Monetary establishments like Vanguard haven’t any plans to permit spot Bitcoin ETF buying and selling regardless of approval from the U.S. SEC.

Whereas buying and selling for spot Bitcoin ETFs opened on Jan. 11 throughout main U.S. exchanges just like the Nasdaq and platforms reminiscent of Robinhood plan to swiftly add assist for these merchandise, some companies have reportedly blocked customers from buying and selling them.

Vanguard, the second-largest asset supervisor after BlackRock, reportedly mentioned spot Bitcoin ETFs don’t align with the corporate’s funding philosophy.

Along with not enabling buying and selling for the newly accepted merchandise, Vanguard disabled the shopping for of Grayscale’s GBTC shares on its platform, based on a number of customers on X.

A spokesperson for the agency mentioned Vanguard additionally has zero plans to supply a Vanguard Bitcoin ETF or different crypto-based merchandise. The Tradfi heavyweight views crypto volatility as a danger to its long-term constructive return technique for purchasers, per feedback from the consultant.

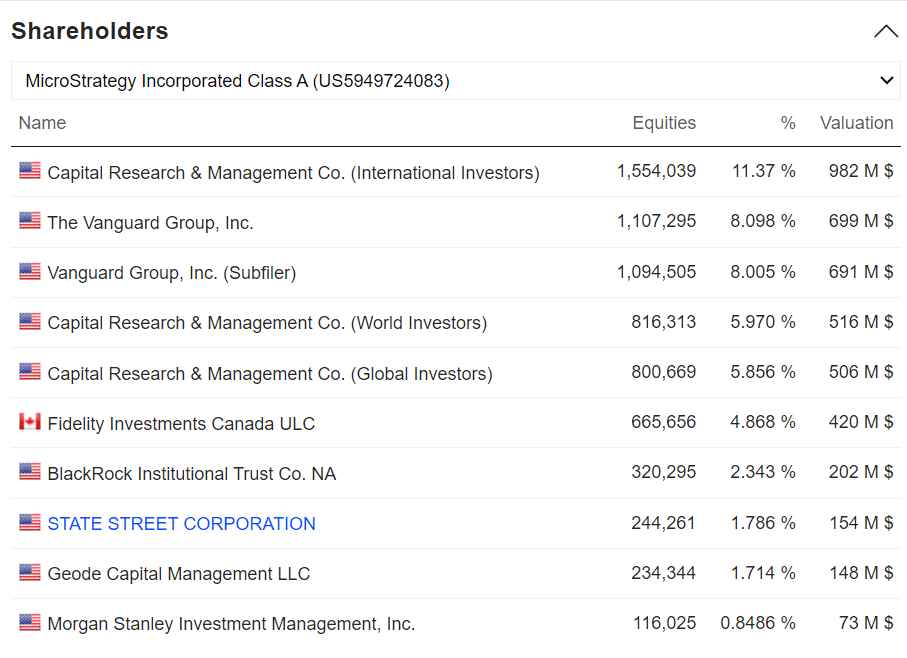

Vanguard is notably one of many largest homeowners of MicroStrategy shares, the Michael Saylor firm, which holds over $8 billion in Bitcoin (BTC).

Moreover, there are studies that different legacy establishments like Merrill Lynch, Citi Financial institution, UBS, Wells Fargo Advisors, and Raymond James will even boycott spot BTC ETFs — Merrill Lynch, specifically, plans to assess how the ETFs carry out and presumably reevaluate its choice.

In the meantime, Bloomberg’s James Seyffart confirmed over $1.2 billion in quantity for spot Bitcoin ETFs within the first half-hour of buying and selling. BTC itself briefly touched $49,000 shortly after buying and selling opened however has since declined barely in worth to round $46,300, per CoinMarketCap.

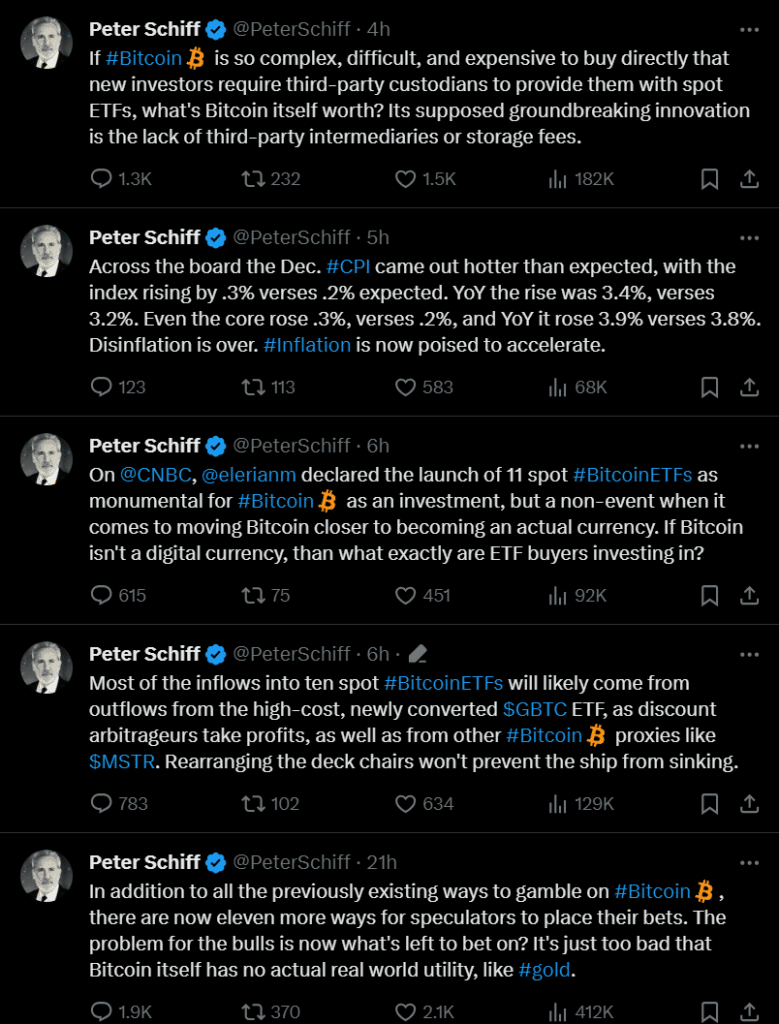

Regardless of confirmation from the Securities and Trade Fee for BTC ETFs, long-standing Bitcoin skeptic Peter Schiff continued championing anti-crypto rhetoric. Schiff scrutinized mainstream media channels for his or her protection of those merchandise and questioned the liquidity following spot BTC ETFs.