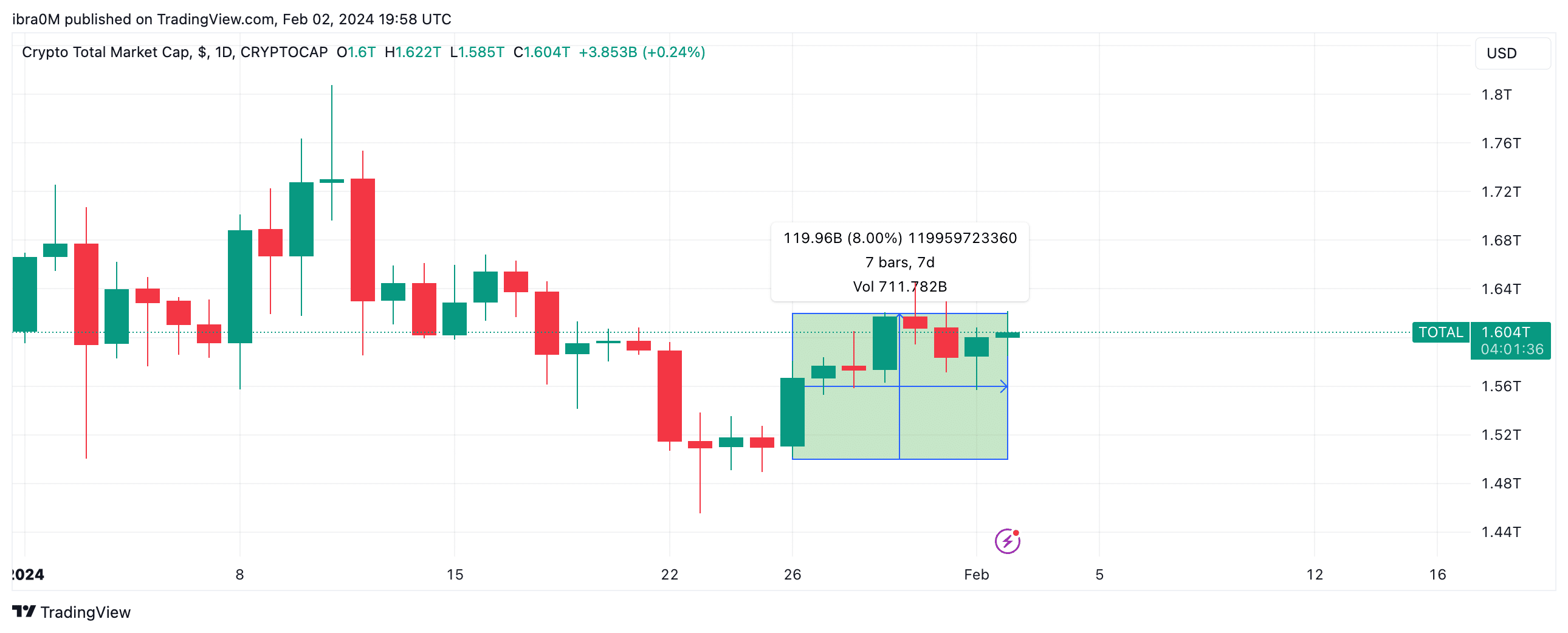

The worldwide crypto market capitalization rebounded above the $1.6 trillion milestone on Feb. 2 as the newest non-farm payrolls figures forged doubt on U.S. Fed Chief, Jerome Powell’s current feedback.

The job figures within the newest non-farm payrolls report counsel crypto bulls might place for constructive value motion.

