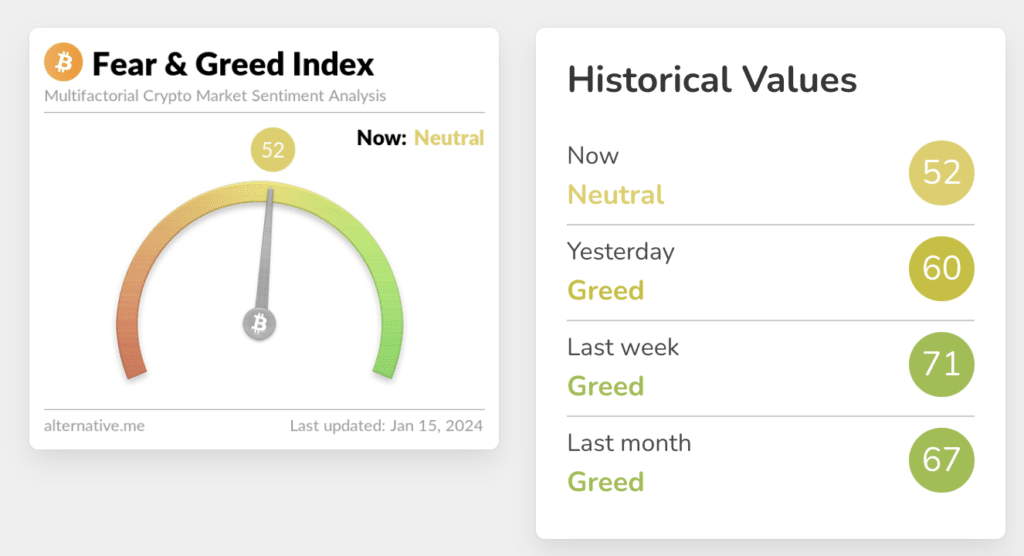

The cryptocurrency concern and greed index has returned to impartial after a surge final week.

In response to Different.me, on Jan. 15, the concern and greed index fell to October 2023 ranges. The drop got here days after the primary spot Bitcoin (BTC) ETFs have been authorized in the USA.

In response to the index, Bitcoin’s market sentiment rating is 52 out of a potential 100, the bottom since Oct. 19 final yr, when BTC traded at a mean each day value of roughly $31,000.

Notably, just some days in the past, the index hit an “excessive greed” studying of 76 because the market awaited the approval of spot Bitcoin ETFs.

The index numerically exhibits the feelings and sentiments of crypto market individuals. It collects and weights knowledge from six key market indicators: volatility (25%), market momentum and quantity (25%), exercise on social networks (15%), survey knowledge (15%), BTC dominance (10%), and tendencies (10%).

On the night of Jan. 10, the U.S. Securities and Change Fee (SEC) announced the approval of 11 functions for spot exchange-traded funds based mostly on the primary cryptocurrency. Eligible issuers embody Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Constancy and Franklin Templeton.

In anticipation of approval in X, a faux SEC message was released stating that the fee had already authorized the ETF. The regulator subsequently acknowledged that his account had been compromised, inflicting the value of Bitcoin to fluctuate wildly.