Bitcoin vs. Ethereum: learn our exploration of the important thing variations, options, performances, and prospects.

Cryptocurrency has modified the monetary panorama, with Bitcoin (BTC) and Ethereum (ETH) rising as two main gamers within the house. On this complete comparability, we’ll delve into the important thing variations between Bitcoin and Ethereum, exploring their options, current performances, and prospects.

Understanding the nuances of those cryptocurrencies is essential for traders, builders, and lovers alike, given their important affect on the digital economic system.

Understanding Bitcoin and Ethereum

On the planet of crypto, BTC vs ETH has turn out to be a endless debate. The dynamic duo have widespread traits but in addition bear important variations.

Customers can retailer each in virtual wallets and establish them by distinctive alphanumeric addresses. Whereas the 2 will be purchased and bought on varied on-line exchanges, neither of them is managed or regulated by monetary establishments or central banks. As a substitute, their operations are distributed amongst quite a few computer systems, known as nodes, every working duplicates of their networks to keep away from manipulation.

Regardless of these similarities, Bitcoin and Ethereum serve distinct functions: Bitcoin is commonly used as a retailer of worth, whereas Ethereum is predominantly used to work together with decentralized apps (dapps) developed on its blockchain.

Many traders additionally use BTC as a kind of security web, preserving worth throughout market dips, whereas they use ETH to get entry to decentralized monetary (defi) companies.

Bitcoin fundamentals

Cryptocurrencies formally turned a factor in 2009 when a mysterious particular person or group of individuals working below the identify Satoshi Nakamoto launched Bitcoin to the world.

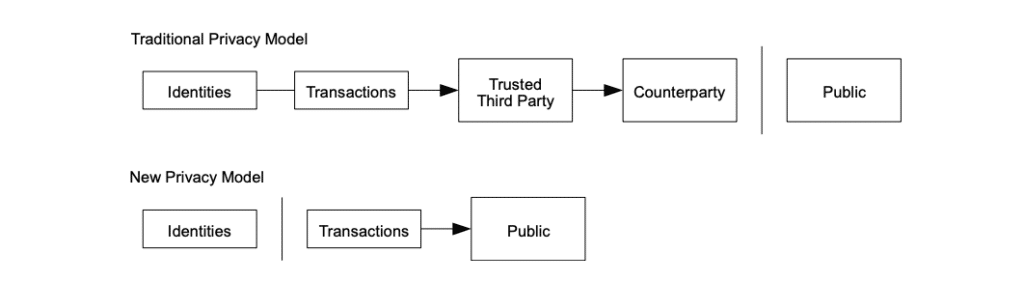

Satoshi aimed to create a decentralized, peer-to-peer (P2P) digital foreign money that will free individuals from the shackles of presidency oversight and the management of conventional monetary our bodies.

Bitcoin’s underlying know-how, the blockchain, serves as an unchangeable ledger, recording each transaction throughout a distributed community of nodes whereas leveraging cryptographic methods to make sure its safety and integrity.

Miners on the Bitcoin blockchain create and share blocks via a proof-of-work (PoW) course of, the place machines make the most of intensive computing energy to carry out hashing capabilities.

Bitcoin’s mining—the decentralized approach of issuing new Bitcoins and validating transactions—and consensus mechanisms defend the community from malicious assaults intending to change consumer balances or double-spend funds, making it resilient with nearly zero downtime.

In its early days, Bitcoin confronted skepticism and was typically related to the darkish net and illicit actions. Nonetheless, as its potential as “digital gold” turned obvious, it began to achieve traction amongst technologists, libertarians, and forward-thinking traders.

