Uncover how Ethereum’s shift to PoS and liquid staking protocols remodel blockchain expertise and tackle the 32 ETH staking problem.

Ethereum staking has revolutionized the best way we use and work together with blockchain expertise. With its safety now counting on capital somewhat than computing energy, Ethereum’s (ETH) shift to proof-of-stake (PoS) presents quite a few advantages, together with a reported 99% discount within the community’s carbon footprint.

Nonetheless, it nonetheless presents a number of drawbacks, chief amongst them being the 32 ETH financial requirement for individuals to run a devoted node on the community.

Liquid staking protocols: what to look out for

As of January, 32 ETH is about $84,724. Not many would-be validators can simply afford that quantity, particularly in areas with decrease incomes.

Moreover, staking funds turn into locked and lack liquidity, pushing stakers to hitch staking swimming pools as a substitute. These swimming pools typically show extra worthwhile than particular person validators because of the benefits of smoothing results, security mechanisms, and insurance coverage they provide.

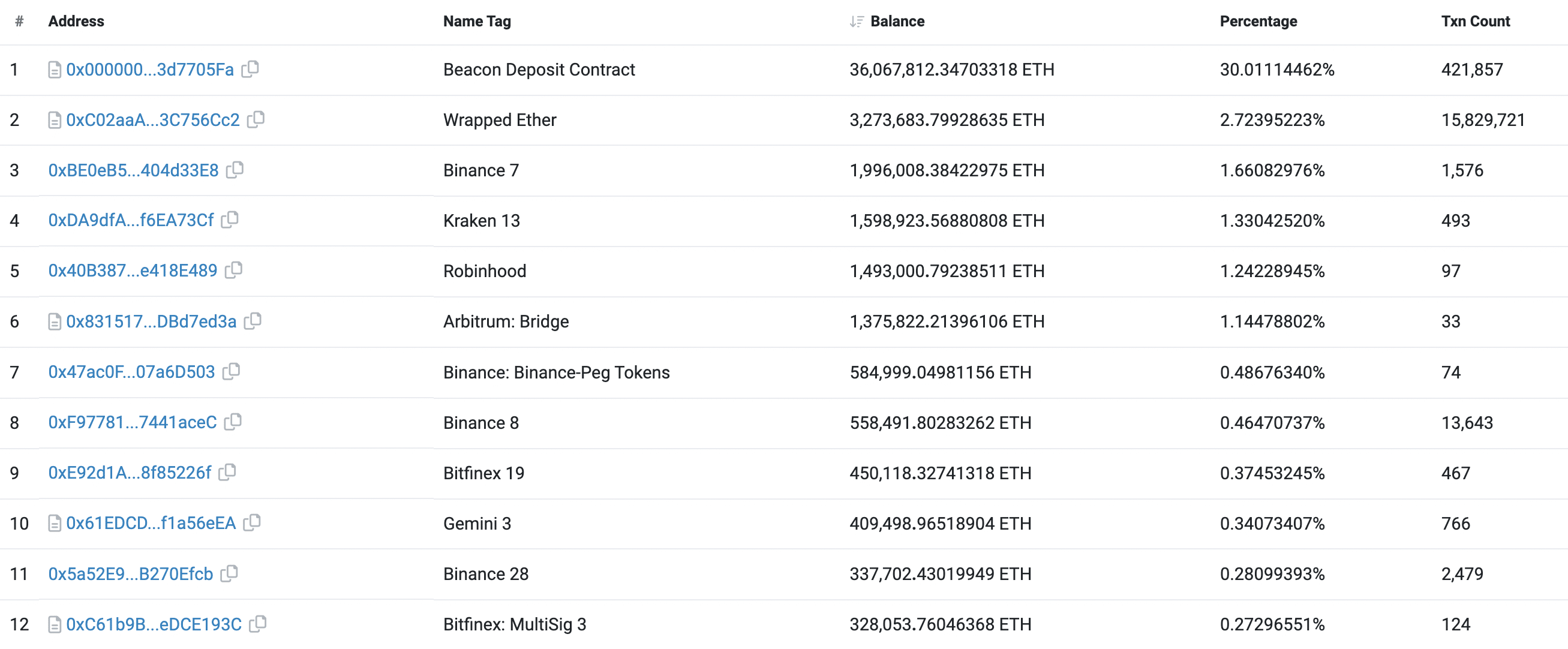

The scenario has led to a focus of energy on the Ethereum community, with a small variety of stakers controlling a big share of the blockchain. Since these entities maintain most of Ethereum’s validator keys, it provides them full management over essential facets like block manufacturing, transaction censorship, and MEV (maximal extractable worth) selections.