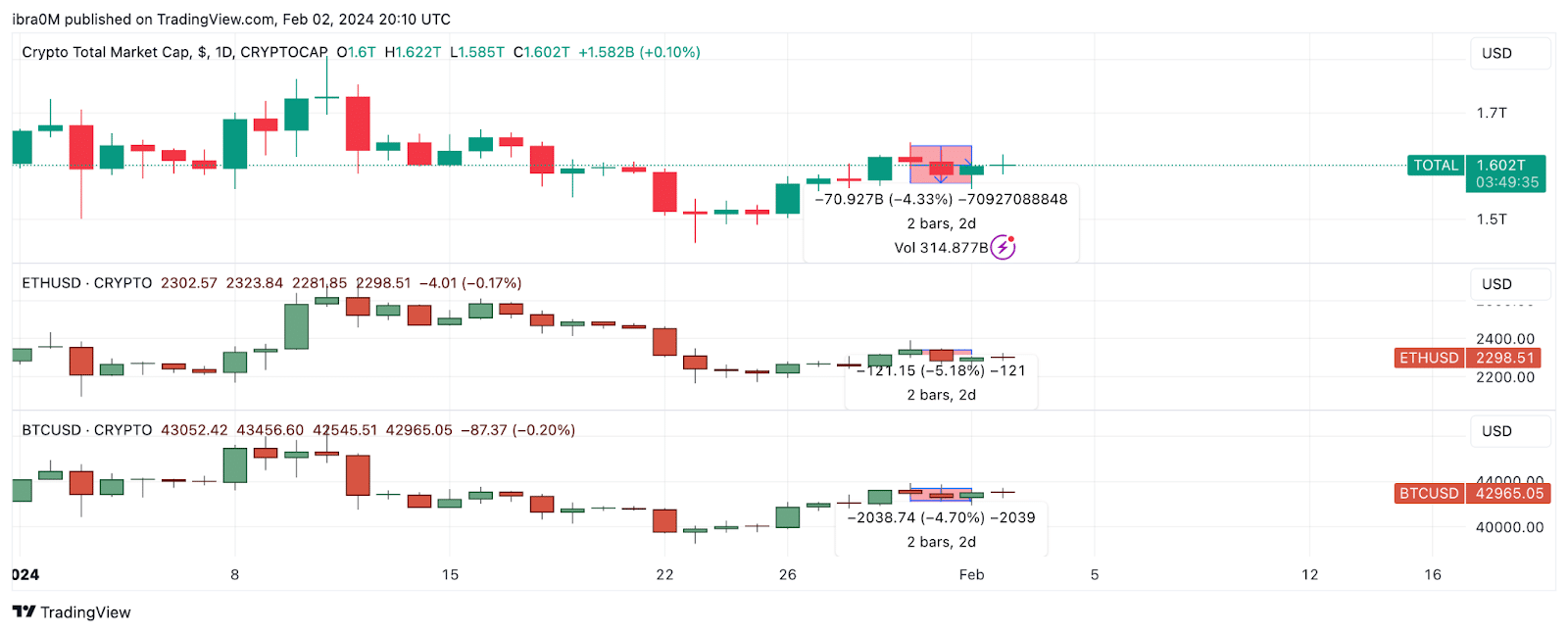

Powell’s feedback ship crypto costs into $90 billion tailspin

On Feb. 1, the worldwide crypto market capitalization dipped towards the $1.5 trillion space. This got here barely 48 hours after Powell made controversial statements suggesting suspending fee cuts past March 2024, as broadly predicted.

“Based mostly on the assembly right now, I might inform you that I don’t suppose it’s seemingly that the committee will attain a stage of confidence by the point of the March assembly to establish March because the time to do this. However that’s to be seen,”

U.S. Federal Reserve Chairman Jerome Powell

Powell’s statements got here after a scheduled Federal Open Market Committee (FOMC) assembly on Jan 31. It triggered a big pullback throughout danger belongings, together with shares and the crypto markets.

Inside 48 hours of Powell’s feedback, Bitcoin (BTC) and Ethereum (ETH) costs dipped 5%, respectively, whereas the general crypto market tumbled 4.3%, shrinking by over $90 billion between Jan. 30 and Feb. 2 as depicted within the chart above.

Nevertheless, on-chain indicators counsel that Ethereum traders doubled down on their bullish positions in defiance of the market pullback. Additionally, the newest official non-farm payrolls report launched on Feb. 2 might set the stage for a bullish restoration section within the days forward.