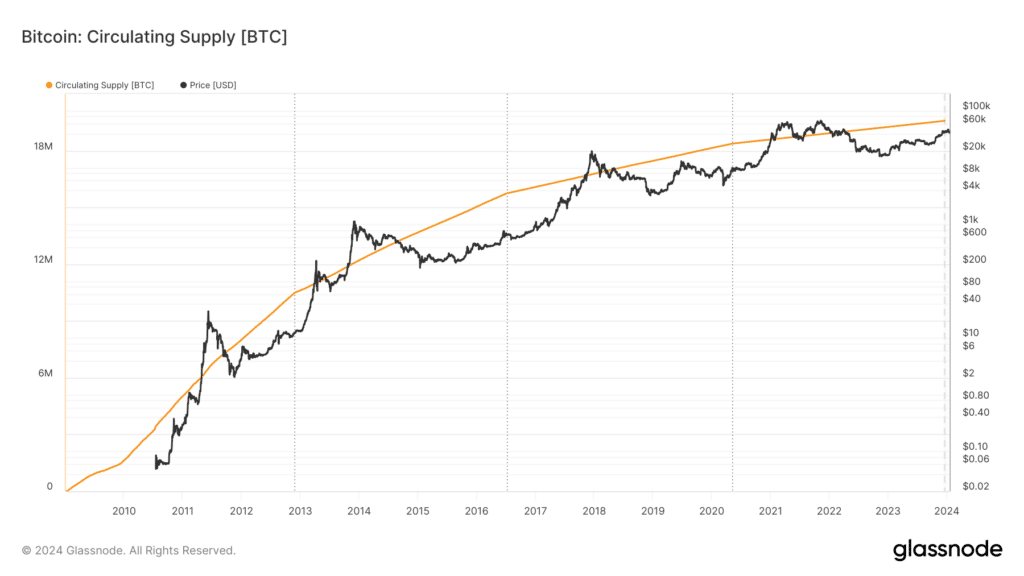

Bitcoin’s decentralized nature, mixed with its fixed supply, capped at 21 million cash, positioned it as a hedge in opposition to inflation and another retailer of worth. It additionally added to its attract and, coupled with the method of mining, has, over time, turned BTC right into a deflationary asset.

The cryptocurrency is about for its subsequent halving event in April 2024, a major occasion that reduces the rewards given to miners for every block of transactions added to the blockchain.

Traditionally, such halving occasions have served as bullish catalysts for Bitcoin costs.

Ethereum fundamentals

4 years after the introduction of Bitcoin, a 19-year-old Russian-Canadian pc programmer named Vitalik Buterin proposed Ethereum alongside different notable figures corresponding to Gavin Wooden, Charles Hoskinson, Anthony Di Iorio, and Mihai Alisie.

The idea of Ethereum was introduced into the general public eye in early 2014 at a Bitcoin convention in Miami, Florida. The blockchain itself formally launched in July 2015 with its first reside launch, often known as Frontier.

Whereas Bitcoin pioneered decentralized P2P transactions, Ethereum sought to increase the capabilities of blockchain know-how, changing into a platform for decentralized functions and good contracts.

Innovation on Ethereum is on the rise, with dapps offering monetary companies and non-fungible tokens (NFTs) representing one of many many potentialities that good contracts provide builders.

Transactions, good contracts creation, and dapps all require fee in Ether, the community’s native cryptocurrency. As Ether’s worth elevated, it additionally started to be seen as a retailer of worth.

Dapps on Ethereum enable customers to make the most of ETH and different crypto belongings in varied methods, together with as collateral for loans or to earn curiosity when lent to debtors on defi protocols.

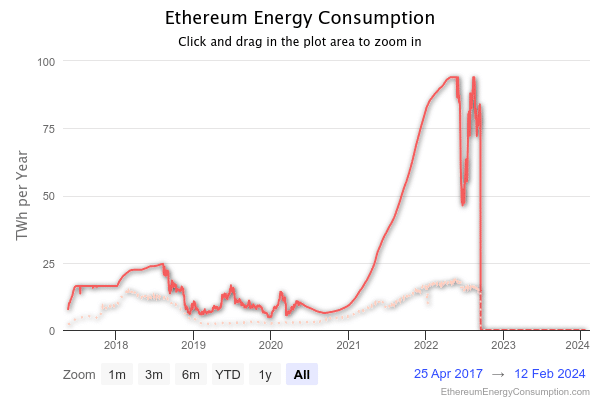

To develop its utility and maintain its companies on the leading edge, Ethereum has undergone a number of upgrades over time aimed toward enhancing its scalability, safety, and sustainability.

The most recent improve, often known as Dencun, is slated for the primary quarter of 2024. It’s a part of an bold set of enhancements deliberate for Ethereum that builders hope will remodel the community into a totally scaled, maximally resilient platform.

Following Dencun, Ethereum can also be anticipated to endure three different upgrades: the Verge, the Purge, and the Splurge.

BTC vs ETH: unpacking the variations

Whereas each Bitcoin and Ethereum depend on distributed ledgers and cryptography, they differ in lots of technical features. The variations between Ethereum and Bitcoin are quite a few. Listed below are just a few:

Transaction sorts: On the Ethereum community, transactions might include executable code, whereas Bitcoin community transactions solely carry data to report the transactions.