And as these swimming pools develop bigger, they acquire extra energy, eroding the core decentralization ideas of Ethereum. In consequence, there have been requires extra decentralized and pocket-friendly options to deal with this concern.

That is the place community-driven liquid staking protocols are available. These platforms supply a brand new strategy to stake ETH and luxuriate in the advantages of staking whereas sustaining liquidity and adaptability. To make clear this groundbreaking pattern, we sat down with the groups behind three rising liquid staking protocols: ether.fi, Diva, and Tenderize.

ether.fi: unlocking liquid staking

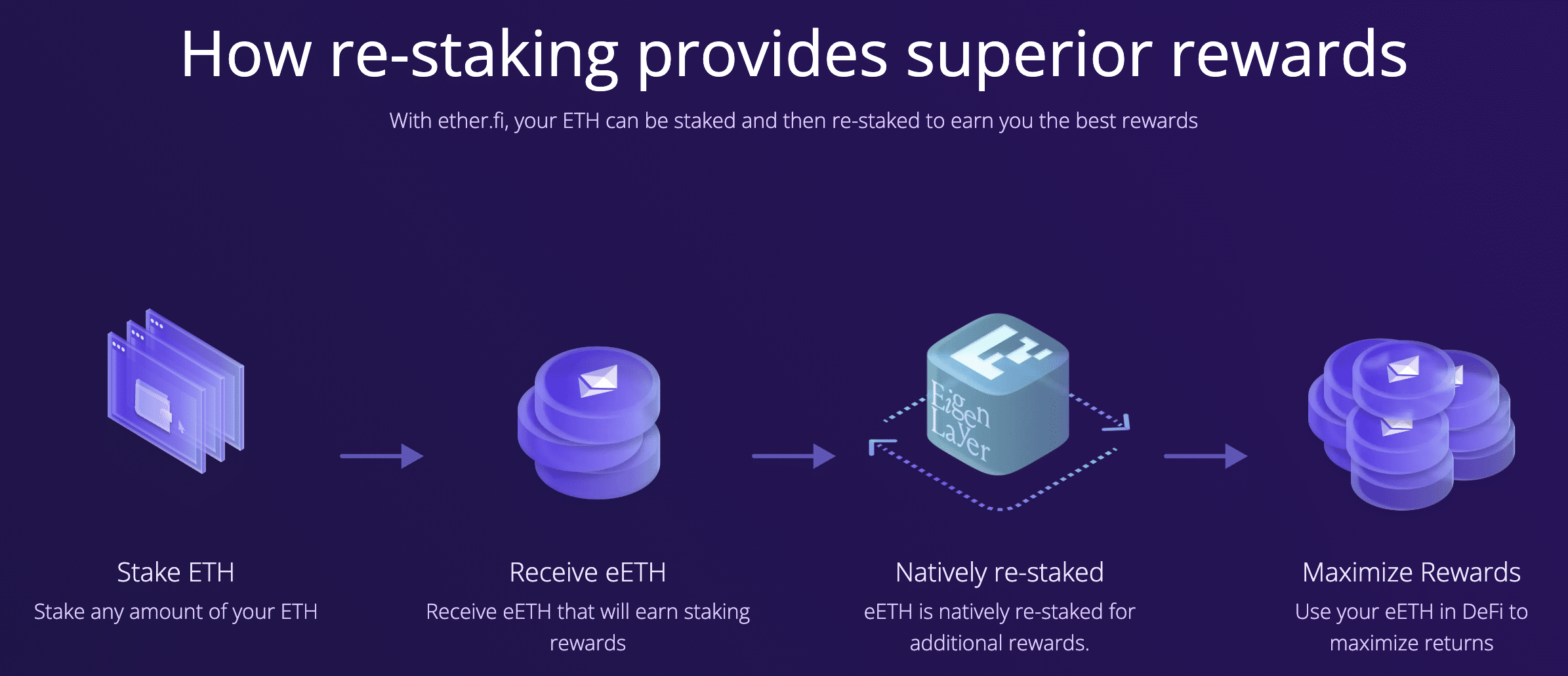

Ether.fi staff has pioneered a non-custodial protocol that permits customers to stake their ETH holdings whereas maintaining their non-public keys securely of their possession.

