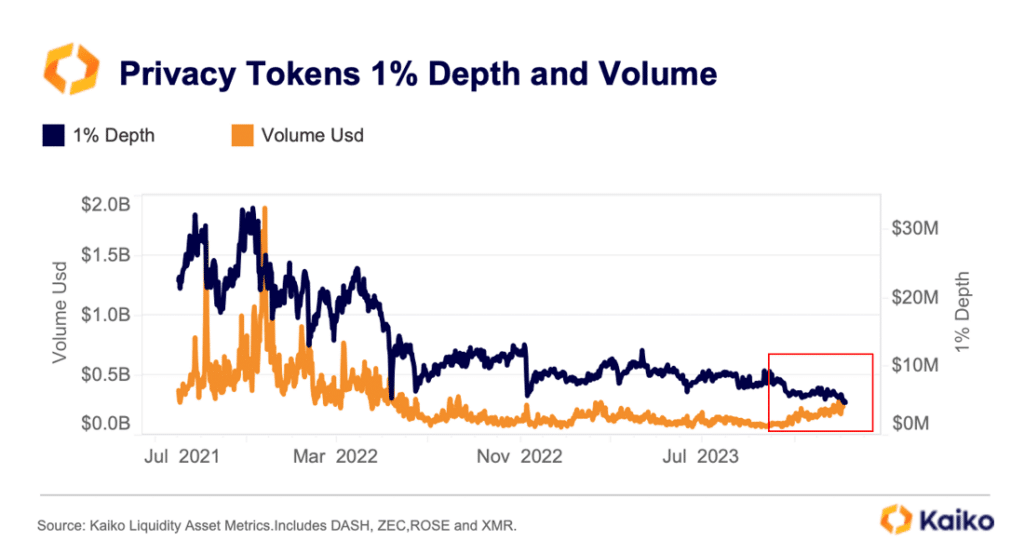

In a latest research report, analysts at Kaiko have revealed that market liquidity for privateness tokens — together with Monero (XMR), Zcash (ZEC), and DASH — has reached all-time lows as crypto exchanges hold eradicating these belongings from their listings. In response to information, privacy-focused tokens witnessed final week simply $5 million in liquidity following the removing of a number of buying and selling pairs with these belongings from OKX.

“Whereas commerce volumes step by step elevated since October, they’re nonetheless nicely under their 2021 ranges.”

Kaiko

Analysts at Kaiko identified that privateness tokens have more and more been delisted by main platforms as a result of regulatory stress over the previous few years.

This has helped to exacerbate the decline in liquidity through the crypto bear market. Each XMR and ZEC are presently at excessive threat of being delisted on Binance as a result of low liquidity, Kaiko notes, including that ZEC has been the “most delisted privateness token over the previous two years.” This has led to a higher fragmentation of the market, with XMR dominating on giant exchanges, whereas ZEC and DASH are largely traded on smaller unregulated venues, the analysts say.

In early January, crypto.information reported that Binance expanded the Monitoring Tag protection with an extra 10 tokens, together with Monero (XMR) and Zcash (ZEC). The transfer got here amid elevated makes an attempt by Binance to bolster threat administration after admitting to a litany of crimes in late 2023, together with cash laundering and failing to adjust to know-your-customer (KYC) rules stipulated by the U.S. Securities and Alternate Fee (SEC).

Regardless of the widespread delistings, not everybody within the crypto business shares the identical perspective. In September 2023, Ethereum co-founder Vitalik Buterin pointed out that centralized entities like custodial exchanges are “weak” and might be corrupted, emphasizing that customers ought to be capable of transact instantly on the Ethereum blockchain with out counting on centralized suppliers.