The decentralized platform Pendle Finance sees a surge in liquidity crossing the $500 million threshold on the heels of a cope with Ondo Finance.

Pendle Finance’s native token PENDLE is up over 18% following a cope with Coinbase-backed protocol Ondo Finance, which revealed in an X post on Jan. 29 that its customers can now leverage the “composability of our tokenized money equivalents.”

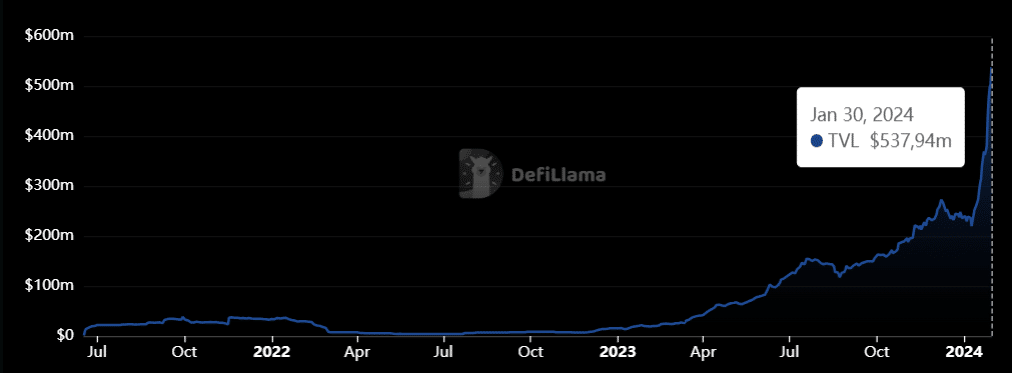

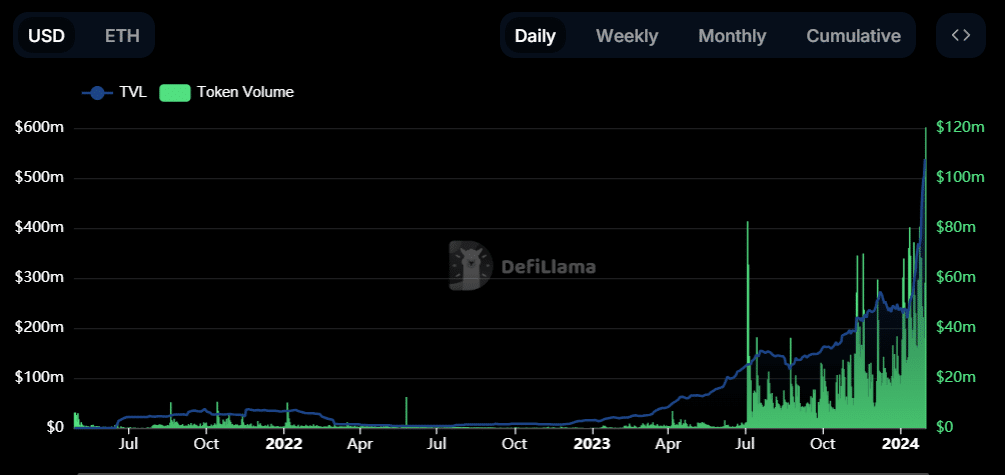

Whereas particular particulars concerning the collaboration stay undisclosed, the announcement has seemingly performed a task in fostering constructive sentiment throughout the Pendle group. In accordance with DefiLlama data, the whole worth locked (TVL) in Pendle Finance set a brand new all-time excessive, nearing the $538 million mark as of Jan. 30.

The PENDLE token has demonstrated vital participation, with practically $60 million in PENDLE quantity recorded on Jan. 30 alone, in line with obtainable knowledge.

Amidst this surge in exercise, the PENDLE token soared to $2.66, surpassing its earlier all-time excessive established since its launch, as indicated by CoinGecko knowledge. Nonetheless, the sustainability of this fast progress in the long run stays to be seen.

Established in 2022, Pendle Finance initially centered on the Ethereum community, offering a platform for tokenizing and buying and selling future yields throughout the defi area. Later in the identical yr, the platform expanded its attain to different networks, together with BNB Chain, Arbitrum, and Optimism.

Pendle Finance’s method permits customers to tokenize and commerce future yields generated by belongings throughout numerous decentralized protocols. This function permits customers to commerce these future yields as distinct tokens, apparently representing a brand new solution to have interaction with and speculate on defi yields.