The thrill over spot Bitcoin (BTC) ETFs has calmed, however a recent wave of enthusiasm is rising. May the prospect of an Ethereum (ETH) ETF propel the crypto market to new heights?

In america, competitors is unfolding for supremacy within the exchange-traded fund (ETF) market, with a specific emphasis on outstanding crypto property. Whereas the preliminary funds, each operational and awaiting regulatory approval, had been completely linked to Bitcoin, a brand new wave of ETFs has seized the highlight. These newest choices allow traders to take a position on the value actions of ETH, the second-largest cryptocurrency.

Why does the market want cryptocurrency ETFs?

The launch of the primary ETFs pegged to the value of Ethereum occurred two years following the introduction of the primary Bitcoin futures ETF in america – the Bitcoin Technique ETF from ProShares, with shares traded on exchanges beneath the ticker BITO. At the moment, the launch coincided with the top of pleasure surrounding the crypto market, marked by historic document highs for Bitcoin and different cryptocurrencies. The panorama has advanced considerably since then: the crypto business is at present grappling with substantial regulatory scrutiny globally, and the buying and selling quantity on crypto exchanges has dwindled to its lowest level in three years.

Within the context of the cryptocurrency market, ETFs allow traders to trace the value actions of cash with out straight proudly owning them. Fairly than navigating exchanges and wallets independently, traders should purchase ETF shares by commonplace brokerage accounts. This funding strategy is extra prevalent amongst shoppers of administration firms or pension funds in america.

The U.S. Securities and Trade Fee (SEC) has given the inexperienced gentle to a number of Bitcoin ETFs, particularly these based mostly on futures contracts. In contrast to spot ETFs, futures ETFs don’t provide direct possession of cryptocurrency and don’t entail its supply (i.e., shopping for it in the marketplace). As an alternative, they monitor futures contracts that forecast their value at a future date. A number of market gamers launched Ethereum futures funds on October 2, 2023.

ProShares, Bitwise, and VanEck, amongst others, debuted their Ethereum funds after receiving regulatory approval to launch them. Just a few hours earlier than the opening of the American market and the graduation of fund buying and selling, the value of the ETH cryptocurrency surged by virtually 5%. Nonetheless, throughout the buying and selling session, it began to say no, and inside a day, it had dropped even decrease, erasing all of the earlier positive aspects.

Do we want an Ethereum ETF?

Investor curiosity in Ethereum may reignite if its costs recuperate to earlier highs, significantly contemplating that many desire Ether to Bitcoin as a result of quite a few choices for using its blockchain as infrastructure for numerous tasks and monetary providers.