Among the many folks related to this mission is Arthur Hayes, an investor who actively contributes to ether.fi by way of his household workplace, Maelstrom.

Once we requested the ether.fi staff about their target market, they responded,

“We cater to people who’ve a eager curiosity in staking Ethereum.”

Nonetheless, additionally they highlighted the regulatory uncertainties surrounding ETH staking in america. Consequently, ether.fi has quickly geofenced U.S. customers till the Securities and Alternate Fee (SEC) offers extra exact steerage.

The ether.fi staff prioritized safety for his or her protocol, using auditors like Nethermind, Omniscia, Zellic, and Solidified to boost security measures.

Ether.fi presents loyalty factors and membership packages, offering rewards for customers. The platform adopts a non-custodial method, permitting customers to take care of management over their keys, aligning with the precept of “Not your keys, not your cash.”

To deal with liquidity and volatility points in staked tokens, ether.fi has made provisions for customers to withdraw or commerce their belongings by way of the eETH liquidity pool.

As of Jan. 12, ether.fi was one of many main liquid staking protocols per the quantity of ETH staked within the final six months.

Diva: one other method to liquid staking

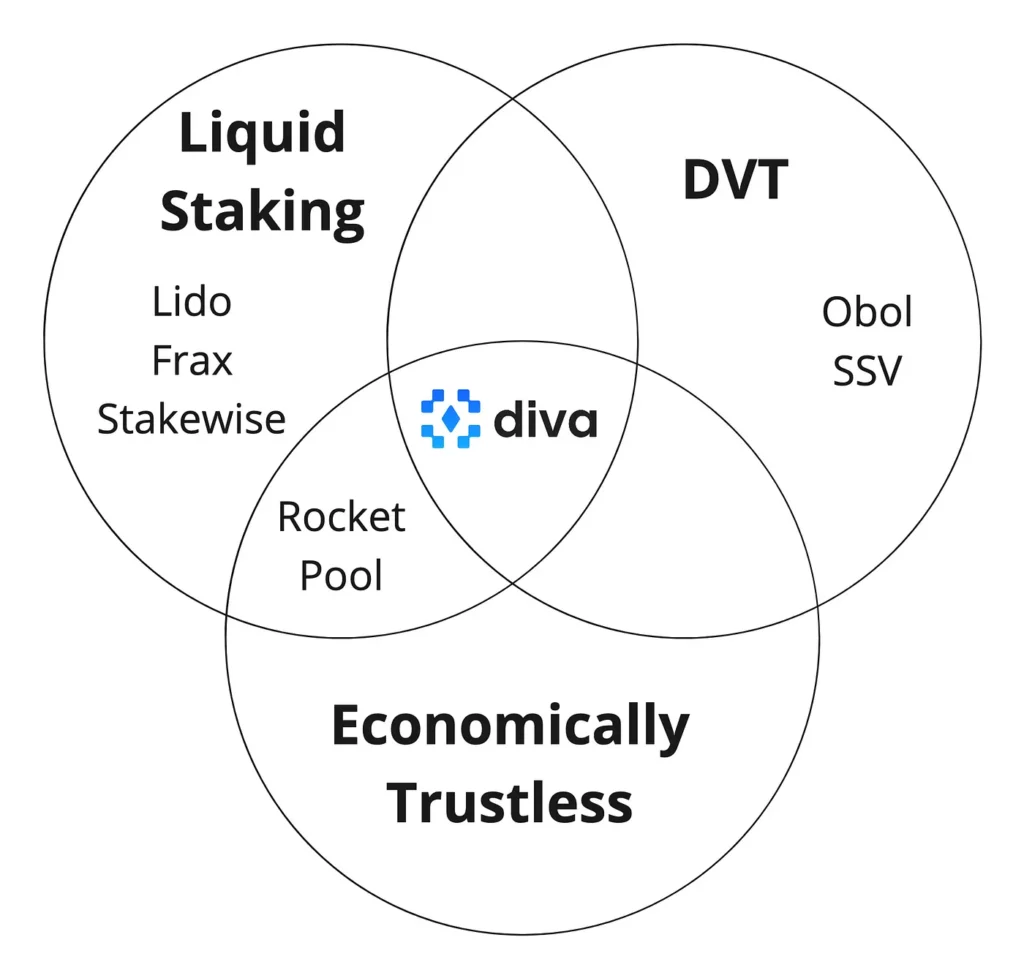

Diva, a liquid staking protocol that shall be launched in 2024. Diva’s distributed validator expertise (DVT) permits all the community to carry out validation, lowering the dangers related to centralization. Per builders, Diva’s safety mannequin, primarily based on DVT, presents improved uptime and a various vary of operators with out requiring permission.

