The USA Securities and Change Fee (SEC) authorised a number of spot Bitcoin ETFs on Jan. 10.

Based on an official SEC filing, spot Bitcoin ETFs have been authorised for itemizing on all registered nationwide exchanges within the U.S., together with the Nasdaq, NYSE, and CBOE, following a decade-long hunt for these merchandise.

The approval means ETFs will go reside in buying and selling on the CBOE from 9 am on Jan. 11 when the U.S. inventory market opens

11 issuers have been talked about within the SEC’s approval submitting, issuing the inexperienced mild to checklist Bitcoin (BTC) exchange-traded funds. The submitting broke in the course of the late hours of Jan. 10 earlier than briefly disappearing, doubtless on account of giant site visitors on the SEC’s web site.

“As described in additional element within the Proposals’ respective amended filings, every Proposal seeks to checklist and commerce shares of a Belief that may maintain spot bitcoin, in entire or partly. This order approves the Proposals on an accelerated foundation.”

SEC approval of spot BTC ETFs

Corporations had indicated readiness to start buying and selling as early as Jan. 11. VanEck CEO Jan Van Eck confirmed this in an interview with CNBC. Different issuers have additionally signaled the power to kickstart spot BTC ETF operations promptly.

Hours earlier than approval arrived, BlackRock and ARK 21Shares filed amended purposes disclosing even decrease charges than beforehand talked about. Because it stands, Bitwise nonetheless affords the bottom charges at 0.2%, adopted by ARK 21Shares, BlackRock, and Constancy in that order.

As famous by Bloomberg’s Eric Balchunas, the so-called price conflict could not affect how these ETFs in the end carry out. It’s additionally unlikely that companies will change their charges now that the SEC has issued inexperienced lights for spot BTC ETFs.