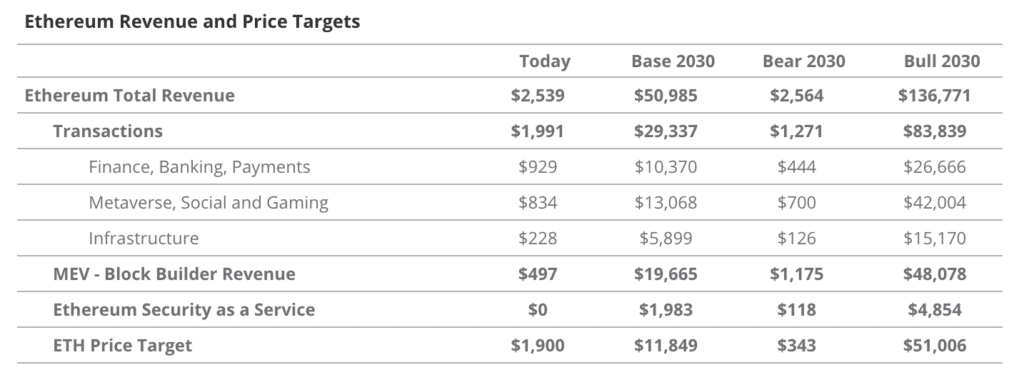

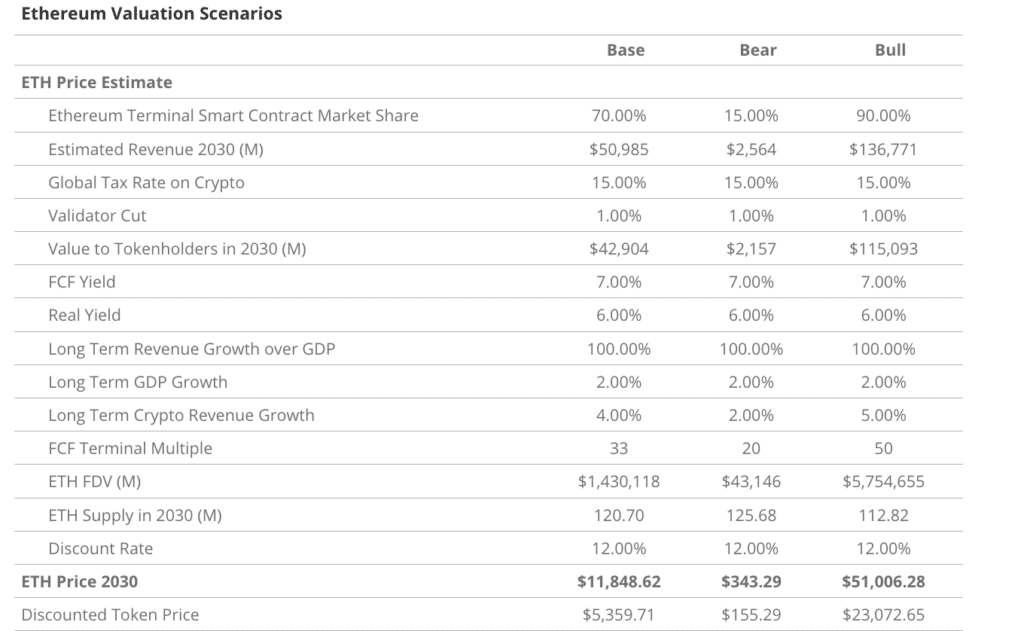

Again in Might 2023, a couple of months earlier than the launch of their Ethereum-ETF, VanEck analysts published an in depth report by which they shared the outcomes of a examine on the technical part of the Ethereum blockchain and its prospects. Based mostly on their calculations and the rationale for the demand for the ETH cryptocurrency as “gas” for future infrastructure, they predicted a variety of future costs for the coin.

Based on their estimates, by 2030, the value of ETH beneath the “base” situation will likely be $11,848, and beneath the “bullish” situation, the coin will exceed $51,000. Furthermore, within the worst-case situation and with an absence of correct demand, the ETH trade price, in keeping with their estimates, might drop to virtually $300.

Who has utilized for Ethereum ETFs?

In August 2023, crypto asset supervisor Valkyrie introduced the conversion of its Bitcoin futures ETF right into a fund that invests in Ethereum futures. Originally of October, a number of market gamers, together with ProShares, Bitwise, and VanEck, launched futures ETFs on Ethereum.

In September 2023, entrepreneur Cathie Wooden’s Ark Make investments additionally utilized for a spot Ethereum ETF.

In November 2023, the world’s largest funding agency, BlackRock, filed with the SEC to record a spot ETF on Ethereum.

Will purposes for spot Ethereum ETFs be authorized?

Analysts consider that spot Ethereum ETFs is also authorized inside a 12 months. Bloomberg analyst Eric Balchunas mentioned he doesn’t see a situation by which Bitcoin ETFs will likely be approved however Ethereum ETFs won’t.

The professional added that he estimates the probability that the SEC will approve spot Ethereum ETFs earlier than Might is 70%. Lawyer Joe Carlasar believes the company will do that earlier than the top of the 12 months, however “the method will take longer than individuals count on.”

Bloomberg analyst James Seyffart is assured that the SEC will “give the inexperienced gentle” to identify Ethereum ETFs. BlackRock CEO Larry Fink is now expecting the launch of spot ETH ETFs.

Nonetheless, SEC Chair Gary Gensler is exercising warning on Ethereum. Whereas acknowledging the approval of Bitcoin ETFs, he emphasised that this was particular to Bitcoin as a non-security commodity token.