It offers a substitute for solo staking, which calls for 32 ETH per validator and requires appreciable technical experience. Diva’s operator union mannequin makes staking extra accessible by permitting customers to lock as little as 1 ETH whereas offering higher rewards and adaptability, in keeping with the protocol’s builders.

The platform engages its neighborhood by way of Discord channels, encouraging customers to contribute to early testing and supply suggestions. In line with the staff, the neighborhood performs a big function in governance choices, guaranteeing the protocol evolves in response to the wants and issues of its customers.

The Ethereum Shanghai improve has performed a vital function in accelerating the expansion of liquid staking for ETH. This improve accomplished the circle for Diva, notably by making liquid staking tokens (LSTs) totally useful. This performance permits LSTs to commerce carefully to their honest worth, considerably lowering the price of offering liquidity in defi.

With deep liquidity swimming pools now extra accessible, protocols like Diva might acquire a aggressive benefit over established gamers like Lido Finance.

To make sure the steadiness and liquidity of the stETH by-product token, Diva employs divETH tokens, which carefully monitor ETH at a 1:1 ratio. This method, mixed with DVT-based safety, is how Diva mitigates vital value deviations from ETH.

The protocol has additionally adopted a particular method to navigate authorized challenges and guarantee regulatory compliance globally. As a substitute of working as a conventional firm or platform, Diva positions itself as a pure software program extension of Ethereum. Its immutable code, much like contracts equivalent to Wrapped ETH or Liquity, ensures that no central entity presents providers or fees charges. Diva goals to determine regulatory equivalences by staking on Ethereum itself, simplifying compliance efforts.

On the time of writing, Diva has not but launched. Nonetheless, by providing an Operator Testnet Alpha and proposing a Pre-Launch Vault, Diva goals to encourage early commitments of complete worth locked (TVL) in ETH or stETH.

