Bid-ask spreads on main U.S. exchanges like Coinbase and Kraken have tightened post-spot ETF approvals, signaling enhanced market liquidity and depth, analysts at Kaiko say.

Bid-ask spreads for Bitcoin (BTC), which signify the distinction between the best bid and lowest ask costs, have decreased considerably post-approval, indicating an enchancment in market liquidity and deeper buying and selling exercise.

In a current analysis report, analysts at Kaiko revealed that U.S.-based crypto change Kraken skilled the best volatility in spreads throughout January, reaching a peak of 10 foundation factors on Jan. 20. Equally, spreads on Bitstamp and Coinbase additionally peaked between Jan. 8 and Jan 13 at 6.7 and 1.7 foundation factors respectively, earlier than plummeting to beneath 1 foundation level in current weeks.

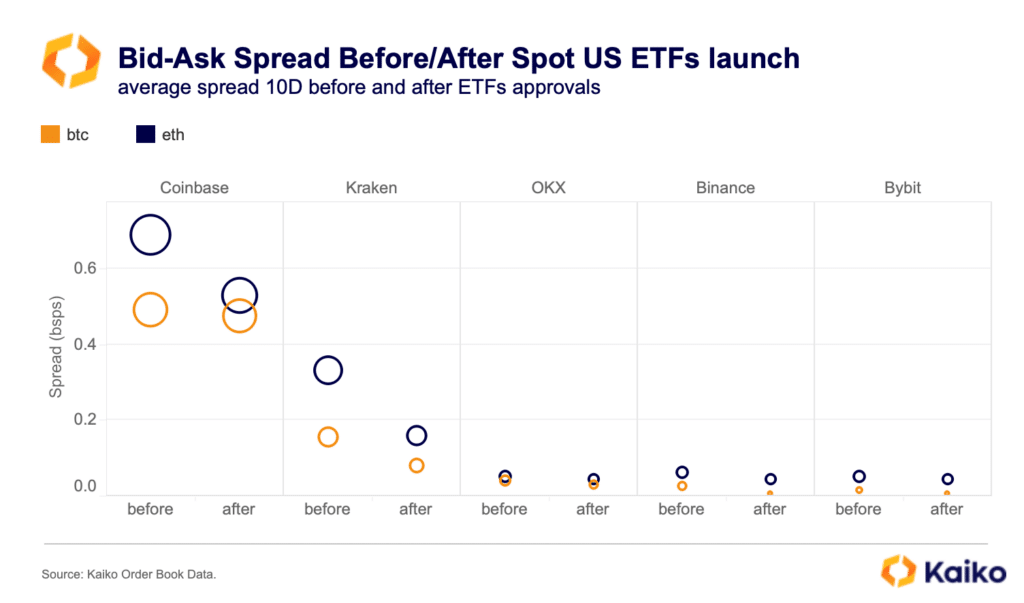

Kaiko identified that the development extends past U.S. markets and Bitcoin, as the typical bid-ask unfold for essentially the most liquid BTC and Ethereum (ETH) buying and selling pairs has additionally declined throughout varied crypto exchanges.

“Coinbase and Kraken noticed the strongest decline whereas the drop was much less pronounced on Binance and OKX, which already provide very low spreads.”

Kaiko

Analysts say the approval of spot exchange-traded funds (ETFs) will ultimately gasoline a brand new wave of competitors amongst exchanges, as Coinbase has already introduced price waivers for big merchants, which is anticipated to additional drive down spreads.

As crypto.information earlier reported, the U.S. Securities and Alternate Fee (SEC) has greenlit all spot Bitcoin ETF functions. Nonetheless, Gary Gensler, who has maintained a crucial stance on cryptocurrencies since assuming management of the U.S. monetary regulator, reiterated in a statement that the SEC “didn’t approve or endorse Bitcoin,” regardless of approving spot ETFs.