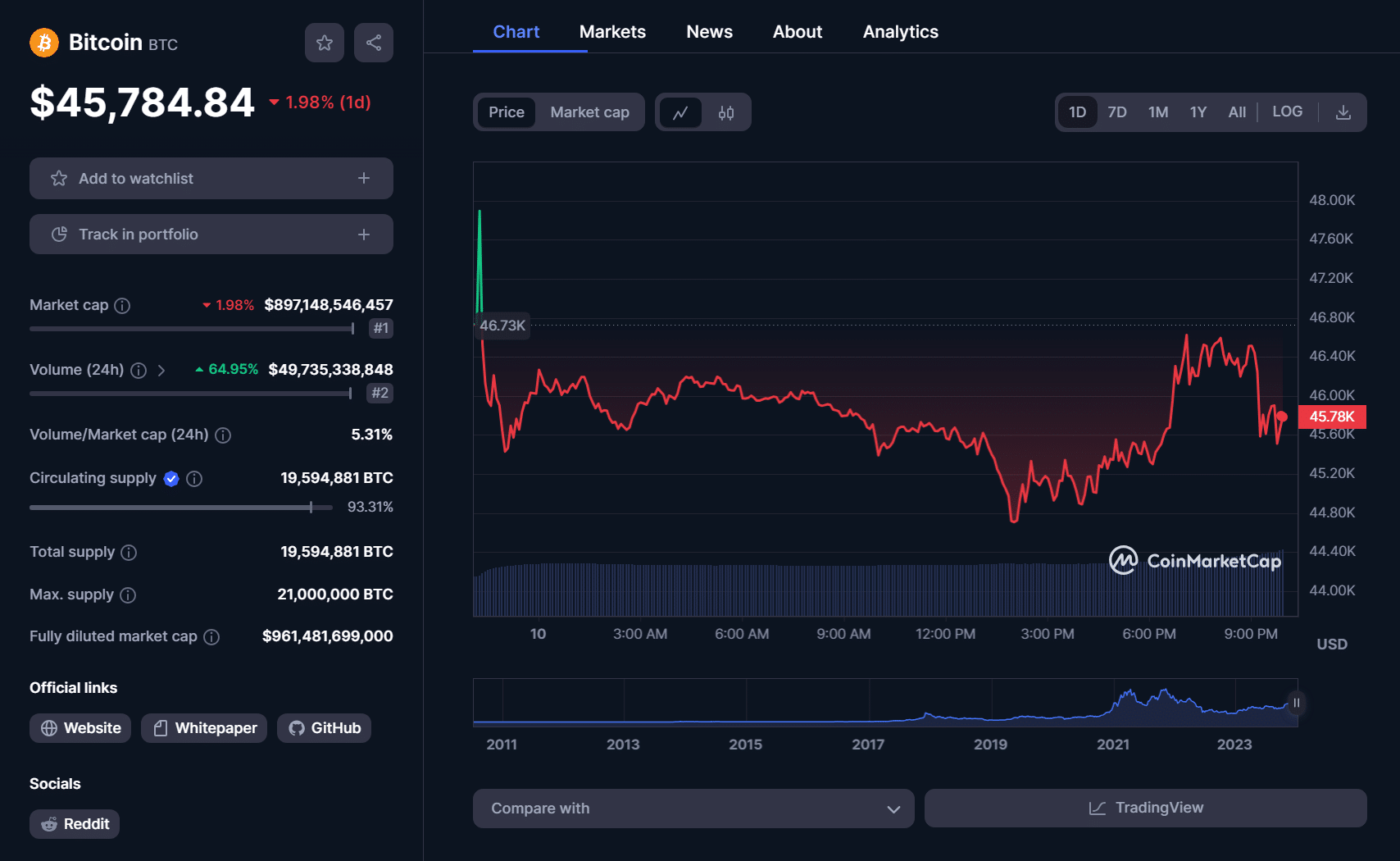

Upon the SEC’s declaration of acceptance for a number of bids, the underlying asset in BTC skilled volatility and value swings. BTC traded beneath $46,000, down over 2% at press time.

BTC additionally skilled fluctuating costs on Jan. 9 after the SEC’s X account tweeted a sham spot BTC ETF approval message. SEC chair Gary Gensler mentioned unknown hackers compromised the web page because the information triggered a 6% drop in BTC’s value, wiping out over $230 million in crypto positions. $90 million of that collectivecomprised leveraged Bitcoin positions per Coinglass information.

SEC legal professionals confirmed a forthcoming inner communication to unearth the foundation trigger behind what U.S. Senators have deemed a “colossal error”. The FBI is reportedly concerned in investigations into the matter.

Now that spot Bitcoin ETFs have lastly acquired approval, the following milestone could also be logged on the BTC halving in April and the inflows into these BTC-related TradFi funding automobiles. Whereas Wall Road stalwarts like JP Morgan foresee a staggered capital curiosity, crypto-native entities like Mike Novogratz’s Galaxy Digital count on huge value surges of as much as 74%.

Responding to claims that BTC markets might even see as much as $100 billion in inflows within the first 12 months, Bloomberg’s James Seyffart espoused expectations across the $10 billion to $15 billion vary. The ETF professional famous that these flows may very well be break up throughout new publicity to Bitcoin and capital rotation from different automobiles like Canadian ETFs, crypto mining operations, and futures-based merchandise.

Matthew Sigel, head of VanEck’s digital asset analysis division, estimates $2 billion in inflows on week one and $40 billion in belongings beneath administration within the first 12 months.

These numbers could enhance or decline relying on a number of elements, together with the upcoming 2024 U.S. presidential elections and shifts in authorities in another 50 sovereign nations.

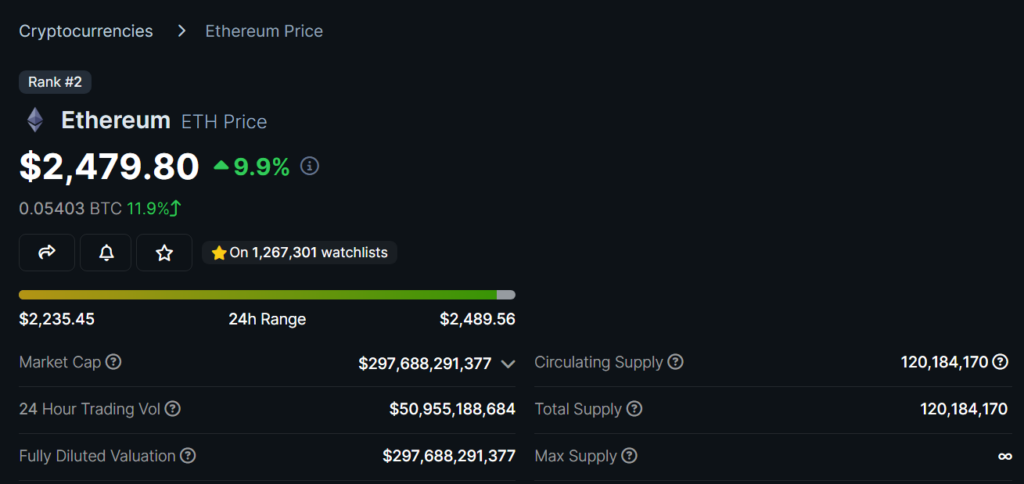

Consideration could now shift to Ethereum (ETH), which boasts its personal ETF frenzy and upcoming technological upgrades. ETH additionally confirmed resilience within the face of a pretend Bitcoin ETF approval and has gained greater than 9% previously 24 hours.