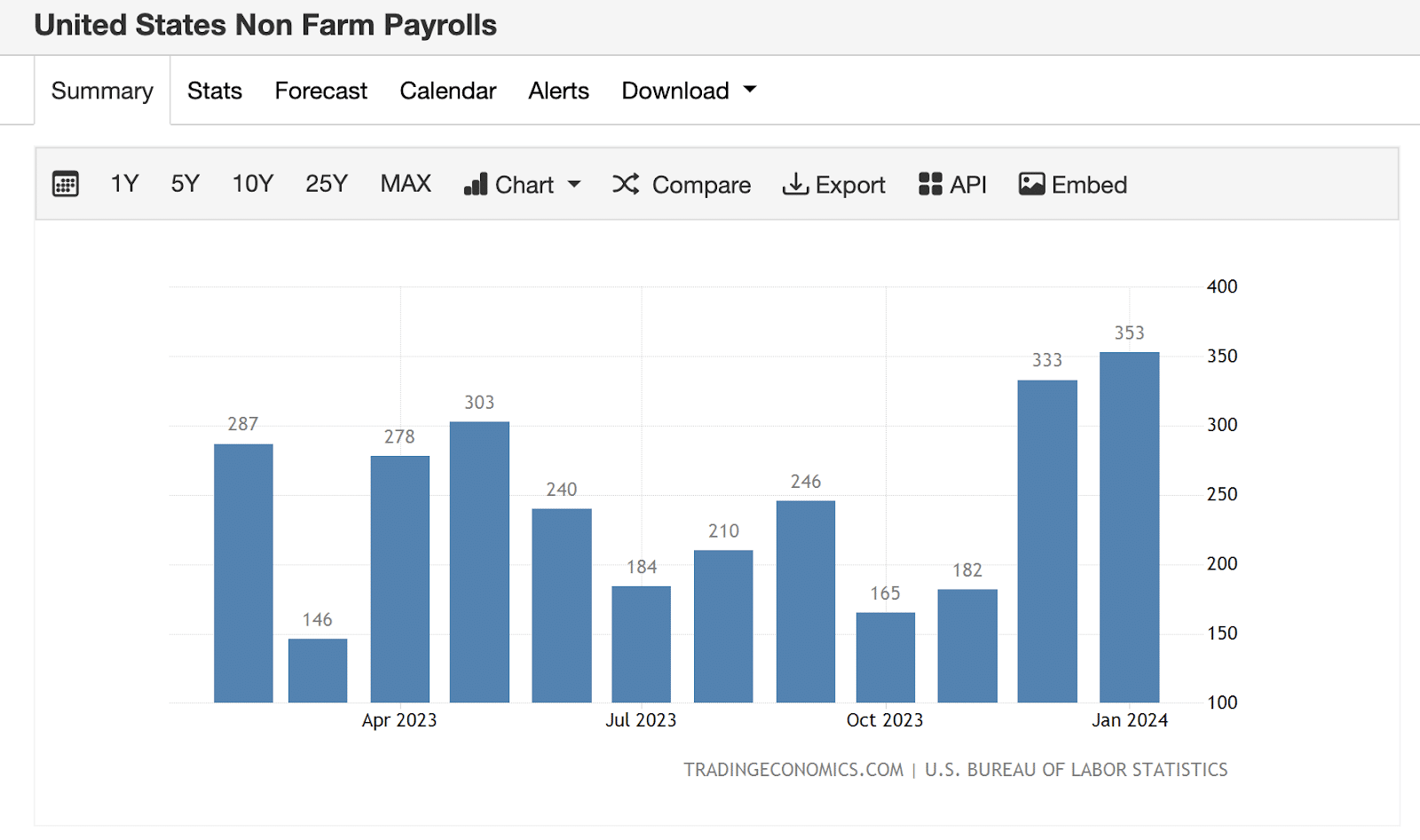

Non-Farm Payrolls Report Practically Doubles Market Expectation

On Feb. 2, the U.S. Bureau of Labor Statistics launched the newest version of its month-to-month non-farm payrolls report. Forward of the newest figures, consensus information compiled by TradingEconomics exhibits that the market analysts had priced in a 180,000 improve in U.S. non-farm jobs.

The official figures launched on Feb. 2 confirmed that U.S. non-farm institutions added 353,000 jobs in January 2024, 92.8% larger than market expectations. A better look additionally exhibits this uptick of 20,000 jobs represents a fourth consecutive month-on-month improve relationship again to October 2023.

How U.S. non-farm payrolls report influence crypto market

Strategic traders might interpret this better-than-expected jobs information as a probably bullish indicator for danger belongings, together with shares and cryptocurrencies. Rising jobs sometimes indicators an overheating financial system, which frequently prompts consideration for fee cuts to chill the market.

This doubts Powell’s current assertion that the Fed might postpone fee cuts past the widely-predicted March 2024.

In essence, the newest U.S. non-farm payrolls report for January 2024 will increase expectations of imminent fee cuts amongst traders. This might set off extra bullish buying and selling exercise throughout the crypto markets within the days forward.

At press time on Feb. 2, the worldwide crypto market capitalization is trending at $1.6 trillion, including $3.6 billion every day. Because the non-farm payrolls report was printed, Bitcoin value is again above $43,000 whereas Ethereum value has additionally reclaimed the $2,300 territory.

This tamed constructive response might set the stage for a extra bullish outlook within the days forward.