Transaction charges: Whereas Ethereum transactions are usually sooner than Bitcoin transactions, they arrive with greater transaction charges, often known as fuel charges. Ethereum is presently engaged on options to extend scalability and cut back fuel charges.

Major function: Whereas each BTC and ETH are digital currencies, Ether’s main function is to not function a financial system different however to facilitate and monetize the operation of the Ethereum community’s good contracts, dApps, and different potential blockchain options.

Block time: Some Ethereum transactions are confirmed inside seconds, making them considerably sooner than Bitcoin transactions, which might take minutes.

Scalability: Each Bitcoin and Ethereum face scalability points. Bitcoin handles a mean of seven transactions per second, whereas Ethereum handles round 30 transactions per second. Each are engaged on options to extend their transactional capacities.

Ethereum plans to make use of sharding to extend its base blockchain’s capability and cut back community congestion. Sharding creates new blockchains, or “shards,” to assist distribute the computing sources essential to run Ethereum throughout 64 networks.

Bitcoin, alternatively, has carried out the Segregated Witness (SegWit) improve and is creating a layer-two scaling resolution known as the Lightning Community. These options goal to make use of the restricted Bitcoin block house extra effectively and deal with as much as 15 million transactions per second.

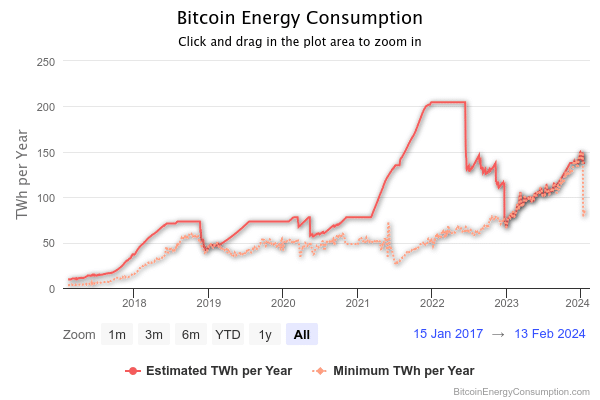

Consensus mechanisms: The largest distinction between Ethereum and Bitcoin is consensus mechanisms. Bitcoin employs a PoW system, whereas Ethereum moved to a proof-of-stake (PoS) mechanism in September 2022.

Vitality consumption: One main criticism of the PoW system utilized by Bitcoin is its excessive vitality consumption as a result of computational energy required.

Ethereum’s transition to the PoS system has made it considerably much less energy-intensive, changing miners with validators who stake their crypto holdings to achieve the power to create new blocks.

Market capitalization and transaction quantity: Regardless of having extra cash in circulation, Ethereum’s market capitalization is considerably decrease than Bitcoin’s. Bitcoin processes round 500,000 transactions per day, whereas Ethereum processes about 1.2 million. Ethereum’s larger block rely and smaller block measurement are resulting from its sooner block addition time.

