Regardless of spot Bitcoin ETFs producing over $20 billion in buying and selling quantity, the crypto market faces ongoing challenges with liquidity.

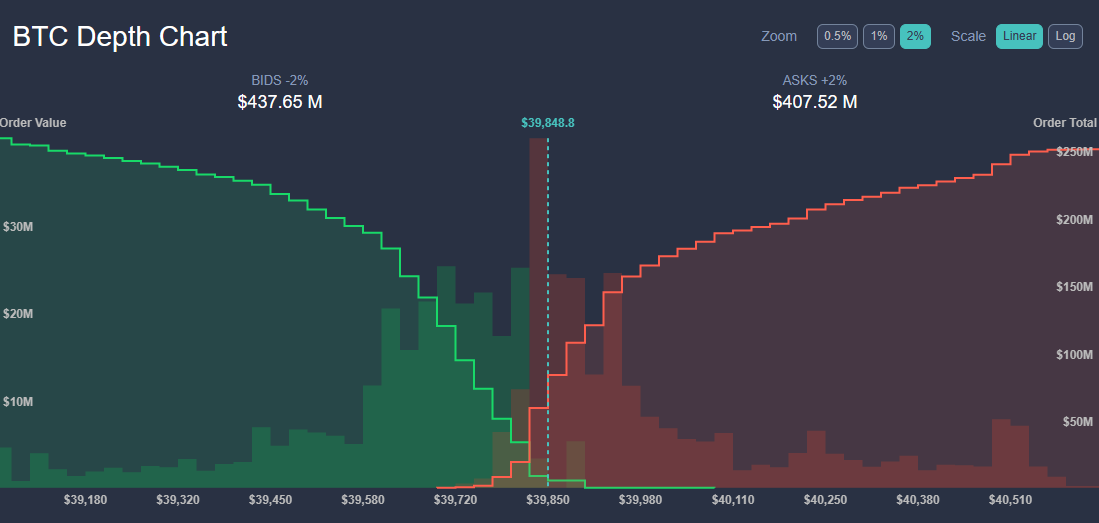

The market’s liquidity, as measured by Bitcoin’s market depth, signifies that the benefit and velocity of executing transactions within the digital foreign money stay suboptimal. The present Bitcoin (BTC) depth chart signifies that there’s a appreciable quantity of orders positioned each for purchasing (bids) and promoting (asks) Bitcoin, but the liquidity—referring to the power to execute massive orders with out impacting the value considerably—is restricted across the present value stage.

So, the ‘Alameda gap’ affect remains to be seen on market liquidity. Vital entities like Jane Avenue Group and Bounce Crypto have additionally scaled again their cryptocurrency buying and selling efforts, contributing to the liquidity shortfall.

This discount in market participation from main gamers is inflicting heightened value volatility. As an illustration, Bitcoin skilled value swings as massive as 12% across the ETFs’ launch. The retreat of those bigger companies, beforehand instrumental in market stabilization, has been conspicuous.

Smaller companies attempting to fill this hole are constrained by their comparatively modest monetary assets, making them much less outfitted to deal with substantial dangers during times of excessive volatility. This scenario usually results in vital liquidations when market fluctuations intensify.

Furthermore, the inflow of buying and selling exercise related to the brand new Bitcoin ETFs doesn’t immediately improve Bitcoin’s liquidity. A considerable portion of the ETF-related Bitcoin buying and selling is over-the-counter, which doesn’t have an effect on the market’s depth.

The conversion of the Grayscale Bitcoin Belief into an ETF, for example, resulted in about $4 billion in redemptions. This has led to a scenario the place GBTC shares incessantly commerce at a reduction to their underlying belongings, highlighting a disconnect between the buying and selling quantity of fairness shares and the precise liquidity within the cryptocurrency market.

The present state of the Bitcoin market, with its diminished liquidity and heightened susceptibility to cost manipulation, underscores the challenges going through the cryptocurrency sector within the absence of bigger, stabilizing market makers.