Tenderize: empowering validators

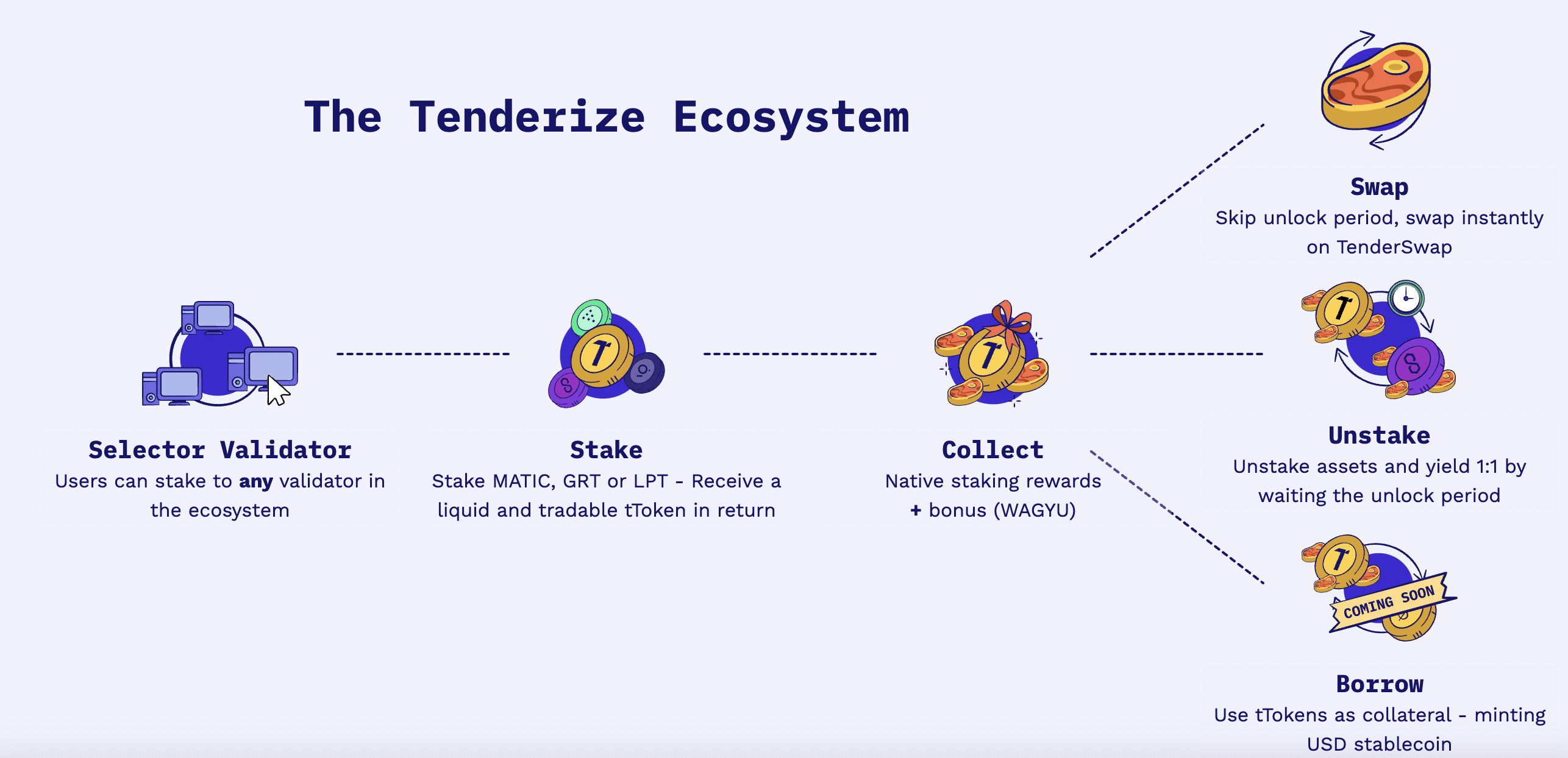

Tenderize is a liquid staking answer that enables any validator on the community to take part, doubtlessly unlocking as a lot as $30 billion value of crypto beforehand uncared for in liquid staking.

In line with the Tenderize staff, the platform has tried to deal with problems with uncared for belongings by offering every validator with highly-liquid staked tokens, selling decentralization within the ecosystem.

The platform has a brand new improve dubbed Tenderize v2, and what units it aside, within the phrases of its creators, is its self-custodial nature, which eliminates the necessity for intermediaries. It means customers can swiftly exit staking by way of a local decentralized alternate (DEX), with the shared liquidity method guaranteeing larger flexibility and liquidity entry with out centralizing stake on whitelisted nodes.

Very like Diva, the Ethereum Shanghai improve performed a significant function in accelerating the expansion of liquid staking for Tenderize, with the platform reportedly experiencing its fair proportion of constructive influence.

Previous to the improve, TenderSwap, a vital part of the Tenderize protocol, confronted limitations in facilitating unstaking. Nonetheless, with the improve, customers might unstake ETH, which paved the best way for the launch of tETH by way of Tenderize v2.

The protocol emphasizes neighborhood involvement in its improvement, with Tenderize providing grants to validators and liquidity suppliers for his or her enter and testing. The platform additionally entails token holders in governance choices, equivalent to payment and reward willpower.

In liquid staking, addressing stability and liquidity issues is essential. Tenderize presents two strategies for changing tTokens again to their unique type.

One technique is thru TenderSwap v2, the place customers can alternate their tTokens (like tMATIC, tLPT, or tGRT) for the corresponding asset (MATIC, LPT, or GRT) at a 1:1 ratio, topic to a service payment. The choice technique requires ready for the unstaking interval to finish, which varies by blockchain. Tenderize goals to take care of a 1:1 swap ratio on TenderSwap to handle value deviation dangers and help consumer stability and liquidity.

The mainnet launch is scheduled at Jan. 29, in keeping with Tenderize X account.

Liquid staking protocols: the way forward for staking?

Ethereum staking represents a notable improvement within the cryptocurrency house, with numerous initiatives contributing to this pattern. These initiatives allow customers to stake quantities lower than 32 ETH, supporting Ethereum’s transition to proof-of-stake.

Moreover, these initiatives supply strategies for customers to liquidate their staked belongings with out present process a full withdrawal course of, enhancing the flexibleness of cryptocurrency staking.

Initiatives supporting ETH staking beneath the 32 ETH threshold present a chance for customers to take part in staking with smaller investments.