Analysts anticipate a significant Bitcoin provide shock heading into April’s halving as BTC is down by practically 10% since ETF approval.

Bitcoin’s provide dynamics have considerably modified for the reason that SEC authorized spot Bitcoin ETFs earlier this month. The main token has been largely risky prior to now few weeks, however this volatility has remained inside a really slim value vary. BTC’s value has fluctuated between $41,000 and $44,000, dropping under $41,500 in the present day, the bottom value in 30 days.

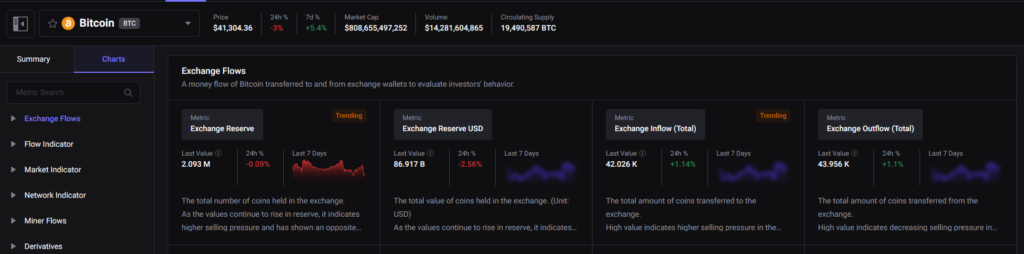

Analysts attribute these quick value actions to provide dynamics pushed by the ETF market. Since yesterday, based on information from Arkham Intelligence, Grayscale has transferred over $1 billion price of BTC to Coinbase from its ETF fund. With different main funds contributing to this huge influx of round 5,000 to 7,000 BTC every day to their custodian exchanges, solely 900 BTC is being mined every day.

Regardless of this, a report share of BTC provide stays untouched. Due to the distinctive provide dynamics of Bitcoin, analysts are predicting that the main token may expertise main supply-side illiquidity earlier than the halving, which can lead to a provide shock.

On the similar time, though slowly, we’re already seeing BTC provide shrink. Previously week, Bitcoin’s provide has declined from 19.6 million to 19.4 million. Traditionally, the token’s provide has by no means shrunk heading right into a halving.

Simply months away from the subsequent halving, the ETF market is quickly rising, and the market may see some main value actions within the subsequent few months. Bitcoin has already change into the second-largest ETF commodity within the U.S., surpassing silver, which signifies rising involvement from conventional institutes.

All of those components might translate into one of the intriguing and unpredictable halvings the market has seen for the reason that inception of crypto.