Current market efficiency

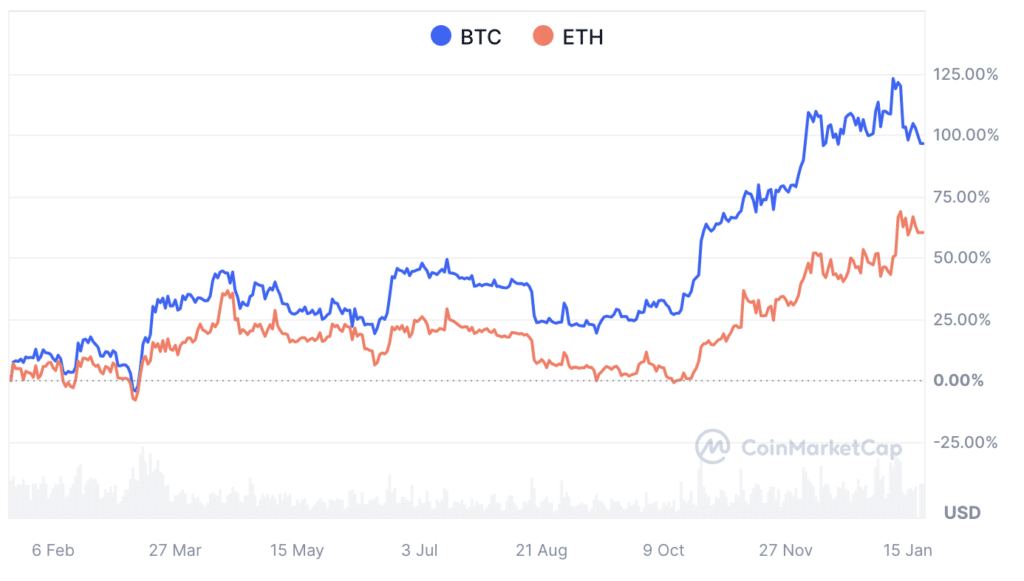

In 2023, the crypto market demonstrated important resilience, bouncing again from 2022’s downturn but nonetheless falling wanting the height seen in 2021. Bitcoin noticed a strong yr, with its market capitalization hovering to a excessive of +172%. Others, together with Ethereum, additionally skilled a vibrant yr, boasting a +90% enhance of their market caps.

Bitcoin’s value climbed steadily from lower than $17,000 firstly of 2023 to $43,550 by yr’s finish regardless of intermittent durations of minor volatility. However, the market chief’s share, which hovered round 50%, was nonetheless under its 2021 peak when it exceeded $65,000.

On the steadiness entrance, each have maintained relative stability within the final 12 months. Nonetheless, bitcoin concluded 2023 with a month-to-month achieve of 12.6% and an annual achieve of 156%, the best since 2020. Ethereum costs rose by 15.7% in December, ending the yr at $2,353, representing a 91% achieve for the yr.

Bitcoin additionally surpassed Ethereum in a number of indicators. As of December 2022, BTC held a market dominance of 40.1%, whereas ETH’s share was 18.4%. At the moment, BTC’s market share has surged to simply below 50% of the overall crypto market worth, whereas ETH’s is round 18%.

Ultimate ideas

As we proceed to contemplate Bitcoin vs. Ethereum, it’s plain that each cryptocurrencies convey distinctive worth propositions to the digital economic system. Their market performances make the selection to purchase Bitcoin or Ethereum fairly powerful for traders as a result of they each current robust circumstances.

Bitcoin has solidified its place as a retailer of worth and deflationary asset, providing a substitute for conventional monetary programs and appearing as a hedge in opposition to inflation.

Ethereum, alternatively, with its give attention to good contracts and decentralized functions, has turn out to be a hotbed for innovation, giving rise to developments corresponding to defi and NFTs.

Seeking to the long run, each are poised to take care of their positions within the crypto house. Bitcoin’s upcoming halving occasion in 2024 may possible function a bullish catalyst for its value, whereas Ethereum’s ongoing upgrades goal to enhance its scalability, safety, and sustainability, holding the potential to spice up its utility and efficiency.

Nonetheless, as crypto lovers talk about and take into account an Ethereum vs. Bitcoin funding, they need to do not forget that the 2 are usually not with out dangers. Because the crypto panorama evolves, it is going to be important for traders to remain knowledgeable and make educated selections.

Is Ethereum higher than Bitcoin?

The comparability between Ethereum and Bitcoin isn’t essentially about which is “higher,” however somewhat which is extra suited to sure makes use of or funding methods. Bitcoin, as the primary cryptocurrency, is commonly considered as digital gold resulting from its restricted provide and is primarily used as a retailer of worth. It’s widely known and has excessive liquidity, making it a steady alternative for a lot of traders. Alternatively, Ethereum goes past being a digital foreign money – it additionally allows good contracts. It hosts a mess of decentralized functions (dapps), making it extremely versatile and a driving issue behind the Decentralized Finance (defi) motion.

What’s the distinction between Bitcoin and Ethereum?

There are a number of variations between Bitcoin and Ethereum as a result of they serve completely different functions and have distinctive technical foundations. Bitcoin was designed as a digital different to conventional fiat currencies, with its main function being a decentralized type of digital money that permits peer-to-peer transactions. Ethereum is an open-source platform that permits builders to construct and deploy good contracts and decentralized functions (dapps).

Ought to I purchase Bitcoin or Ethereum?

The choice to purchase Bitcoin or Ethereum depends upon your particular person monetary objectives, threat tolerance, and understanding of every cryptocurrency’s underlying know-how. Each have proven important progress potential, however in addition they include dangers, because the crypto market is understood for its volatility, so it’s crucial so that you can DYOR (do your individual analysis) earlier than making any purchases within the monetary world.