Crypto trade HTX, beforehand referred to as Huobi, has unexpectedly deactivated its proof-of-reserves function.

This commentary was famous right this moment by widespread fintech analyst Adam Cochran, Managing Associate at Cinneamhain Ventures. This growth coincides with points confronted by the stablecoin TrueUSD (TUSD), reportedly linked to HTX stakeholder Justin Solar, struggling to remain aligned with its supposed $1 worth for over two weeks.

Cochran additionally famous that reside knowledge from DefiLlama confirmed that HTX solely had $120 million in ETH holdings, though the most recent audit reported almost $300 million.

Earlier right this moment, HTX’s proof-of-reserves webpage displayed no data relating to the trade’s cryptocurrency holdings. Key knowledge, together with reserve ratios, pockets balances, and person asset totals, have been briefly absent from the web page. Though the web page has since been restored, the timing of this transient downtime is questionable, significantly in gentle of the continuing challenges surrounding TUSD.

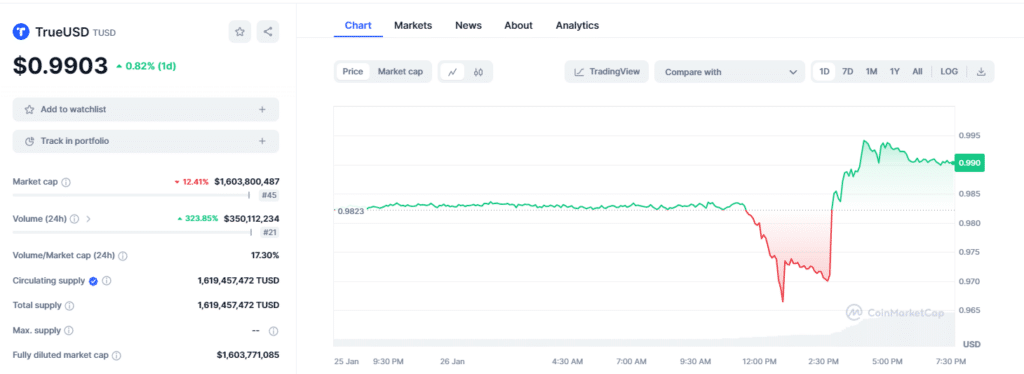

This incident follows heightened scrutiny of TUSD, significantly regarding its purported lack of full backing. Since Jan. seventh, TUSD’s buying and selling worth has dipped beneath the $1 mark, as reported by CoinMarketCap.

Considerations intensified earlier within the month when TrueUSD couldn’t current well timed attestations verifying that it held sufficient U.S. greenback reserves to again the stablecoin. This lapse in transparency fueled conjectures about the potential of TrueUSD being under-collateralized.