ARK 21Shares has lately adjusted its software for a spot Ethereum exchange-traded fund (ETF), shifting in the direction of a cash-creation mannequin akin to its beforehand accepted spot Bitcoin ETF.

The strategic modification filed on Feb. 7 additionally consists of plans to stake a portion of the ETF’s Ether (ETH) holdings doubtlessly, aiming to generate extra revenue via staking rewards.

This transfer follows the agency’s profitable transition of its Bitcoin ETFs to a cash creation and redemption model in December after participating in discussions with the US securities regulator.

The transition from an in-kind redemption mannequin, the place non-monetary funds resembling BTC have been used, to a cash-creation mannequin marks a big strategic pivot. Below the brand new mannequin, ARK 21Shares will purchase Ether akin to the order quantity and deposit this Ether with the custodian, resulting in the creation of ETF shares.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, highlighted this alteration, stating, “Appears to be like like they up to date to be solely money creations and another issues that convey it according to the lately accepted spot BTC ETF prospectus.”

The difference is seen as a transfer to align the Ether ETF intently with the regulatory preferences demonstrated within the approval of Bitcoin ETFs.

Nonetheless, the adoption of the money creation mannequin might affect arbitrage transactions carried out by Approved Individuals, that are essential for sustaining the ETF’s share value in shut correlation with Ether’s market value. This complexity underscores the nuanced stability ETF issuers should strike between regulatory compliance and market performance.

Furthermore, ARK 21Shares’ newest S-1 submitting introduces the idea of staking a portion of the ETF’s Ether holdings via “a number of trusted third-party staking suppliers.” Whereas this proposal goals to leverage the income-generating potential of staking, it’s accompanied by notable dangers, such because the potential for Ether losses via slashing and the requirement for staked Ether to be locked up for prolonged durations.

The proposal to incorporate staking within the ETF construction has stirred debate amongst trade observers. Finance lawyer Scott Johnsson identified that the staking-related paragraphs being in brackets means that the proposal is tentative and topic to regulatory dialogue.

Echoing this cautious stance, James Seyffart, one other ETF analyst at Bloomberg, expressed skepticism concerning the SEC’s willingness to allow staking inside spot Ether ETFs, stating, “However time will inform.”

The SEC’s choice on numerous purposes for spot Ether ETFs, together with these from ARK 21Shares, VanEck, Hashdex, Grayscale, and Invesco, is eagerly awaited, with a sequence of deadlines stretching from Might to August 2024. Nonetheless, Seyffart anticipates a collective choice by Might 23, mirroring the SEC’s method to Bitcoin ETFs earlier on Jan. 10.

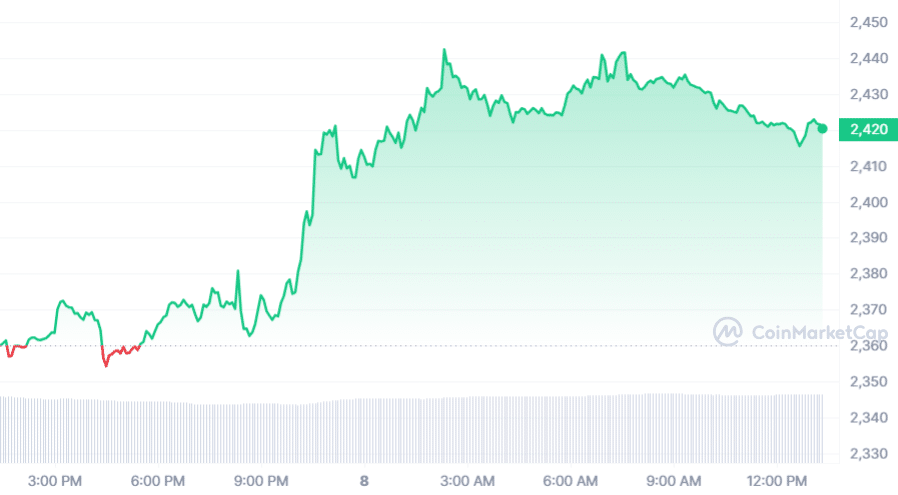

The modification to ARK 21Shares’ ETF software has not solely sparked discussions round regulatory compliance and innovation within the ETF house but additionally influenced market dynamics. Following the announcement of the up to date submitting, Ether’s value skilled a notable surge, breaking above $2,400 and marking a two-week excessive.